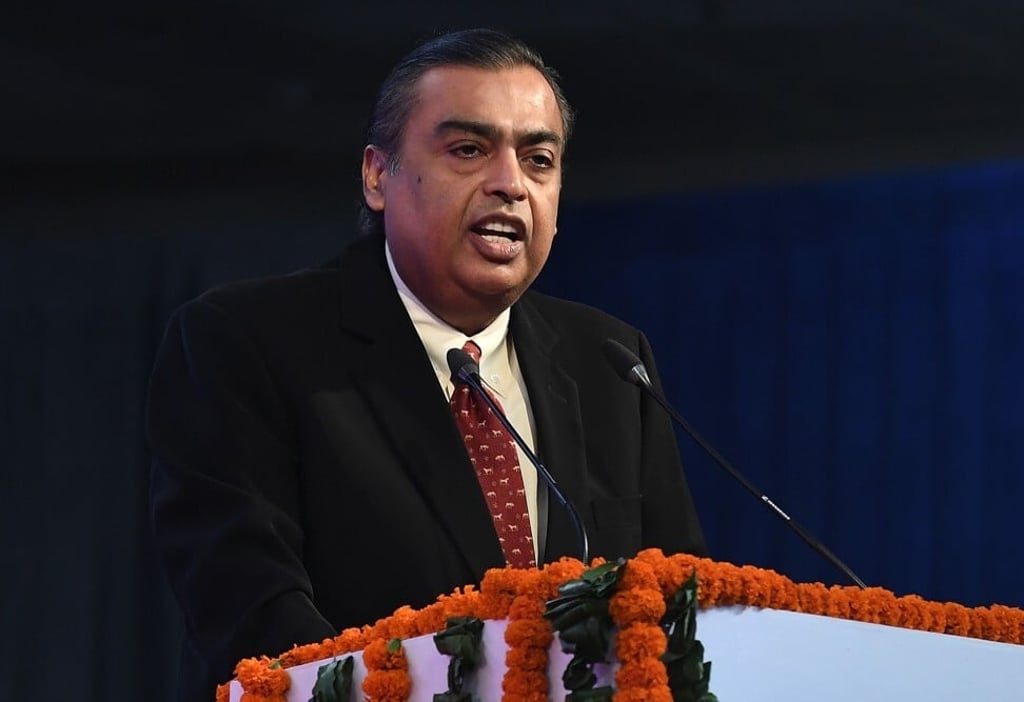

Amazon set for face-off with Ambani for India retail dominance

- Mukesh Ambani’s Reliance Industries has agreed to buy Indian firm Future Group’s retail, wholesale, logistics and warehousing units for US$3.4 billion

- Amazon, which owns a stake in a Future unit, has accused the supermarket chain operator of violating a contract between the two sides by agreeing to the Reliance deal

In a separate statement on Monday, Future Retail said it was not party to the Singapore proceedings and the matter “will have to be tested” under Indian arbitration law.

“One can expect legal proceedings to be initiated in Indian courts from both” Future and Amazon, said Amit Jajoo, a partner at law firm IndusLaw. “If Future Group is stopped from going ahead with the sale, effectively it also stops Reliance.”

Amazon wants to block Reliance’s purchase of Future’s bricks-and-mortar assets because such a deal would give Ambani unparalleled dominance in the only billion-people economy open to foreign firms. Bezos has bet more than US$6 billion on India, and Future’s assets will allow it to reach small towns that house key consumers in a market estimated to swell to US$1 trillion.