The world is dangerously dependent on Taiwan for semiconductors

- Taiwan’s role in the world economy largely existed below the radar, until it came to recent prominence as the car industry suffered shortfalls in chips

- By dominating the outsourcing of chip production, Taiwan is potentially ‘the most critical single point of failure in the entire semiconductor value chain’

Taiwan’s role in the world economy largely existed below the radar, until it came to recent prominence as the car industry suffered shortfalls in chips used for everything from parking sensors to reducing emissions.

By dominating the US-developed model of outsourcing chip production, Taiwan “is potentially the most critical single point of failure in the entire semiconductor value chain”, said Jan-Peter Kleinhans, director of the technology and geopolitics project at Berlin-based think tank Stiftung Neue Verantwortung.

The “CHIPS for America Act” introduced to the US Congress last year aims to encourage more plants to be established in the US. Michael McCaul, a Texas Republican, plans to reintroduce the bipartisan bill this year with a view to securing US$25 billion in federal funds and tax incentives.

McCaul said in a statement he is working with colleagues in the House and Senate “to prioritise getting the remaining provisions of CHIPS signed into law as quickly as possible”.

How did the world’s carmakers run out of chips?

The EU is also encouraging Taiwan to increase investments in the 27-nation bloc, with some success. GlobalWafers Co – based in TSMC’s hometown of Hsinchu – just boosted its offer for Germany’s Siltronic to value the company at 4.4 billion euros, an acquisition that would create the world’s largest silicon wafer maker by revenue.

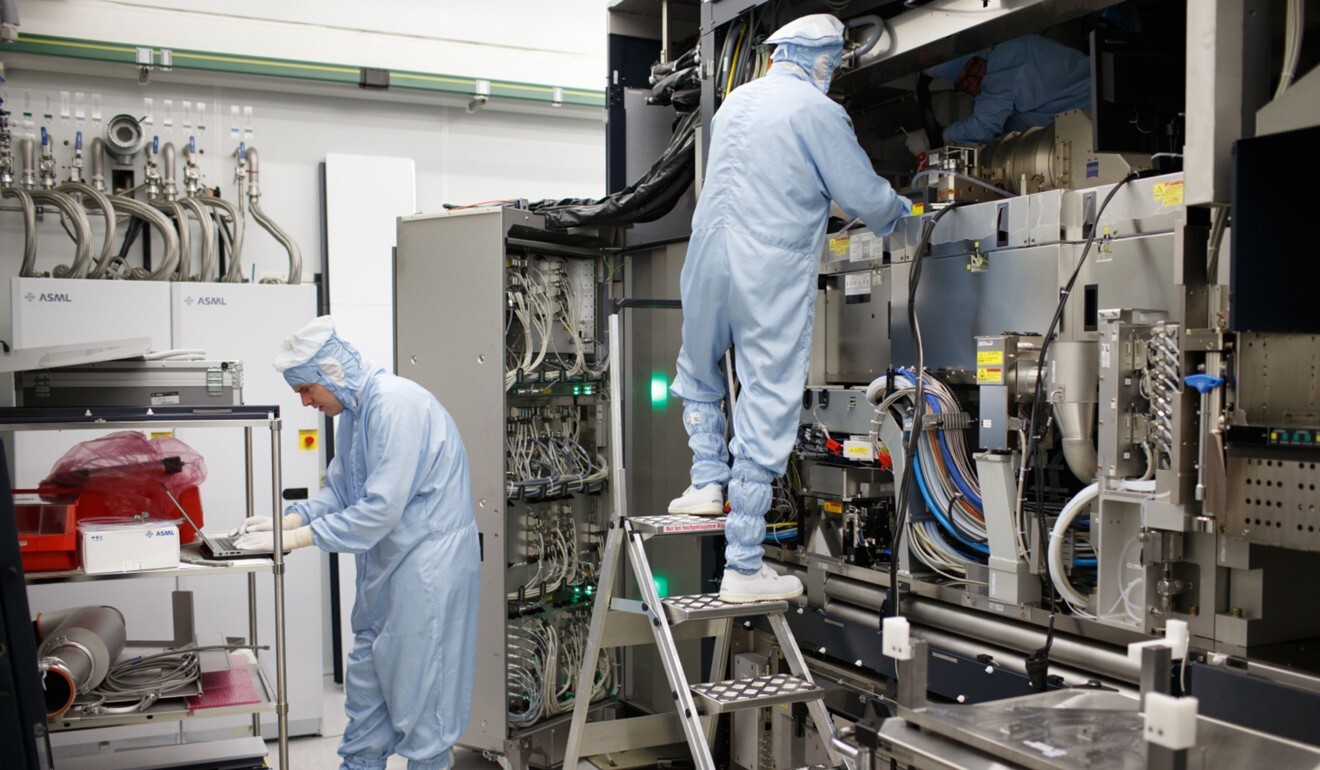

That is not to say Taiwan is the only player in the semiconductor supply chain. The US still holds dominant positions, notably in chip design and electronic software tools; ASML Holding of the Netherlands has a monopoly on the machines needed to fabricate the best chips; Japan is a key supplier of equipment, chemicals and wafers.

“TSMC is becoming more and more dominant,” said Kazumi Nishikawa, an official working on technology issues at Japan’s Economy Ministry. “This is something everybody in the chip industry must find a way to deal with.”

Taiwan’s 2020 economic growth looks to outpace mainland China’s for first time in decades

Fellow analyst Linda Kuo said the Taiwanese government was alarmed by a ransomware attack on TSMC in 2018 and had announced plans for some US$500 million to help the industry become more aware of cybersecurity issues.

The greater worry is that TSMC’s chip factories could become collateral damage if China were to make good on threats to invade Taiwan if it moves toward independence.

TSMC’s capital spending of as much as US$28 billion for this year suggests it is going to stay out in front.

“Taiwan is the centre of gravity of Chinese security policy,” said Mathieu Duchatel, director of the Asia programme at the Institut Montaigne in Paris.

Yet while Taiwan’s status in the global chip supply chain is a “huge strategic value”, it’s also a powerful reason for Beijing to stay away, said Duchatel, who has just published a policy paper on China’s push for semiconductors.

US-China tech war: battle over semiconductors, Taiwan stokes trade feud

Assuming Taiwanese forces were to be overwhelmed during an invasion, “there is no reason why they would leave these facilities intact”, he said. And preserving the world’s most advanced fabs “is in the interests of everyone”.

For all the moves to reel back domestic chip fabrication, it is optimistic to think the supply chain for such a complex product as semiconductors could change in short order, Peter Wennink, ASML chief executive, told Bloomberg TV. “If you want to reallocate semiconductor build capacity, manufacturing capacity, you have to think in years,” he said.

In the meantime, geopolitics means chip shortages could become a more regular occurrence, according to Joerg Wuttke, president of the EU Chamber of Commerce in China.

“This is going to move on to the point where actually because of export controls, because of governmental intervention, there will be all of a sudden supply chain disruptions not just because of capacity problems,” he told Bloomberg Television. “So better get prepared.”