Will Chinese drone giant DJI fly the friendly skies under Joe Biden’s watch?

- Shenzhen-based DJI, the world’s largest drone maker, has been caught in the crossfire of deteriorating relations between Washington and Beijing

- Concerns remain about how Chinese-made drones can potentially be used in the US as a Trojan Horse for intelligence-gathering and espionage

“While we assume the Biden administration will take a different approach, the Trump administration’s actions align closely with Biden’s stated policy goals and directions,” said David Benowitz, head of research at DroneAnalyst and a former DJI executive. “The shift, however, is likely to move away from criticising Chinese manufacturers on the basis of security … to being more upfront about goals to support a domestic manufacturing base for UAS.”

Shenzhen-based DJI, the world’s largest drone maker, has been caught in the crossfire of deteriorating relations between Washington and Beijing, with the US government raising questions about data security and human rights violations.

“The use of Chinese-manufactured drones at sensitive locations has been a national security concern for all four years of Trump’s presidency,” said Christopher Williams, chief executive of California-based counter-drone technology company Citadel Defence.

DJI declined to comment for this story. Still, the company said in a Twitter post in December that it “has done nothing to justify being placed on the Entity List”.

Privately held DJI has been trying hard to alleviate the US government’s security concerns since the incident at the White House lawn. At the time, the company updated its drones’ firmware to include a “no-fly zone” that extended 25 kilometres around the Washington, DC area.

In 2018, DJI commissioned a study to verify that its drones’ users have control over how their data is collected, stored and transmitted. The company’s effort to get its data security practices validated came after the US Army banned the use of its drones.

00:59

US warns of ‘security risk’ from China-made drones as tech war heats up

There could be some short-term disruption to DJI’s supply chain, according to DroneAnalyst’s Benowitz, as the company’s access to US hi-tech hardware, software and services get restricted under the US Entity List. He said major enterprises could also be dissuaded from buying products made by DJI and other blacklisted Chinese companies, as the US trade restrictions indicate that these firms had committed human rights abuses and supported a repressive regime.

That builds on the prevailing notion in security circles, where there is speculation about Chinese-made drones potentially being used as a Trojan Horse for intelligence-gathering and espionage. These could track federal employees and build a database of personally identifiable information that could expose potential security vulnerabilities or targets of interest, according to Williams of Citadel Defence.

China’s DJI turns its eye to enterprise uses like agriculture after conquering global commercial drone market

Blades indicated a chance for Trump’s executive order to be reversed, but not the US trade blacklist. “I expect that Biden won’t be as hardline as Trump on Chinese trade,” he said. “But there will be many domestic companies that will lobby to keep the rules the way they are, so they can benefit from building a UAS industrial base with US suppliers.”

US companies were estimated to account for 6.9 per cent of the global commercial drone market in 2020, according to data from DroneAnalyst.

As such, DJI has had little to no competition in the US. “From our experience and interviews with other companies that we know, only consumer-level drones are actually affected by US policy,” said Yang Yang, deputy secretary general of the Shenzhen-based World UAV Federation.

Most [Chinese] exports of consumer drones belong to DJI, according to Yang. He indicated that US consumers have no choice because DJI has no major competitor in that market.

“China provides, arguably, the most advanced and cost-effective manufacturing capabilities in the world,” said Williams of Citadel Defence. “In situations where a capability does not exist, the Chinese government can mobilise industry quickly to re-engineer solutions necessary to maintain their competitive edge.”

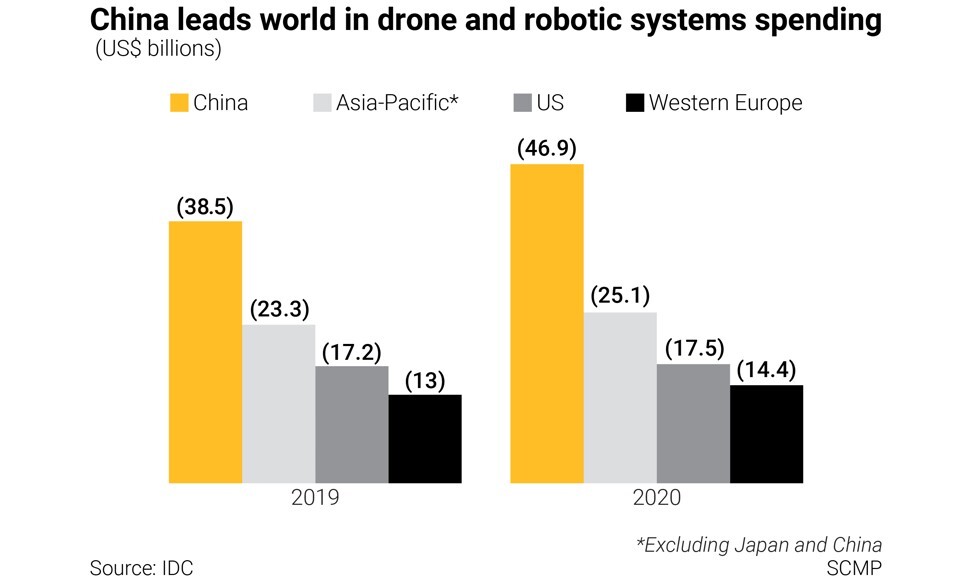

The stakes are high for the US, as global spending on drones continues to rise – totalling US$16.3 billion in 2020, according to a report last year by tech research firm IDC.

How DJI went from university dorm project to world’s biggest drone company

“We have seen as [drone] regulations catch up in India and Europe, that other regions have grown faster than the US market in recent years,” said DroneAnalyst’s Benowitz. “The US Government’s non-military drone fleet is still incredibly small, but has been very reliant on DJI products in the past, and there is evidence that a lack of alternatives has kept their fleet small over the past few years.”

“As new US manufacturers enter the market, the question will be if any can offer a range of drones that competes across DJI’s product range, and if they are cornered off into the government market, or compete across all market segments,” he said.