How Huawei, other tech firms can help make workers safe in China’s most dangerous industry

- The world’s largest telecommunications equipment supplier is trying to bring the benefits of 5G mobile technology in the coal mining sector

- Alibaba, Tencent and ZTE are among the Big Tech firms revving up digital transformation in the industry

For 60-year-old Jin Liguo, coal mining runs in the family. His parents were miners and now his offspring is also part of the industry in Shanxi province, the centre of China’s coal production. Retired after a 40-year career in the industry, Jin is now helping develop systems that will cut the risk of workers getting injured or dying in the coal mines.

These devices are expected to support stable and fast upload of real-time data from unmanned machinery, sensors and high-definition cameras, which would help China’s most dangerous industry cut back on the number of people sent to work underground in the pits.

“Fewer people underground means higher safety,” said Jia Haoran, coal industry solutions manager at Huawei. He said that approach encourages increased hi-tech application in the industry.

01:00

16 miners killed, one rescued after fire in coal mine in Chongqing, China

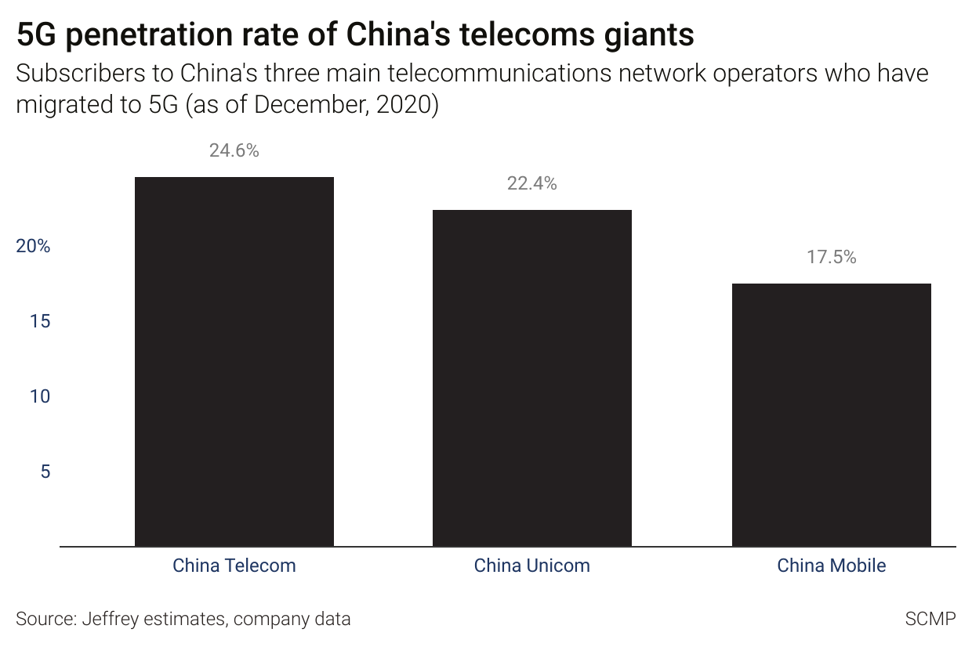

The roll-out of 5G mobile network services across China, with the world’s biggest internet user population and largest smartphone market, is expected to rev up digital transformation across industries, from financial services and health care to manufacturing and long-standing economic workhorses like coal mining.

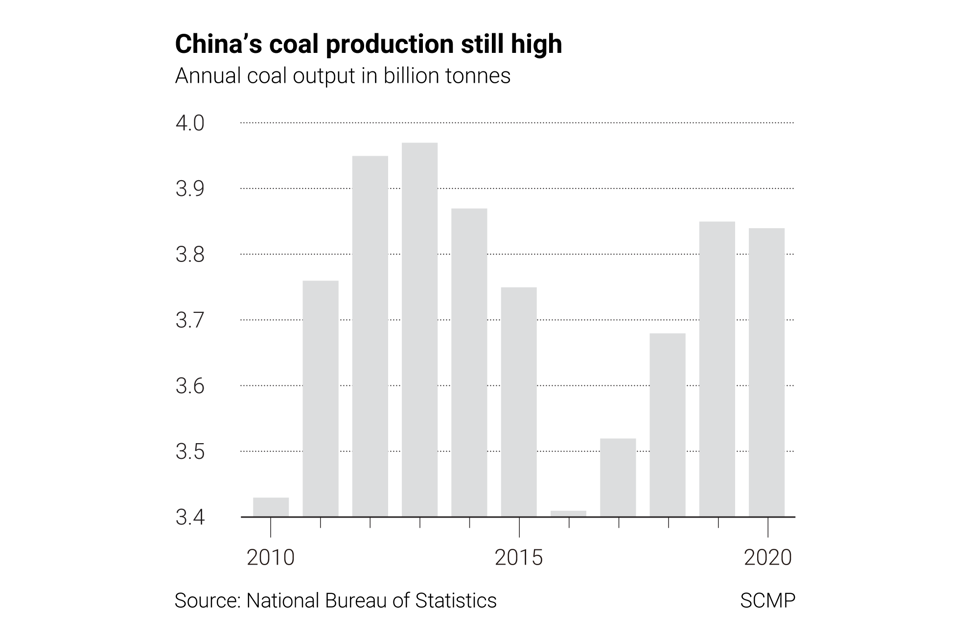

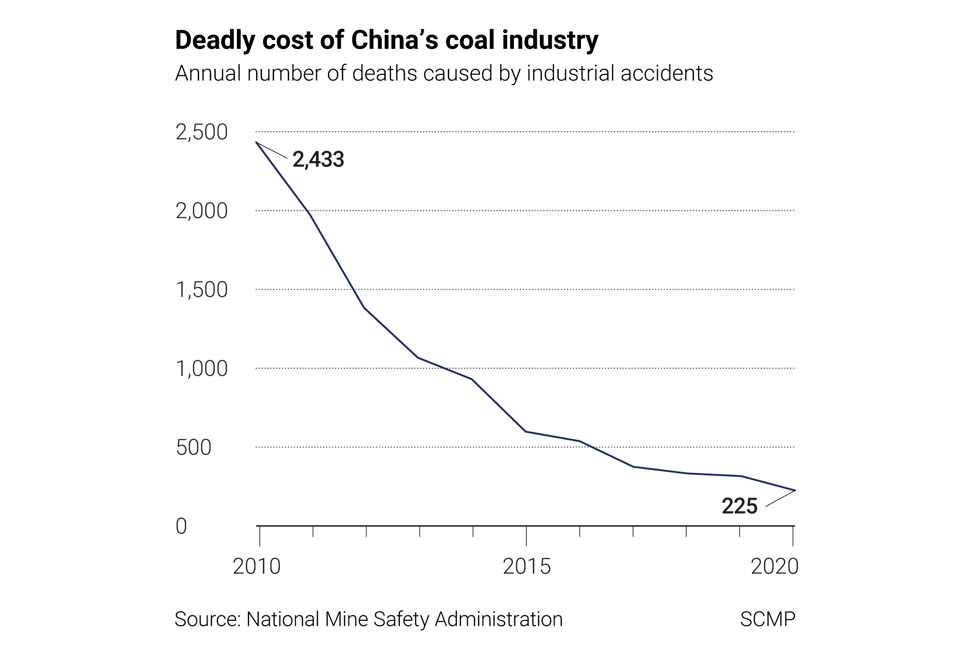

China’s coal mining industry has been known for its dirty and dangerous working conditions for decades, with annual deaths caused by workplace accidents in the thousands. That remains the case to this day even though the number of such fatalities tapered off to hundreds annually in recent years.

Huawei has centred its work with the coal industry in Shanxi province, which has 260 billion metric tonnes of known coal deposits – about a third of the country’s total – and more coal companies than any other province.

That same month, Huawei introduced a range of solutions for unmanned and low-carbon operations in Taiyuan, where the company has built an intelligent mining innovation lab that is backed by the local government and coal industry partners. The lab is developing ways to make coal mining safer, with less human labour, through the use of intelligent sensors, big data and automation.

In 2021, Huawei wants coal operations in Shanxi to reduce the number of workers who go down to the mining pits by 10 per cent to 20 per cent each shift.

Huawei is currently collaborating with coal mining companies to develop compact 5G mobile base stations designed specifically for their industry.

“The use of 5G technology in some industries is a requisite,” said Sihan Bo Chen, the head of Greater China at the GSM Association, which represents the interests of more than 750 wireless network operators around the world. She said 5G networks can enable efficient remote operations in underground mining, helping coal companies reduce the number of people exposed to the dangers of working down the mines.

China’s first private 5G mobile network for mining deployed in Shandong province

In October last year, China’s first privately built 5G mobile network for mining started operations at a coal mine in the eastern coastal province of Shandong. The 5G network was independently built and deployed by state-owned Shandong Energy Group Co at its subsidiary Baodian Coal Mine’s operations.

That next-generation mobile system delivers faster data transmission inside the mine – reaching less than 20 milliseconds, compared with 3 to 4 seconds on 4G, according to a report by state broadcaster China Central Television. That difference enables workers to better control the operation of mining equipment deployed hundreds of metres underground, it said.

Still, the cost of deploying 5G infrastructure and other relevant technologies may initially be an issue that prevents coal-mining enterprises from pursuing digital transformation, according to retired mine worker Jin, who now advises Huawei. “Some feel they can continue operating with traditional infrastructure, but pressure from competition and [economic] survival may spur them to make the necessary changes,” he said.

Shandong Energy said it was able to reduce the number of people working at its Baodian operation to 90, from 226 previously, while increasing output from 15,000 to 20,000 tonnes per day. The hi-tech upgrade, however, cost 4.5 billion yuan (US$690 million) to install, which included underground sensors, high-definition cameras, a 5G network and fibre-optic lines that connect the underground 5G base stations to the aboveground control room.

Shenhua Energy, which is the world’s largest coal mining enterprise, set up in 2019 an automated system that allowed it to deploy robots down its mines to cut coal and monitor manned operations. This system has allowed the company to minimise the number of employees deployed underground, it said. The company said the death rate from industrial accidents at its mining operations, per million tonnes of coal output, was zero in 2019. Its use of IoT devices and big data has enabled real-time monitoring at its biggest coal port in Huanghua, a city in the northern coastal province of Hebei.

China coal: why is it so important to the economy?

The company, which has more than 70 coal mines under operation and construction, has been conducting intensive research and development on “flexible manpower” and unmanned coal mining equipment. Prototypes have been tested for large-scale mining at its Menkeqing coal mine in Inner Mongolia.

Representatives of Shenhua Energy and China Coal Energy did not immediately reply to inquiries for comment.

China’s other major technology companies are also involved in various digital transformation initiatives in the country’s coal hubs.

ZTE Corp, China’s No 2 telecoms gear maker, collaborated with a unit of state-owned China Baowu Steel Group Corp to deploy two 5G-enabled autonomous mining trucks last year at an open-pit iron ore mine in eastern China’s Anhui province. This project also involved testing of integrated drone inspections, virtual reality surveys and high-definition wireless video surveillance.

“After the digital transformation of coal mines, we can cut 10 to 20 per cent of workers going down to mining pits each shift,” said Tu Jiashun, a principal scientist for software-defined networking and network function virtualisation at ZTE. “A lot of underground works are being gradually replaced by aboveground systems with 5G remote-monitoring abilities. The aim is to have fewer people in the mines should any disaster occurs.”

China’s carbon neutral goal: mainland companies seen trailing global peers by 2050

For retired coal miner Jin, increased automation and the application of other relevant technologies in the industry come as a welcome sign of improvement.

“Over my career, I’ve seen many accidents,” Jin said. “Some took an arm or leg, and some took the life of people I worked with. These things affected me deeply.”

It remains to be seen whether the efforts of Big Tech companies in China’s coal industry will result in long-term improvements that can drastically lessen, if not eliminate, accidents in underground mines.