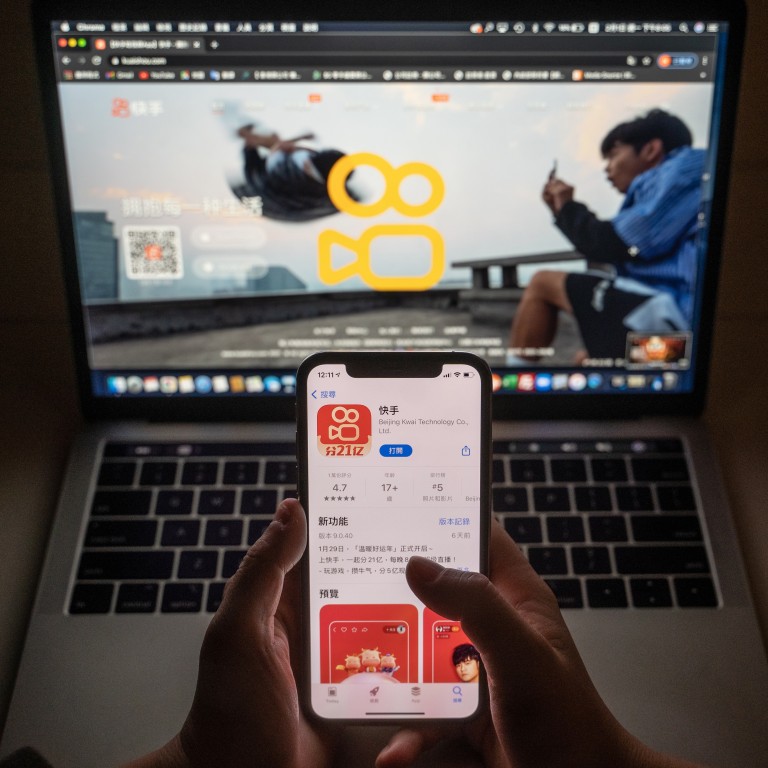

Short video giant Kuaishou beats revenue estimates in first quarterly report since its Hong Kong listing

- Beijing-based Kuaishou reported revenue of US$2.8 billion in the December quarter on the back of its marketing services and live-streaming operations

- The company’s net loss widened to US$2.9 billion on higher operating expenses in the same period

Beijing-based Kuaishou reported revenue of 18.1 billion yuan (US$2.8 billion) last quarter, up from 11.8 billion yuan a year earlier, to surpass the 10.9 billion yuan market estimate. That growth was mainly attributed to the firm’s strong online marketing services and live-streaming business, according to its regulatory filing on Tuesday after the market closed. Full-year revenue reached 58.8 billion yuan, in line with the market consensus median of 58.6 billion yuan.

The company’s net loss widened to 19.3 billion yuan in the December quarter, compared with 18 billion yuan in the same period in 2019, because of a significant rise in marketing and selling expenses to grow its users, as well as increased administrative, research and development costs during the period. For the whole of 2020, losses totalled 116.6 billion yuan, from 19.6 billion yuan in 2019.

“We have seen a substantial increase of our user base and user engagement, as well as a robust growth of our monetisation capabilities,” said Su Hua, chairman and chief executive of Kuaishou, in a statement on Tuesday after the firm’s earnings announcement.

Kuaishou’s average daily active users and monthly active users on all its apps and mini-programs in China last year were 308.1 million and 777 million, respectively.

“We expect Kuaishou to surf on the entertainment tailwinds, with its ads, live-streaming and e-commerce market size growing 34 per cent, 20 per cent and 58 per cent, respectively, at a compound annual growth rate from 2019 to 2025,” said Sophie Huang, an analyst at CMB International, in a recent report that cited forecasts from iResearch.

Online marketing services contributed 47 per cent of Kuaishou’s total revenue in the fourth quarter, while live streaming contributed 43.6 per cent. The rest comprised of other services. This marked the first time that online marketing services became the largest contributor to Kuaishou’s total revenue. Live streaming accounted for 95.3 per cent of the firm’s overall turnover in 2017 and 91.7 per cent in 2018, according to the firm’s prospectus.

Kuaishou’s fourth-quarter results show that the company’s growth potential in the internet industry remains high, despite efforts by Beijing to tighten its control of the market.

Chinese regulators seek cap on tips given by internet users to live-streaming content creators

China had 818 million short video app users as of the end of June 2020, according to a report released by the China Netcasting Services Association in October. It said ByteDance-owned Douyin and Kuaishou are the country’s two biggest players in that market.

Kuaishou’s online marketing and e-commerce segments are expected to become the firm’s major revenue growth drivers over the next three years, according to a recent report by analysts Martin Bao and Zhao Zeping of ICBC International Research. “We estimate online marketing services to overtake live streaming as the largest revenue contributor from 2021,” the analysts said.

Additional reporting by Iris Deng.