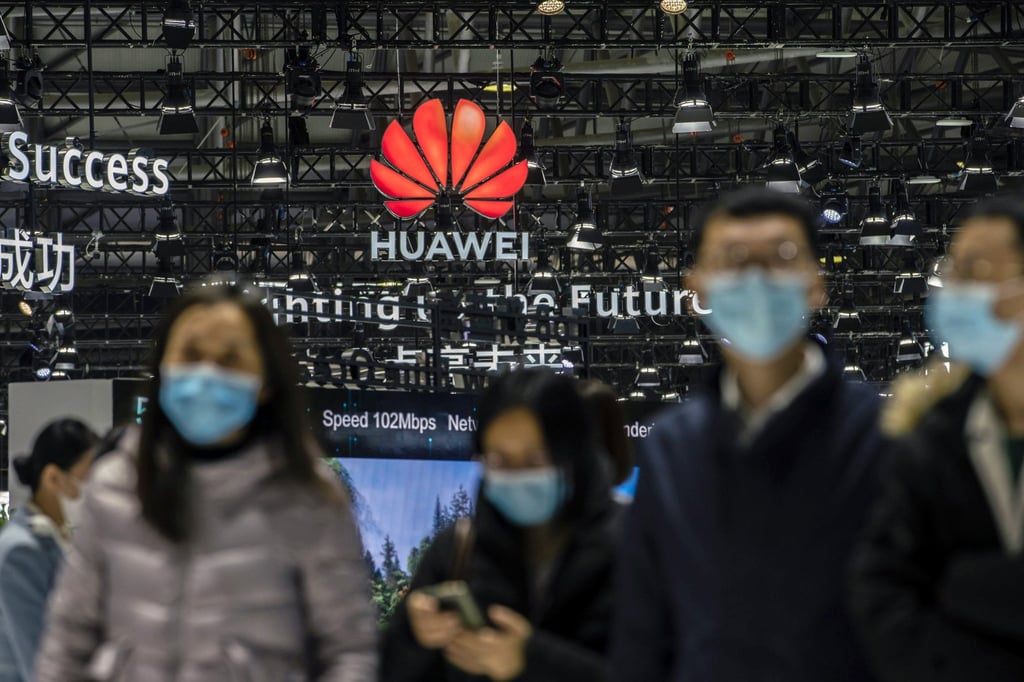

Huawei puts on a brave face despite reporting 3.8 per cent revenue growth for 2020, slowest in a decade

- Huawei generated US$136.7 billion in group revenue, representing 3.8 per cent year-on-year growth, its slowest annual increase in the past decade

- Net profit rose 3.2 per cent last year, with 7.3 per cent net profit margin

“Over the past year we’ve held strong in the face of adversity,” said Ken Hu Houkun, Huawei’s rotating chairman, in a statement on Wednesday. “We’ve kept innovating to create value for our customers, to help fight the pandemic, and to support both economic recovery and social progress around the world.”

Shenzhen-based Huawei reported on Wednesday 891.4 billion yuan (US$136.7 billion) in group revenue, up 3.8 per cent from a year ago, its slowest annual revenue growth in the past decade. Revenue from China accounted for 65.6 per cent of total sales, driven by a 15.4 per cent domestic sales growth, according to financial statements audited by KPMG.

That contrasts with negative growth in its overseas markets, with sales down 12.2 per cent across markets in Europe, Africa and the Middle East and sales in the Asia-Pacific declining 8.7 per cent. That fall showed the company’s difficulties outside its home market after it was targeted with trade sanctions by Washington over national security concerns.

In a media briefing after the release of the company’s results, Hu said that although smartphone revenue declined last year, there was an increase in income from other kinds of hardware, software and services. “I believe you will see more hardware products, software and services from Huawei”, said Hu, referring to the company’s so-called 1+8+N strategy to develop an ecosystem of digital products beyond the smartphone.

Privately held Huawei’s three key business segments – consumer, carrier, and enterprise – generated revenue of 482.9 billion yuan, 302.6 billion yuan and 100.3 billion yuan, representing growth of 3.3 per cent, 0.2 per cent, and 23 per cent, respectively.