Advertisement

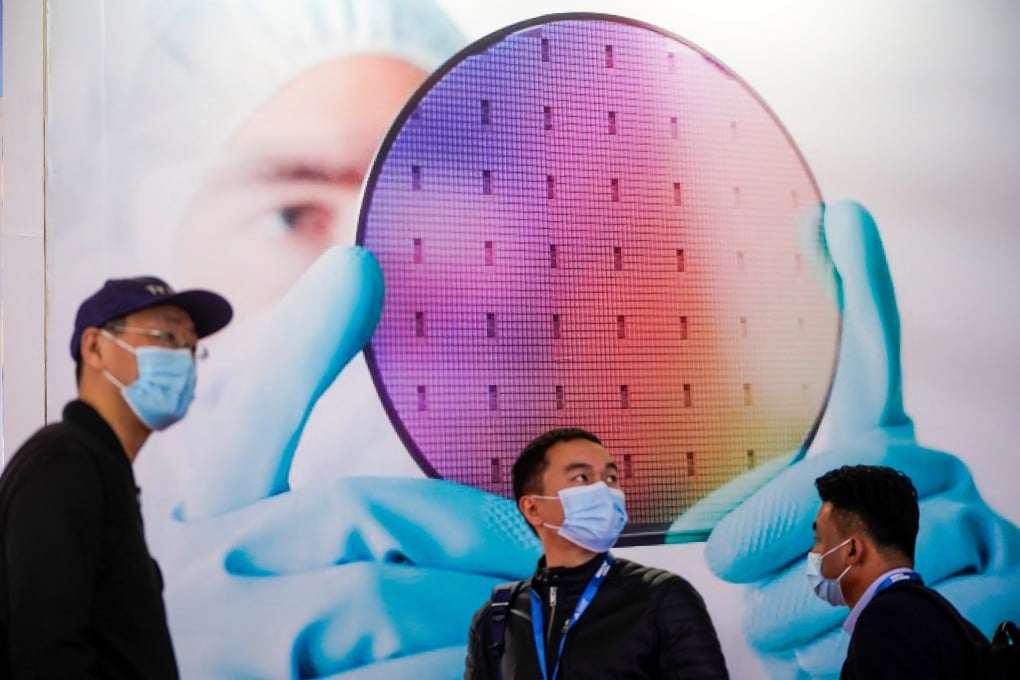

Semiconductor giant SMIC rewards senior Taiwanese executive with hefty compensation as China builds up chip sector’s hi-tech talent pool

- SMIC co-chief executive Liang Mong-song’s annual salary reached US$1.53 million in 2020, up 450 per cent from a year earlier

- He also received a flat worth US$3.4 million and 259,800 shares in the Shanghai-based contract chip maker

Reading Time:3 minutes

Why you can trust SCMP

48

Semiconductor Manufacturing International Corp (SMIC) more than quadrupled the salary of a senior Taiwanese executive and gifted him with a flat worth 22.5 million yuan (US$3.4 million) last year, according to the firm’s latest annual report, providing a testament to how the world’s second-largest economy is spending lavishly to woo and retain talent in its chip industry.

That hefty compensation package was given by SMIC, China’s largest contract maker of integrated circuits (ICs), to its 69-year-old co-chief executive Liang Mong-song, an industry veteran who previously worked as a senior director for research and development (R&D) at Taiwan Semiconductor Manufacturing Co (TSMC), according to the report published last week.

Liang’s total salary last year reached US$1.53 million, the highest received by an executive at Shanghai-based SMIC, up 450 per cent from his US$341,000 pay in 2019. Along with the flat, Liang also received 259,800 shares in the company. SMIC’s share price traded at HK$27 in Hong Kong and 58 yuan in Shanghai as of Wednesday.

Advertisement

SMIC’s annual report, which stated record-high revenue for the company in 2020, did not provide specific reasons for the sharp rise in compensation for Liang. He remains the company’s co-chief executive along with Zhao Haijun, according to recent corporate filings.

It is not known whether that package helped convince Liang to stay on at SMIC, which is the world’s fourth-largest chip foundry and China’s best hope to boost its self-sufficiency in semiconductors. The company declined to comment on Wednesday.

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x