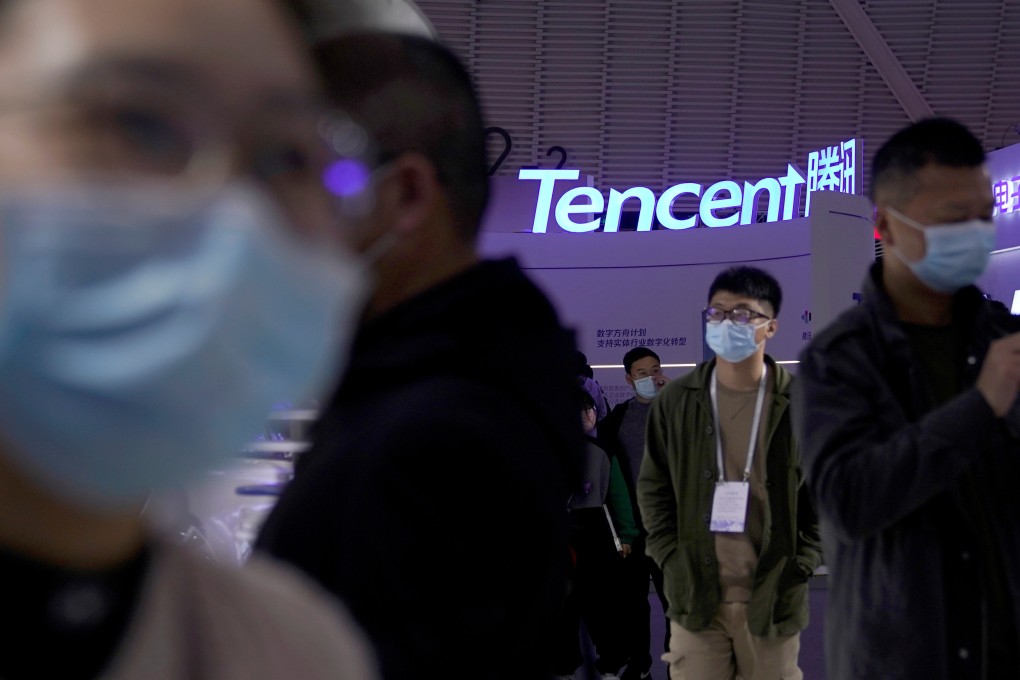

Tencent fundamentals still solid despite record US$15bn share sale by investor, analysts say

- Some analysts have knocked aside comparisons with the past, saying shares should be bought on dips

- Tencent’s share price fell 1.5 per cent on Thursday

The announcement of a US$15 billion stock sale by Tencent Holdings’ largest shareholder, three years after the last big divestment by a major shareholder, has heightened investor scrutiny of the outlook for China’s biggest social media and video games company at a time when Beijing is tightening regulations for the country’s tech titans.

Holland-based Prosus, Tencent’s largest shareholder and majority controlled by Naspers Ltd, sold 191.89 million shares for HK$114.1 billion (US$14.67 billion), reducing its stake to 28.9 per cent, according to a stock exchange filing from Tencent before the market open on Thursday.

Prosus said the 2 per cent stake sale was a financial operation and it remained committed to Tencent. Nevertheless, the news knocked 1.5 per cent off Tencent’s share price on Thursday following on from a fall of 4 per cent on Wednesday. The sale has reminded some investors of the time three years ago when Naspers, then Tencent’s largest shareholder, sold a 2 per cent stake that precipitated a 45 per cent decline in Tencent’s share price over the following seven months.

Some analysts have knocked aside comparisons with the past though, saying the shares should be bought on dips given a commitment from Prosus to not sell any more shares for three years.

“There has always been short-term declines following large sales by Tencent’s top shareholders, but the company’s longer term performance is more dependent on its own business development,” said Wang Xueheng, a Guosen Securities analyst, in a report.