Advertisement

SoftBank Vision Fund’s profit nears US$30 billion on Coupang IPO, ByteDance stake

- Coupang’s US$4.6 billion offering marks SoftBank’s best return since Alibaba’s listing in 2014

- Vision Fund will also book a gain on its 3 per cent stake in ByteDance, the TikTok owner with a US$140 billion valuation

Reading Time:4 minutes

Why you can trust SCMP

SoftBank Group Corp’s Vision Fund profit may reach an unprecedented US$30 billion in the March quarter, almost quadrupling the record it had just set, according to people familiar with the matter.

Profit in the unit was supercharged by the successful initial public offering of Coupang, the South Korean e-commerce leader which debuted in New York last month. That will account for the lion’s share of what is expected to be between US$25 billion and US$30 billion in reported gains for the three months ended March 31, the people said, asking not to be named because the details are not yet public. SoftBank is expected to report its latest financial results on May 12.

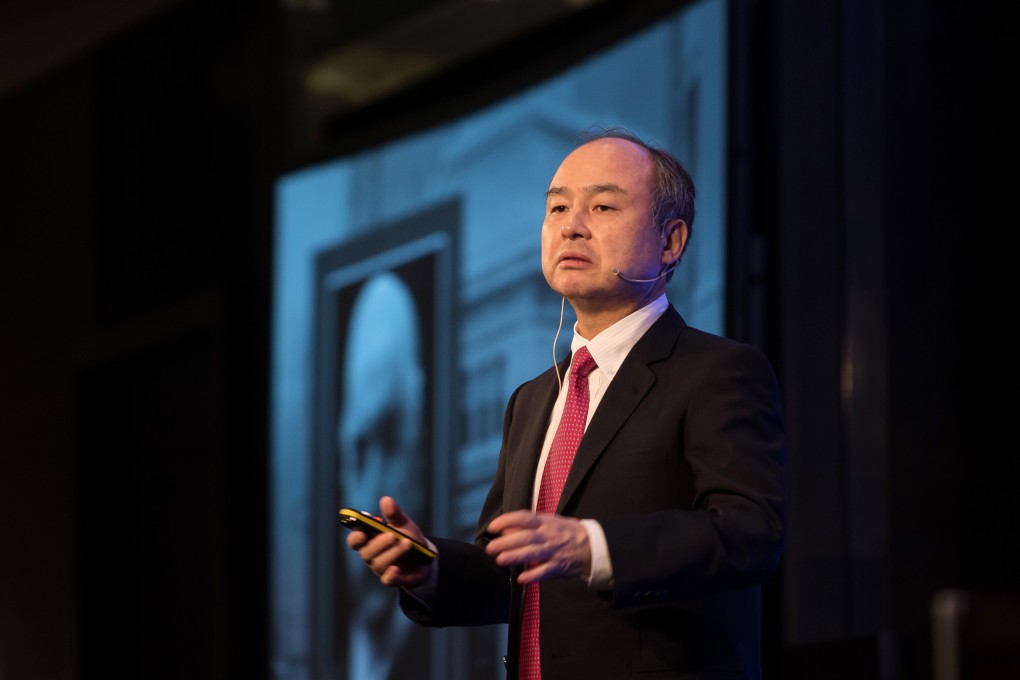

The markets are delivering their strongest validation yet for SoftBank founder and chief executive Masayoshi Son’s oft-criticised strategy of pouring massive amounts of cash into mature start-ups. The Vision Fund’s portfolio of more than 160 investments will record its third straight quarter of record profits helped by a global initial public offering (IPO) rush that has seen companies worldwide raise more than US$200 billion in 2021.

Advertisement

When Son takes the stage to report the latest results, he will probably have one more milestone to celebrate: group net income that is the highest ever for a listed Japanese company in any quarter dating back to 1990, according to data compiled by Bloomberg. SoftBank already holds the top spot, setting the current high of 1.26 trillion yen (US$11.5 billion) in June.

Coupang’s US$4.6 billion offering was the second biggest this year and marks SoftBank’s best return since Alibaba Group Holding’s listing in 2014. Alibaba is the parent company of the South China Morning Post.

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x