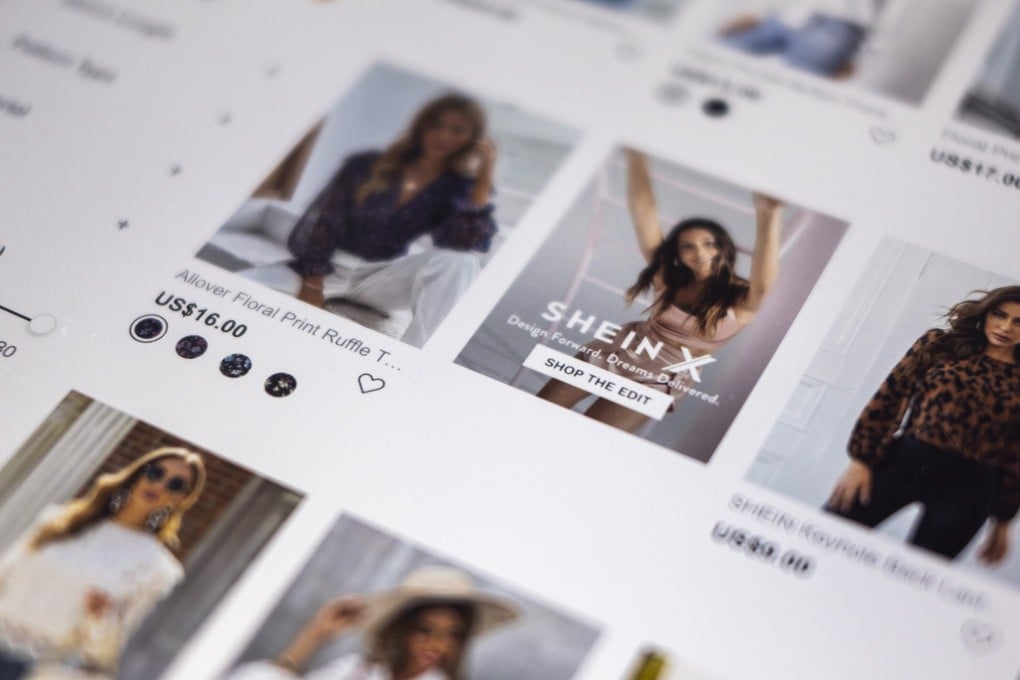

Made in China but not for China: how a mysterious fashion retailer has emerged to take on the world

- Shein, although a demanding client, is hugely popular among China’s suppliers in the Pearl River Delta - for one thing, it pays its bills on time

- China’s sophisticated supply chain as well as the country’s early bounce back from the pandemic, have helped Shein to build a base with Generation Z consumers

Kenny Li’s garment factory works on a tight schedule: while factories usually have a month or two to make thousands of T-shirts for a brand, Li only has five days, as required by his client Shein, a mysterious Chinese online retailer that is helping to re-shape the global fashion industry.

On top of the short lead time in production, Li is told to develop 100 to 200 new designs for consumers on Shein to choose from, even though Li’s factory only has one designer. Shein also makes it clear that deliveries will be returned to Li’s factory if any problem on a long list of defects is found, such as a skipped stitch in a piece of clothing.

Li, whose factory employs around 100 people, said “no other brands have such detailed and demanding requests like Shein”. If things go smoothly, the T-shirts Li makes leave the factory gate bound for Shein at a price of 20 yuan (US$3) each, shipped on to overseas markets by the e-commerce retailer, including the US and the Middle East, where they sell for US$10 a piece.

But Shein, although a demanding client, is hugely popular among China’s suppliers in the Pearl River Delta, a large export base for Chinese-made clothing. Why? Well, for one thing, it has a reputation for paying garment-producers on time.

China’s sophisticated supply chain, which enables suppliers like Li to source all the materials he needs in the space of a few hours, as well as the country’s early bounce back from the pandemic, has made it possible for Shein to target Generation Z consumers across the globe with appealing, relatively low cost products, such as US$14 high-waist short jeans and US$3 bandanas for pets.