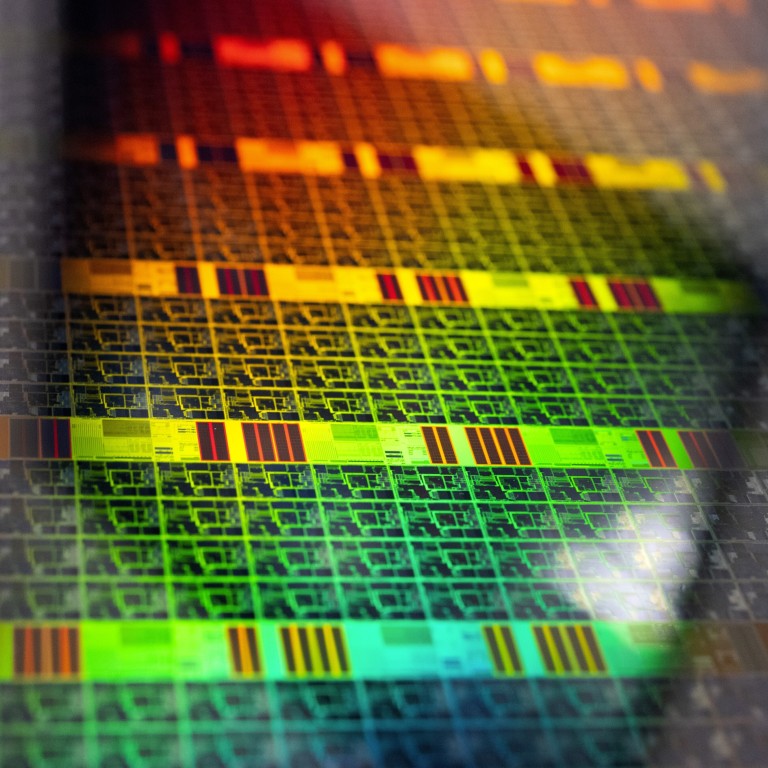

UK probes Chinese takeover of Newport Wafer Fab, the country’s biggest chip plant

- UK Prime Minister Boris Johnson said he asked the country’s national security adviser to look into Nexperia’s acquisition of Newport Wafer Fab

- Dutch chip maker Nexperia was acquired by China’s Wingtech Technology in 2018

Britain’s national security adviser will examine the takeover of the country’s biggest semiconductor plant by a Chinese-owned company after lawmakers said it could threaten the country’s hi-tech future.

“We are looking into it. I have asked the national security adviser to review,” Prime Minister Boris Johnson told Parliament on Tuesday.

Chinese-owned Nexperia said to buy UK chip maker for US$87 million

Johnson told parliament that National Security Adviser Stephen Lovegrove will “judge whether the stuff that they are making is of real intellectual property value and interest to China, whether there are real security implications”.

“The government needs to call this in and block it,” said former Conservative Party leader Iain Duncan Smith in an interview. “This yet again shows that despite the legislation, despite all the earlier tough talk, the government is looking two ways on China. This sale is an investment disaster.”

Vetoing the deal could antagonise Beijing and signal a hardening of Britain’s stance on Chinese investments in the chip industry, which is at the centre of a trade war between the US and China.

Obscure Chinese venture capital fund in spotlight after string of chip deals

A new law was passed this year giving sweeping powers for the government to intervene if takeovers are deemed a threat to national security. Ministers will have five years to scrutinise transactions and have powers to unpick them if they are judged a threat.

“Long-term resilience”

Although Newport Wafer is one of the UK’s largest fabrication plants – where semiconductors are made – it remains tiny compared to facilities in the US and Asia, with annual revenue of 49.4 million pounds (US$68.2 million), according to the latest UK accounts.

Nexperia has been a customer of Newport Wafer for several years, a spokesman for Netherlands-based Nexperia said in an emailed reply to questions from Bloomberg.

“Newport has a proven track record and has unparalleled experience with advanced power and semiconductor technologies,” said the spokesman. “With the acquisition, Nexperia is guaranteeing its own supply chain.”

“I think this should be called in under the legislation,” former cabinet minister and Tory MP Damian Green said in an interview, referring to the Newport Wafer sale. “It’s clear this type of manufacturing facility lies at the heart of many industries of the future and it will be very important to our long-term resilience as a hi-tech country.”