Advertisement

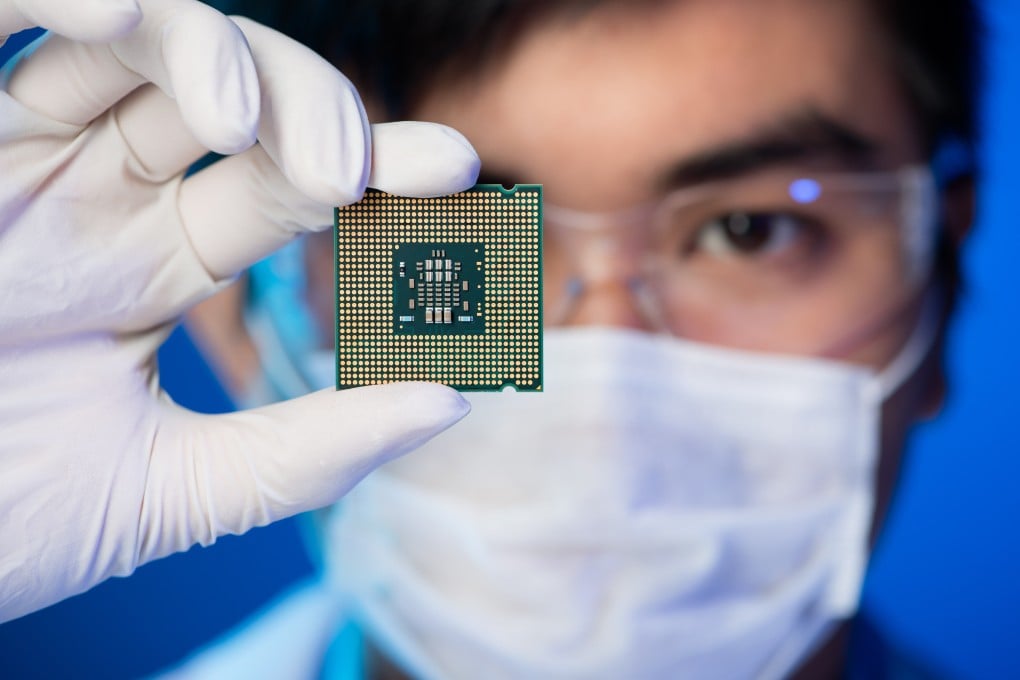

China’s chip imports soar in June as manufacturers build up supply amid global shortage

- China imported 51.9 billion semiconductor devices in June, the third-biggest volume in a single month after March and April

- The country spent a total of US$38 billion on chip imports in June

Reading Time:2 minutes

Why you can trust SCMP

1

China’s semiconductor imports continued to grow at a fast clip in June, meeting the country’s huge demand for integrated circuits (ICs) used in the production of smartphones, cars, computers and home appliances amid a lingering global chip shortage.

The world’s second-largest economy imported 51.9 billion semiconductor devices in June, the third-biggest volume in a single month after a record high in March and another strong period in April this year, according to the latest figures released on Tuesday by the country’s customs administration.

Chips remain the largest product category imported by China. The country spent a total of US$38 billion on semiconductor imports in June, almost double the cost of its crude oil shipments in the same month.

Advertisement

China brought in more than 310 billion semiconductor devices in the first six months of this year, up 29 per cent from the same period in 2020, data from the General Administration of Customs showed.

03:46

Taiwan’s worst drought in decades adds pressure to global chip shortage

Taiwan’s worst drought in decades adds pressure to global chip shortage

The increased IC imports by China come amid a global shortage of semiconductors that has chip foundries, especially those in Taiwan, scrambling to ramp up production to meet demand from industries around the world, especially from manufacturers of cars, smartphones, computers and home appliances.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x