Debt-saddled Tsinghua Unigroup to turn from top buyer to big seller of semiconductor assets

- Tsinghua Unigroup moved a step closer to a restructuring after a creditor asked a Beijing court to start bankruptcy proceedings against the company

- It will need to sell assets to pay off about US$30.8 billion in total liabilities

02:01

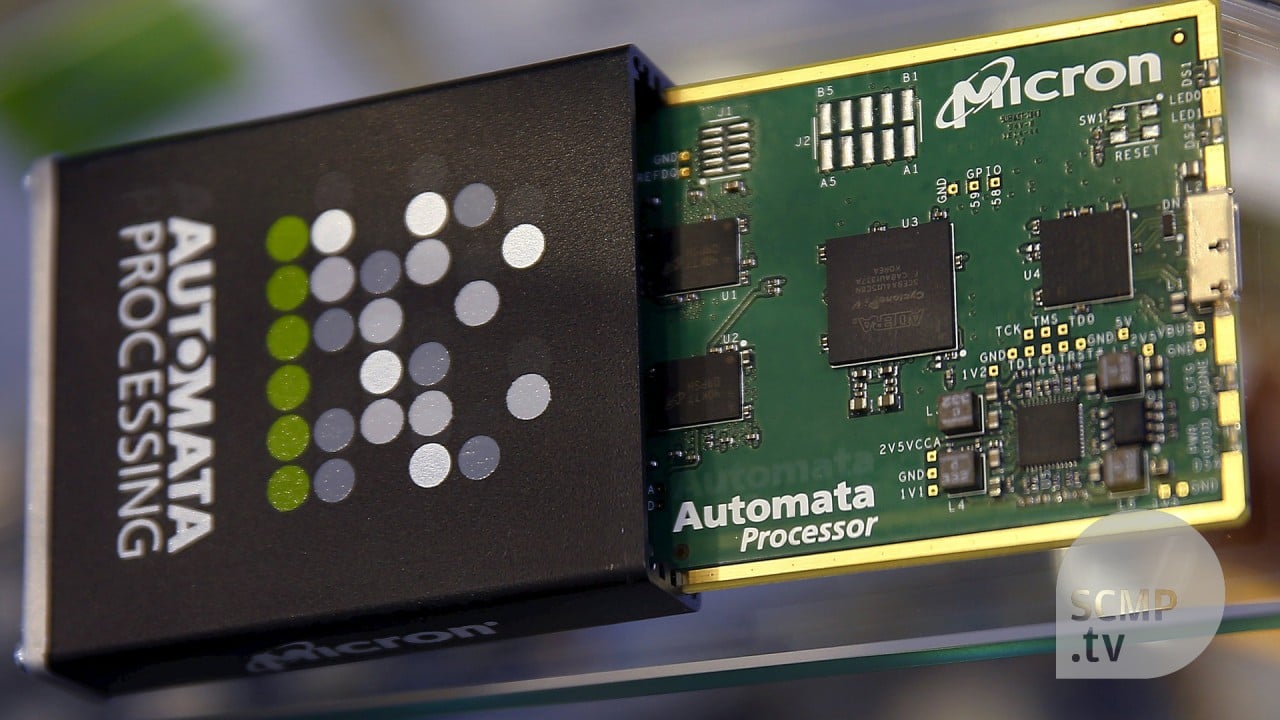

China's Tsinghua Unigroup said to plan $23 billion bid for U.S. chipmaker Micron Technology

Still, Unigroup is expected to delay any asset sale if its liquidity condition permits, according to Gary Ng, economist for the Asia-Pacific region at the Hong Kong office of French investment bank Natixis.

“Tsinghua Unigroup had paid huge premiums in [its] past acquisitions and it may be hard to fully recover the amount if the assets are put on sale,” Ng said on Monday. “Compared to peers, Tsinghua has a higher goodwill at close to 20 per cent of total assets, showing the series of deals comes with heavy cost versus book value at the time of purchase.”

China’s Tsinghua Unigroup bedevilled by debt and bad bets

Unigroup, headed by chairman Zhao Weiguo and driven by debt-funded acquisitions, expanded its operations over the past decade to become a global semiconductor powerhouse.

Unigroup had earlier privatised two US-listed tech companies, Spreadtrum Communications and RDA Microelectronics, in 2013 and 2014, respectively. These firms were merged in 2018 to become Unisoc.

Chip maker Tsinghua Unigroup facing bankruptcy after creditor action

Unigroup, with a total of 286 subsidiaries on its books at the end of June last year, started experiencing debt repayment pressure last summer. It had 202.9 billion yuan in liabilities at the time, according to the company’s 2020 first-half debt report.

That followed its failure to repay an onshore bond worth 1.3 billion yuan in November, which led to a downgrade by China Chengxin Credit Rating Group and a suspension of trading of its debt in Hong Kong.

China, US in race to invest billions in their own semiconductor industries

Introducing outside investors may be a better option for Unigroup, but the uncertainties surrounding its liabilities are a major obstacle, according to Natixis economist Ng.

“It is hard to predict whether a white knight will suddenly arrive before the restructuring, but we have not seen one so far,” Ng said.

“In this sense, the filing for restructuring process is indeed positive for Unigroup to reduce its debt burden and clear the uncertainties if a deal is reached with creditors. Once the restructuring process is completed, it will be much easier for Unigroup to seek outside investors.”