Speculation over whether Alibaba will re-enter music streaming gains traction after Tencent loses exclusive rights

- A subsidiary of Alibaba Group Holding has applied for a slew of trademarks for its now-defunct music streaming service

- Xiami Music, which ceased operations in February, was once Alibaba’s main competitor for Chinese listeners

Alibaba Singapore Holding has filed dozens of applications beginning in June for Xiami Music and Entertainment in various categories, including concert production, ticketing and music publishing, according to a search on the website of the Trademark Office of China National Intellectual Property Administration.

Alibaba, which owns South China Morning Post, did not immediately reply to a request for comment.

Demise of beloved music app shows how China’s internet has changed

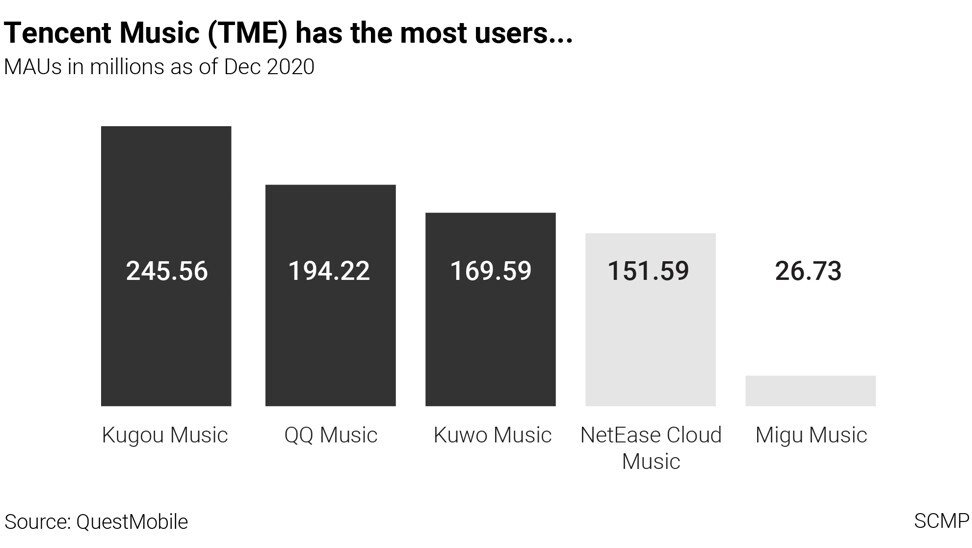

During Beijing’s crackdown on pirated music in 2015, Xiami was forced to remove 2.2 million tracks from its platform but was slow to pursue licensing deals. It went from one of the top streaming platforms to a distant laggard with just 22.4 million monthly active users (MAU) by October last year.

“We failed to satisfy the diversified needs of our users. This is our biggest regret,” Xiami said in a statement before the service was shut down.

Beijing’s latest decision, however, has given the music streaming industry a fresh chance.

On Saturday, China’s antitrust watchdog, the State Administration for Market Regulation (SAMR), slapped Shenzhen-based Tencent with a 500,00 yuan (US$77,117) fine and ordered the company to end its exclusive music licensing deals with global record labels within 30 days. The social media and entertainment giant, however, will still be able to retain its exclusive deals with independent artists, which should last no longer than three years, as well as its partnerships on new releases.

Smaller apps that shift their focus from acquiring exclusive licences back to improving user experience and supporting indie musicians may have a chance to challenge big players, said Li Qingshan, vice research director of EqualOcean consumer department, an investment research firm focusing on China.

Gao Xiaosong, chairman of Alibaba’s music arm, said in April that Xiami has made a comeback by pivoting to concert production and soundtrack publishing, according to a post on his Weibo account.

Following Beijing’s order to rid Tencent of exclusive copyrights, Cloud Village, operator of its closest rival in China NetEase Cloud Music, is reported to be undergoing a listing hearing at the Hong Kong stock exchange as soon as this week, according to Hong Kong media HKET on Monday.

NetEase declined to comment on the report.