China’s video game industry in stormy waters as the country grapples with its love-hate relationship

- China’s domestic video gaming revenue in 2020 rose to 278.7 billion yuan with almost half of the country now playing video games

- After an article in state media called video games ‘spiritual opium’ an investor sell-off saw nearly US$100 billion wiped off the value of gaming stocks

This is the first part of a series exploring China’s recent moves against the technology industry.

On July 14, 2017, the video gaming and social media tycoon went to Beijing to meet with the editors responsible for wiping out nearly US$17.5 billion (HK$136 billion) from his company’s market value.

People’s Daily greeted the billionaire with standard-practice courtesy for a person of his status: a massive LED panel displaying a digital welcome banner.

While photos of Ma and the paper’s senior leaders quickly went viral, no information was released about the content of the meeting.

At the same time as Ma’s visit, Tencent was busy introducing stringent new rules for child and teenage gamers – at the time calling them “the most serious anti-addiction measures in history”.

“[Tencent] has not only been clever in developing and publishing blockbusters, cultivating an incredibly scaled audience and branching out into different verticals such as esports or streaming,” said Serkan Toto, chief executive of consultancy Kantan Games. “[The company] has also been strategic in complying with local laws and regulations.”

And now, as China’s video games industry sees strong growth amid a world locked inside, a new wave of concerns once again puts on display Beijing’s love-hate relationship with the digital pastime as well as Tencent’s ability to navigate an increasingly complex regulatory environment.

Tencent answers call for ‘common prosperity’ with US$7.7 billion fund

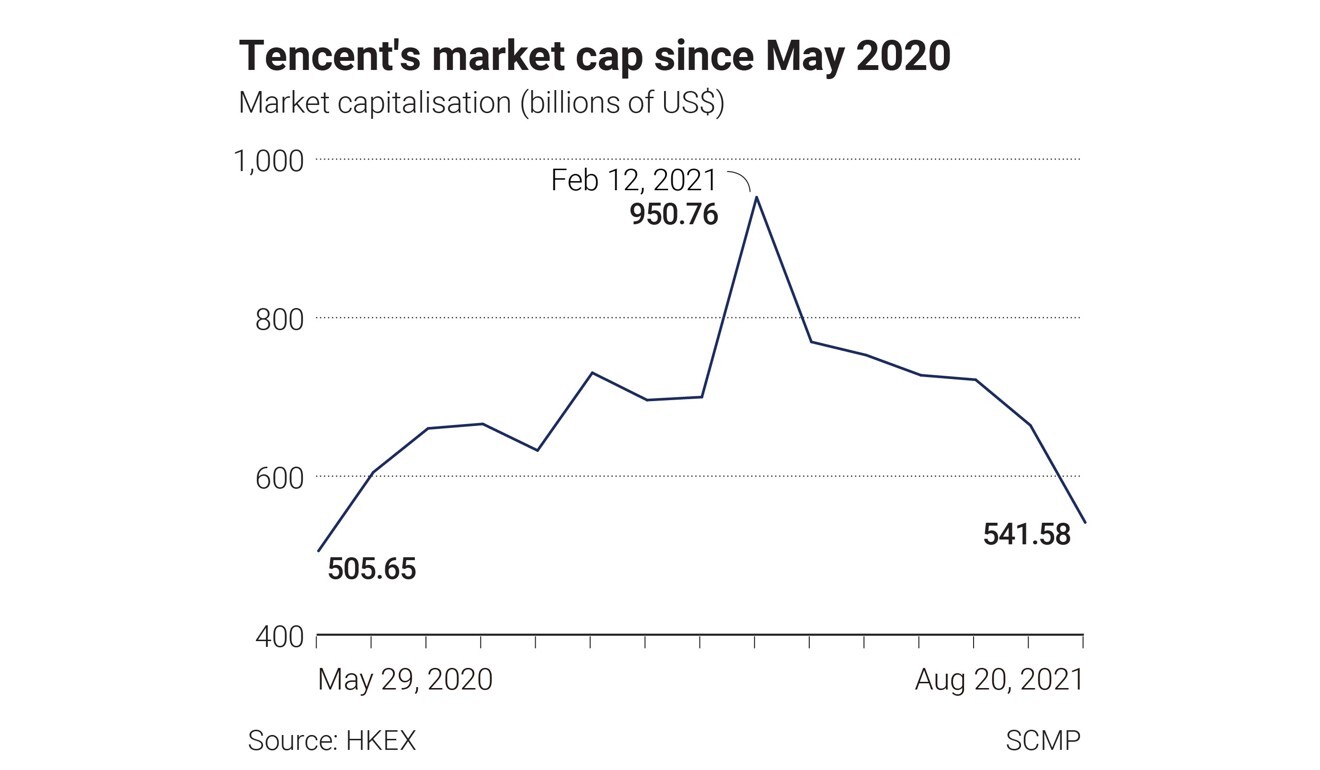

Between Ma’s fateful Beijing meeting in 2017 and this February, not only did Tencent’s market cap nearly triple to US$950 billion, China has also risen to become the world’s biggest video game market in the world.

In 2020, China’s domestic gaming revenues rose more than 20 per cent to 278.7 billion yuan (US$43 billion) with almost half of the country now playing video games, according to statistics from government-backed China Audio-Video and Digital Publishing Association.

With the support of multiple gaming giants, China has laid out big plans to capitalise on its growing gaming and esports industry.

To game is glorious

More than 40,000 gaming fans from around the world packed into the capital’s National Stadium to watch teams compete, driving mainstream interest in gaming and esports even higher.

Gamers can win official medals at Asian Games 2022

Not to be outdone, Shanghai announced in June 2021 that its online games market was worth 1.2 trillion yuan as the city strived to become “the world capital of esports”.

Increasingly, propaganda officials have gone out of their way to publicly endorse gaming and esports, comparing them to art and literature and emphasising the role of esports as “the ambassador for Chinese culture going global”.

Before Tencent’s Honour of Kings went viral, it was a desperate experiment

“Gaming might be perceived as the best chance for China to really tackle its soft power issue abroad,” Daniel Camilo, a Shenzhen-based gaming consultant said. “Consider the soft power that Japan managed to spread internationally with its video games and popular IPs. China has a lot more resources than Japan ever had, and already the biggest gaming company in the world.”

Protecting the youth

The article from state media that called Honour of Kings “spiritual opium” was taken as a signal that the sector could be Beijing’s next target, an investor sell-off saw nearly US$100 billion wiped off the value of gaming stocks.

Tencent alone lost US$43 billion in a matter of hours and, since its high in February, has lost more than US$400 billion.

“Tencent has been quick to respond to criticism and concerns about its game business, that have been raised by the government, media and parents,” said Daniel Ahmad, senior analyst at Niko Partners. “Tencent was the first games company to roll out an anti-addiction system for minors on mobile in 2017.”

However, that does not seem to have been enough as more state-owned outlets continue to pile on.

Pain of China’s Big Tech crackdown a necessary short-term cost: state media

“While the youth modes have apparently accumulated a significant number of users, many problems still persist, with some youth modes being criticised by parents as ‘existing in name only’”, the op-ed said.

A public interest lawsuit, brought by the Haidian District People’s Procuratorate, alleges that the youth mode of Tencent’s multipurpose super app WeChat fails to comply with China’s updated minors protection laws.

Following the barrage of criticisms aimed at Honour of Kings in 2017, trouble in fact did not fully disappear for Tencent or the gaming industry.

As part of a restructuring of regulatory bodies, Beijing virtually halted the approval for all new video game licence applications.

Unlike most other countries, game publishers in China have to obtain approval from regulators before releasing their games.

Uncertain outlook

A large wrinkle in Tencent’s strategy proved deadly for smaller developers.

More than 28,000 gaming companies closed their doors in 2018 and 2019, according to a report by state-run broadcaster China Central Television.

If Beijing does decide to take aggressive action against video gaming, the same thing could happen again.

“Smaller developers in China’s online games market may be harder hit by tightening regulations on the sector than large, diversified leaders including Tencent and NetEase,” wrote Matthew Kanterman, senior analyst at Bloomberg Intelligence, in a recent note.

The comparison between video games and drugs by Chinese state media dates back to 2000 when People’s Daily called video games “digital heroin”.

That same year, the Chinese government banned the sale of video game consoles. It wouldn’t be until 2015 that Sony’s PlayStation and Microsoft’s Xbox were allowed an official presence.

In 2020, three years after its global launch, the Nintendo Switch finally came to China with the help of Tencent. At launch, it only had three games and Chinese players cannot play with their international peers.

04:22

The Chinese grandpa who has cleared 300 video games

It affords authorities better visibility into the industry, forces Tencent to lead the industry by example, and gives China sway over an international cultural behemoth.

“Tencent, as the biggest gaming company in the world, and having direct influence and ownership over many studios worldwide, might function as Beijing‘s spear to spread its influence,” said Shenzhen-based consultant Camilo. “Just like Hollywood moulded world views and perceptions all over the planet in favour of an American-centric perspective, it is legitimate to assume that Beijing has similar plans, including through gaming.”