China phone makers could be squeezed by TSMC and Samsung chip price hikes amid weak consumer demand

- Xiaomi and Oppo may find it difficult to pass rising production costs on to consumers due to weaker global demand for smartphones

- China is the world’s largest semiconductor importer, buying in two thirds of its chip consumption needs

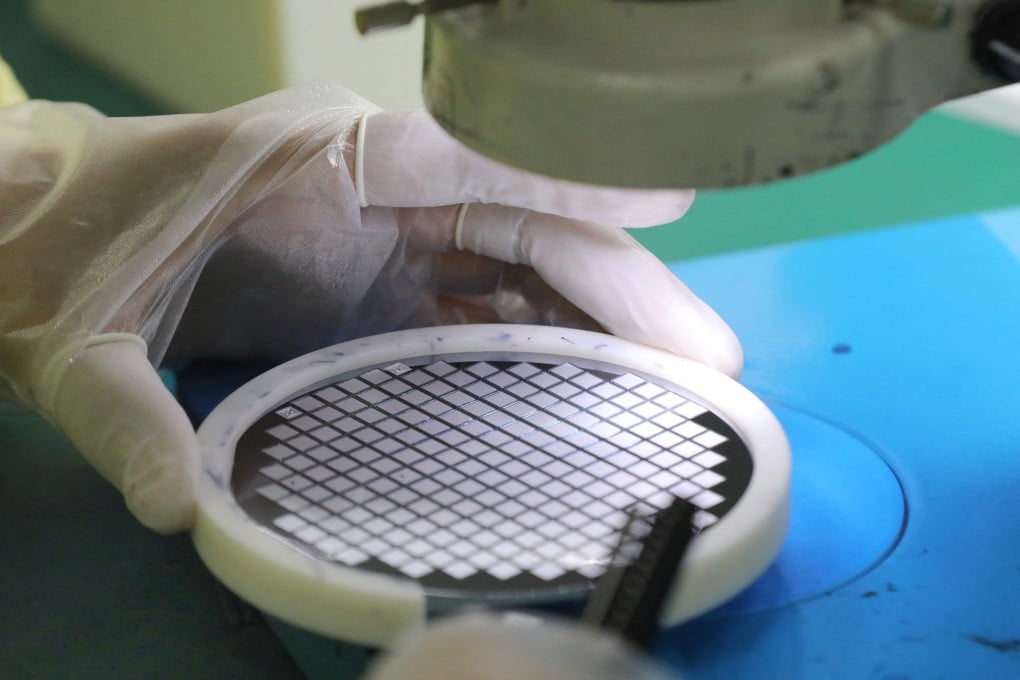

Smartphone makers in China, most of whom currently rely on imported chips, are expected to see rising costs as major chip foundries, including Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Electronics rush to raise wafer prices amid a semiconductor supply crunch, analysts said.

Furthermore, leading Chinese smartphone brands such as Huawei Technologies Co, Xiaomi and Oppo may find it difficult to pass these rising production costs on to consumers due to weaker demand in global smartphone markets, analysts added.

The planned hike in chip prices comes amid an ongoing semiconductor shortage that began with the supply chain impact of Covid-19, and which has been exacerbated by uneven global economic growth and the inability of firms to forecast demand accurately across a range of sectors, such as PCs, phones, consumer electronics and autos.

“Global smartphone market demand rebounded less than expected due to Covid-19, chip shortages and rising logistics costs,” said Chiu Shih-fang, a tech and supply chain analyst at the Taiwan Institute of Economic Research. “To avoid further hammering the willingness of consumers to pay, [we] believe it will be hard for smartphone makers to reflect rising production costs for wafers and logistics by raising product prices.”

As a result, Nicole Peng, vice-president of mobility at Canalys, said companies are expected to suspend products with lower profit margins and focus on higher-priced new models to curb the impact of higher production costs.

Consumer electronics products, such as smartphones and personal computers, both stuttered in the second quarter, with total second-quarter smartphone shipments in mainland China down by 17 per cent year-on-year and total PC shipments falling by 3 per cent in the same period, data from research company Canalys showed.