Nvidia to abandon acquisition of SoftBank’s Arm after regulatory opposition

- SoftBank now plans to proceed with an IPO of Arm, in lieu of the deal, according to sources, with the listing expected to happen in the fiscal year ending March 2023

- Arm Chief Executive Officer Simon Segars has resigned, but the move was not related to the demise of the deal, one of the sources said

Nvidia Corp is abandoning its purchase of British semiconductor design firm Arm from SoftBank Group Corp, according to people familiar with the situation, bowing to regulatory opposition and ending what would have been the chip industry’s largest deal.

SoftBank now plans to proceed with an initial public offering of Arm, in lieu of the deal, according to the people, who asked not to be identified because the move is not yet public. The IPO is expected to happen in the fiscal year ending March 2023.

Arm chief executive Simon Segars has resigned, handing the job to company president Rene Haas, according to the people. The move was not related to the demise of the deal, one of the people said.

Segars was one of Arm’s first employees and worked his way up through the ranks to become CEO in 2013. He continued to lead the company after it was acquired by SoftBank in 2016.

The Financial Times reported earlier that the transaction collapsed on Monday. Last month, Bloomberg reported that Nvidia was preparing to wind down the deal. SoftBank and Arm are entitled to keep US$2 billion that Nvidia paid at signing, including a US$1.25 billion break-up fee.

Nvidia, Arm and SoftBank representatives declined to comment.

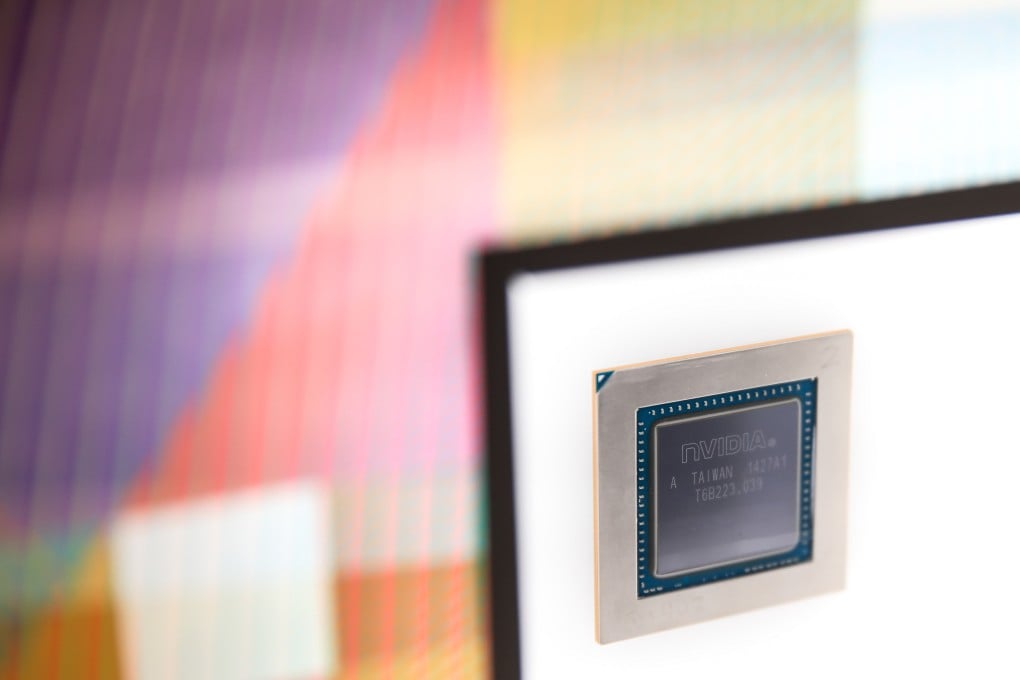

Nvidia announced the acquisition in September 2020, aiming to take control of chip technology that is used in everything from phones to factory equipment. But the US$40 billion transaction faced opposition from the start. Arm’s own customers scorned the idea, and regulators vowed to give it close scrutiny.

The purchase was dealt its most severe blow when the US Federal Trade Commission sued to block it in December, arguing that Nvidia would gain too much control over chip designs used by the world’s biggest technology companies.