Jack Ma’s Ant appoints Southeast Asia head, signalling focus is back on growth after restructuring

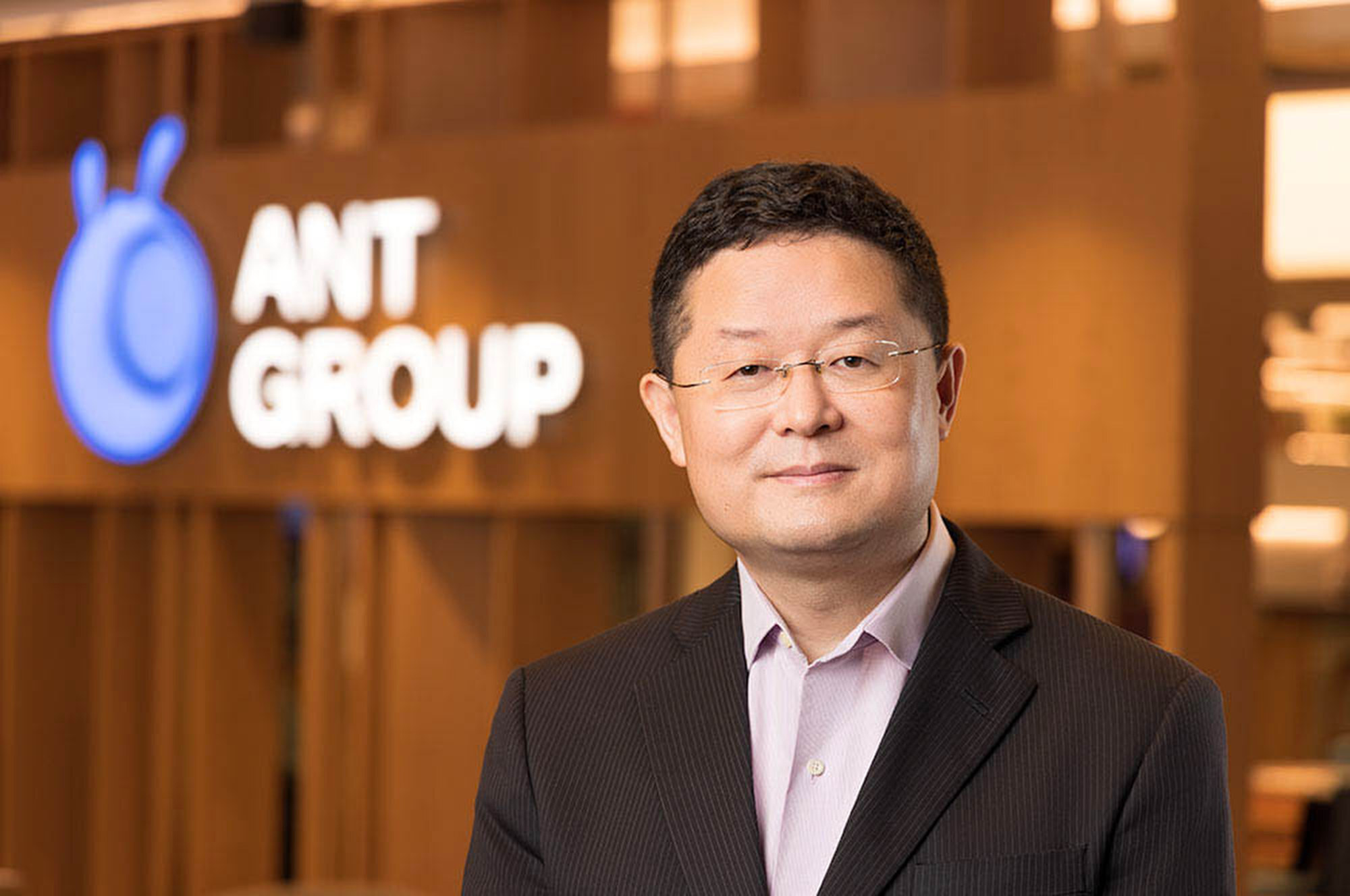

- Jia Hang, a former UnionPay executive who joined the fintech giant in 2015, will take up the newly-created role

- Ant has divested some noncore businesses in recent months, including its entire 15 per cent stake in Chinese tech news portal 36Kr

Ant Group, the fintech business affiliated with Alibaba Group Holding, has named its first regional head for the Southeast Asian market, sending a signal that the group is putting its focus back on growth as a restructuring process to meet tougher Chinese regulations nears completion.

Jia Hang, a former UnionPay executive who joined the fintech giant in 2015, will take up the newly-created role of regional general manager for Southeast Asia, Ant said in a statement on Wednesday. Ant said it wants to “double down on talent and capability-building to better support small and medium enterprises in the region”.

Ant Group was valued at around US$300 billion before its planned initial public offering in Hong Kong and Shanghai was called off at the last minute in late 2020 as Beijing moved to toughen regulations. Since then the company has been undergoing a rectification process, which has seen shrinkage of its lucrative consumer loan and micro credit businesses.

Alibaba expands share buy-back to a record US$25 billion amid stock slump

Ant has also divested some noncore businesses in recent months, including its entire 15 per cent stake in Chinese tech news portal 36Kr, which it bought in 2015, according to a corporate filing last week with the US Securities and Exchange Commission. Alibaba owns the South China Morning Post.

Alibaba affiliate Ant sells stake in tech news site 36Kr

Singapore-based Jia is an industry veteran with more than 20 years of experience in payments and financial technology. He worked at China’s state-backed financial services giant UnionPay for nearly 10 years in its international division. His most recent responsibilities at Ant include the global operation of WorldFirst, an international business payments unit.

Jia said that Ant will leverage Alipay Plus, a cross-border mobile payment service announced last year that accepts popular digital payment methods from across the world, to better serve its “over one billion Southeast Asia consumers by connecting them with their favourite e-wallets and other mobile payment methods”.

The indefinite postponement of Ant’s IPO has weighed heavily on Alibaba’s stock price, along with a sustained regulatory crackdown on Big Tech firms in China, with the share price down about two thirds from late 2020. Alibaba announced on Tuesday that it has upsized a share buy-back programme from US$15 billion to US$25 billion.