Chinese ride-hailing giant Didi Chuxing loses ground at home under Beijing’s wrath, as rivals keep climbing

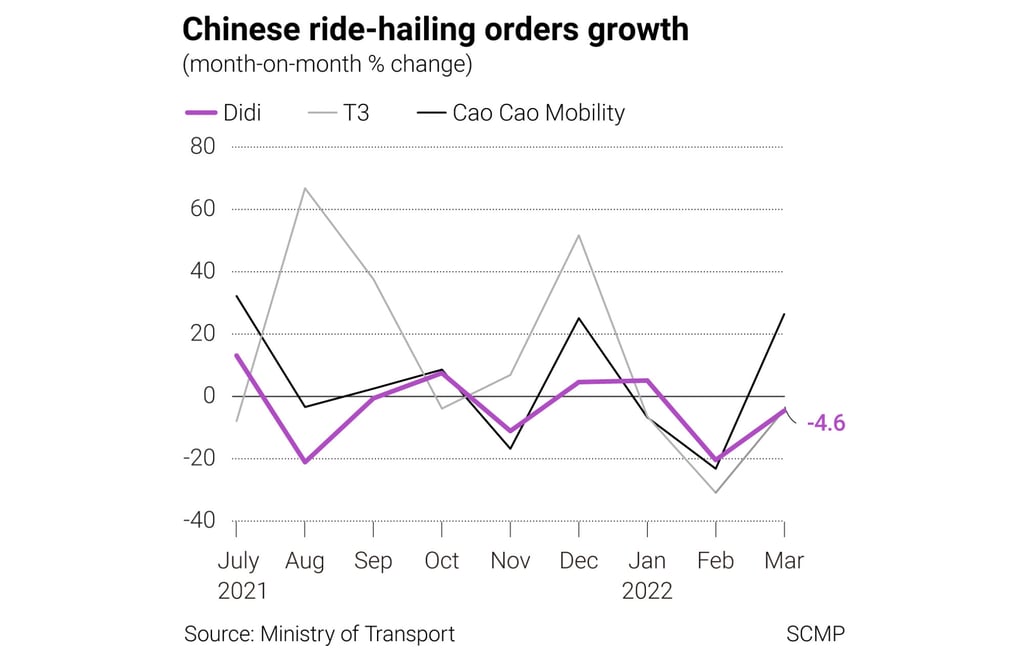

- Didi orders fell 4.6 per cent in March from the previous month, according to China’s transport ministry, and have fallen 29 per cent since last June

- The tech giant’s unsettled cybersecurity probe continues to weigh on the company as it prepares for a shareholder vote on plans to delist in New York

Chinese ride-hailing giant Didi Chuxing has been slowly losing its market dominance since last summer, when Beijing forced the removal of dozens of its apps from app stores and banned the company from taking new users, according to data from China’s Ministry of Transport and other third-party research institutions.

Didi orders fell 4.6 per cent in March from the previous month, the transport ministry’s latest figures show. By comparison, rival Cao Cao Mobility, backed by carmaker Geely, saw its orders jump 26.4 per cent. The ministry’s numbers do not cover all of Didi’s services.

Since its US$4.4 billion IPO, Didi’s order volume plummeted by 29 per cent through March, according to a calculation of monthly growth rate figures published by the transport ministry.

This has left an opening for rivals. Cao Cao saw orders grow 34 per cent in the same period, according to the ministry’s data. Orders at T3, which is backed by state-owned companies, more than doubled.

Still, Didi has held on to a considerable market lead. The ministry does not publish the absolute numbers for orders, but market research firm QuestMobile estimates that Didi had 80.7 million monthly active users (MAUs) by the end of 2021, a 20 per cent year-on-year decline. Cao Cao and T3 had just 6.6 million and 11.5 million MAUs, respectively. For those companies, though, it is a remarkable ascent, with 65 per cent growth for Cao Cao and 125 per cent for T3, according to QuestMobile.