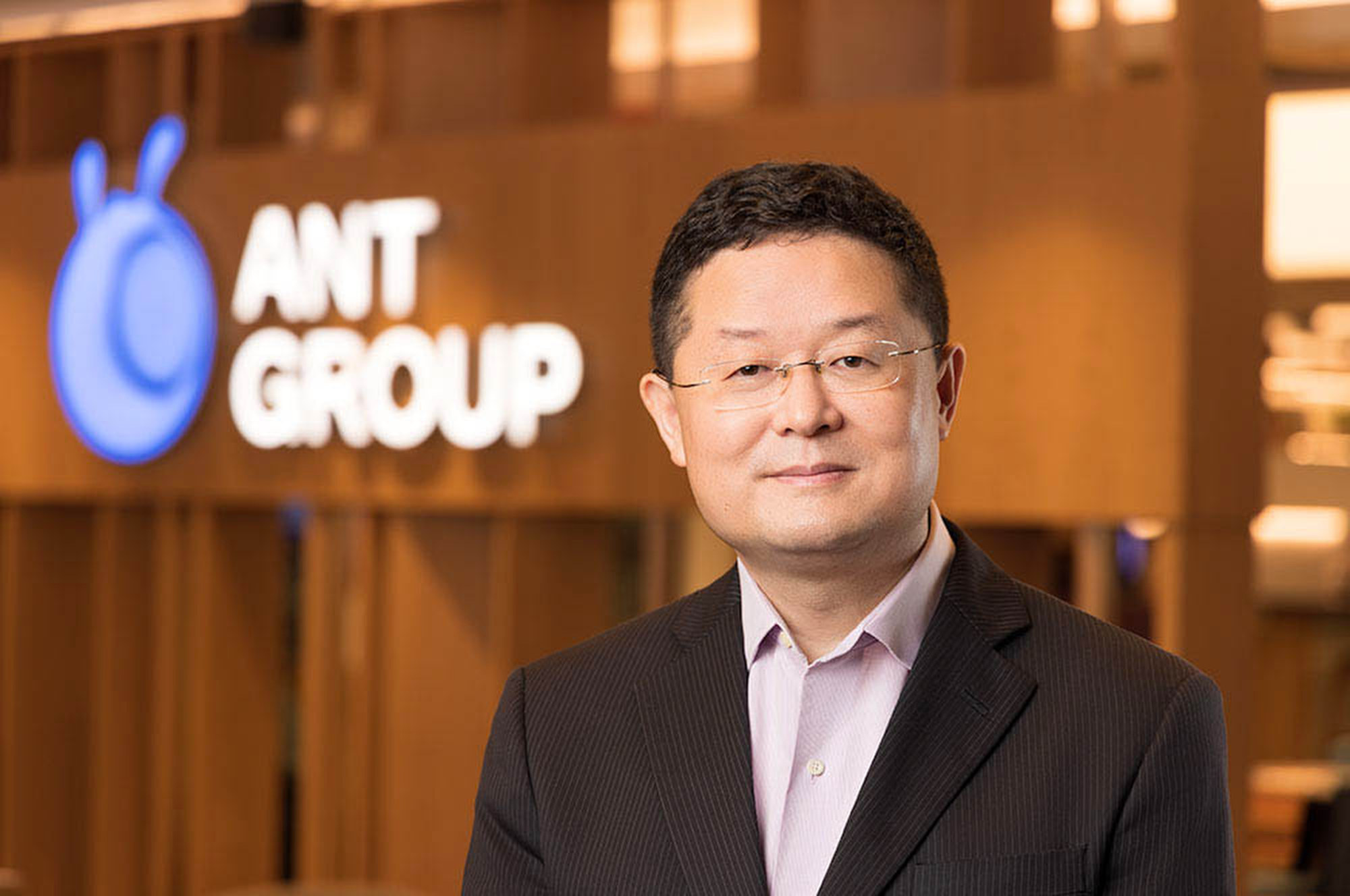

Ant Group on hiring spree in Singapore ahead of digital bank opening, sources say

- The planned expansion of Ant’s digital banking team indicates that its Singapore digital bank is likely to open later this year, one source said

- In 2020, Ant was one of four candidates granted a digital banking license by the Monetary Authority of Singapore

Ant Group, the fintech giant undergoing a restructuring in China at the behest of regulators, is recruiting 20 new positions in Singapore as the Chinese financial technology giant doubles down on expansion in the Southeast Asia region, according to an update posted on its LinkedIn page on Friday.

It is one of the biggest Singapore hiring sprees for Ant, which is affiliated with South China Morning Post owner Alibaba Holding Group. Ant currently employs about 300 workers in the city state to run its Southeast Asian businesses, according to two people familiar with the matter.

The planned expansion of Ant’s digital banking team reflects that its Singapore digital bank is likely to open later this year, one of the people said.

Alibaba affiliate Ant sells stake in tech news site 36Kr

“Hiring and developing talent is a core part of Ant Group’s people strategy as we strengthen our capabilities in Southeast Asia and support individuals and businesses, especially SMEs, to ride the region’s wave of the digital economy,” a company representative said in a written statement.

The new positions cover credit management, security and marketing for the forthcoming digital bank in the city state, as well as payment solutions and compliance for Alipay+, a cross-border digital payment service introduced in 2020, which can process a wide range of mobile payment methods from around the world, according to LinkedIn posts on Friday.

Last month, Ant acquired the majority of shares in Singapore-based payments platform 2C2P.

In 2020, Ant was one of four candidates, including a consortium comprising ride-hailing giant Grab and another wholly-owned by consumer tech giant Sea, to be granted a digital banking license by the Monetary Authority of Singapore.

None of them have become operational yet.