Advertisement

Ant Group, China securities regulator deny reports Alibaba’s fintech giant is reviving stalled IPO

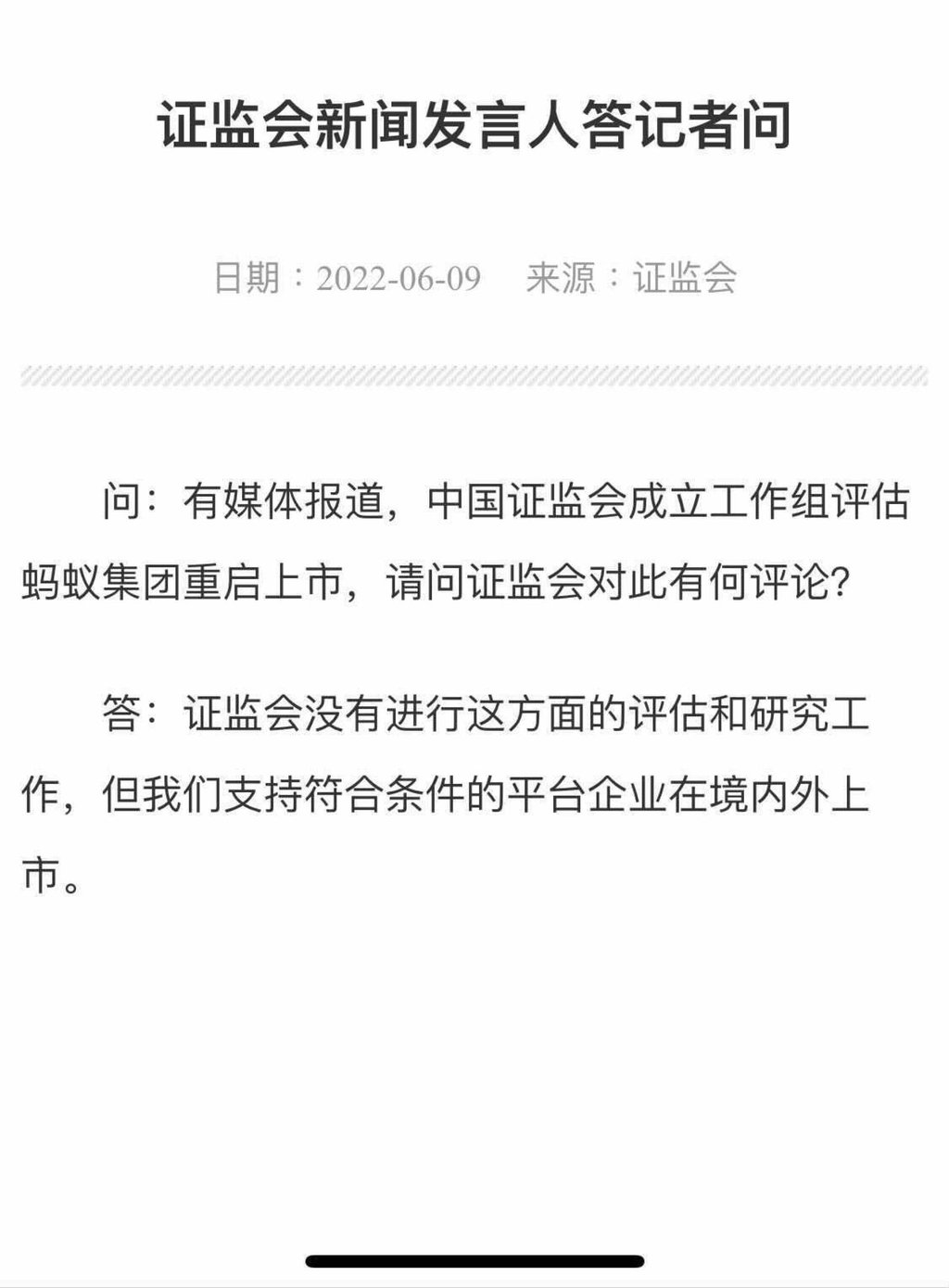

- The China Securities Regulatory Commission says in a one-sentence statement that it ‘has not conducted any assessment or research’ in the matter

- Discussions about a potential resumption of Ant’s planned IPO, which was called off in late 2020, come amid signs Beijing is loosening its grip over the tech sector

Reading Time:2 minutes

Why you can trust SCMP

China’s securities regulator said it was not conducting any assessment regarding the potential resumption of Ant Group’s stock offering, denying a report from Bloomberg News this week that authorities have started “early stage discussions” over the matter.

The China Securities Regulatory Commission (CSRC) said in a one-sentence statement late Thursday that it “has not conducted any assessment or research in this regard”, but that it supports “qualified platform enterprises to go public in domestic and overseas markets”.

Ant Group, the fintech affiliate of South China Morning Post owner Alibaba Group Holding, also denied it was working to revive the plan. The initial public offering (IPO) in Shanghai and Hong Kong, which would have raised almost US$40 billion, was blocked in November 2020, preceding a trillion-dollar tech-sector crackdown.

Advertisement

“Under the guidance of regulators, we are focused on steadily moving forward with our rectification work and do not have any plan to initiate an IPO,” the company said in a statement on Thursday.

Speculation about Ant’s fate resurfaced in recent days after the firm reshuffled its board of directors, adding Laura Cha Shih May-lung – chairwoman of Hong Kong Exchanges and Clearing and a member of the Hong Kong government’s Executive Council – as an independent director.

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x