Advertisement

China’s flagging birth rate, weak consumer spending prompt top online baby-and-mom emporium Mia.com to trim operations

- Mia.com said it will continue to sell products via its mini program on WeChat, the multipurpose super app owned by Tencent

- Other Chinese baby-and-mom product platforms, including Beibei.com and Muyingzhijia, have either closed or significantly scaled back their operations

Reading Time:2 minutes

Why you can trust SCMP

0

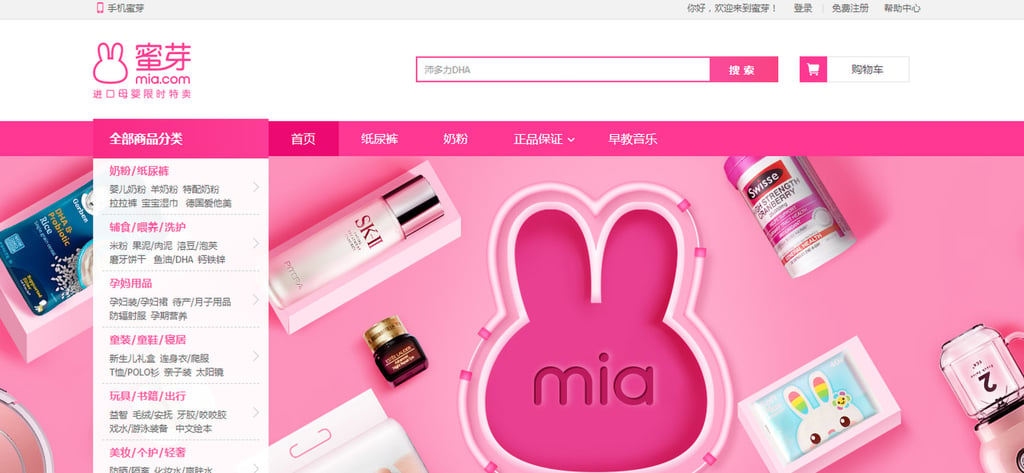

China’s popular online shopping emporium for baby-and-mom merchandise, Mia.com, will close its main app from September 10 amid weak consumer spending and a population crisis in the world’s second-largest economy, where the number of births declined for the fifth consecutive year in 2021.

Beijing-based Mia.com, which was valued at more than US$1 billion in 2015, said it was “time to say goodbye” owing to “changes in consumer behaviour”, according to an announcement on its official website on July 1. The firm said it will continue to sell products via its mini program on WeChat, the Tencent Holdings-owned super app.

Founded in 2011 by stay-at-home mother and entrepreneur Liu Nan, privately-held Mia.com saw its business expand over the past decade on the back of strong demand for imported baby-and-mom products such as diapers, baby milk formula, toys and garments.

That demand helped the start-up quickly raise fresh capital from various investors, including the likes of Sequoia Capital China and ZhenFund. The e-commerce industry was also stimulated by China’s decision to loosen its one-child policy in 2013.

The decision by Mia.com to reduce operations and instead use WeChat’s platform to sell its goods, reflects how the market has soured on specialist baby-and-mom shopping portals amid the country’s flagging birth rate, weak consumer spending and increased competition from larger e-commerce platforms.

Advertisement