Advertisement

Chinese car chip start-up SiEngine raises US$148 million in new funding as private equity firms invest in semiconductors

- SiEngine said the amount it raised represents the biggest funding recorded in the domestic car chip design sector in the first half of this year

- The start-up is a joint venture established in 2018 by smart car technology company EcarX and Arm China

Reading Time:2 minutes

Why you can trust SCMP

SiEngine Technology Co, a start-up focused on advanced automotive system-on-a-chip designs, raised nearly 1 billion yuan (US$148 million) from investors led by Sequoia Capital China in its Series A financing round, the fabless semiconductor company announced on Tuesday.

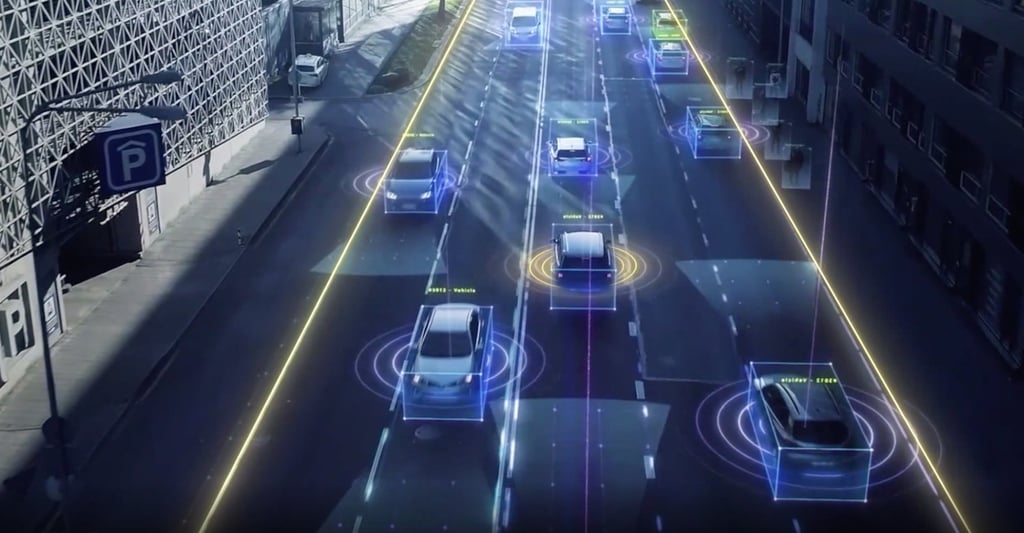

“There is huge long-term potential in intelligent car production,” said Tony Xiang Xiaoxiao, a managing director at Sequoia Capital China, according to the statement posted by SiEngine on its official WeChat account. Xiang also indicated that the venture capital firm will support SiEngine to expand its business in the intelligent car, autonomous driving and other industrial fields.

SiEngine said the amount it raised represents the biggest funding recorded in the domestic car chip design sector in the first half of this year. Its other Series A investors include Chinese software company Neusoft, engineering firm Robert Bosch’s venture capital arm Boyuan Capital and Shanghai-based China Fortune-Tech Capital, an investment firm founded by Semiconductor Manufacturing International Corp.

Advertisement

Based in Wuhan, capital of central Hubei province, SiEngine is a joint venture established in 2018 by smart car technology company EcarX and Arm China. Backed by Chinese carmaker Geely Auto, EcarX was founded by Chinese billionaire Li Shufu, who is also the founder and chairman of Zhejiang Geely Holding Group.

The proceeds from SiEngine’s latest funding round will be used for supply of existing products, research and development, and deployment of high-computing-power automotive chips.

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x