US-China tech war: Beijing forges ahead with all-in chip effort, brushing aside asset bubbles and graft probes

- China lacks the software, equipment and capabilities for advanced chips, a weakness laid bare by the tech war between Washington and Beijing

- In the face of political calls for self-sufficiency, it is hard to avoid waste, fraud and bubbles amid a continuous flow of state funds, experts say

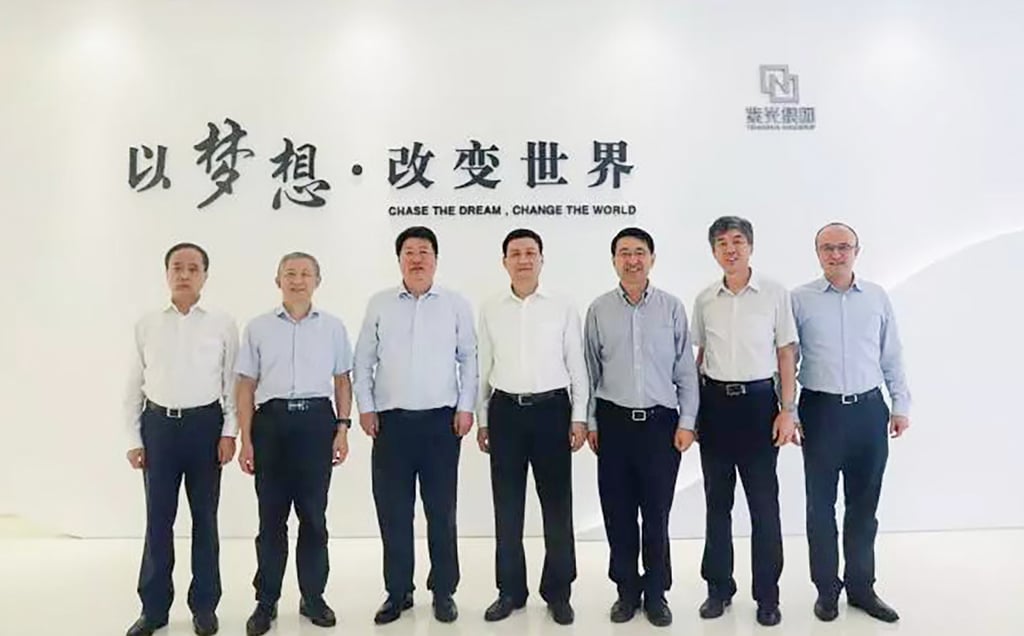

In July 2018, Xiao Yaqing, then chairman of China’s state-owned assets watchdog, visited the Beijing office of Tsinghua Unigroup, a day after the state-backed semiconductor conglomerate announced another big takeover deal – the US$2.6 billion acquisition of French chip maker Linxens.

Xiao, who two years later would head China’s Ministry of Industry and Information Technology, discussed with Unigroup’s then-chairman Zhao Weiguo how the country’s state and corporate sectors could work together in semiconductor development, according to a press release issued at the time.

Fast forward to four year later and three key figures in a group photo taken at the time, shot against the background of Unigroup’s slogan “chase the dream, change the world”, are subject to state graft investigations.

Zhao is also subject to an investigation, as is Diao Shijing, the co-president of Unigroup and a former director general in the industry ministry, according to Chinese media Caixin.

Before these developments, Unigroup went through a bankruptcy restructuring after failing to repay its debts and was taken over by new owners, becoming a cautionary tale for the consequences of blind expansion.

Zhao and Diao have joined a long list of corruption targets in China’s chip industry. They include Ding Wenwu, the former president of the China Integrated Circuit Industry Investment Fund, also known as the Big Fund, as well as Lu Jun, the fund’s former chief executive, and Yang Zhengfan, another executive at the fund, who are all being investigated.