Hong Kong exposure to FTX is ‘immaterial’, securities regulator says, as crypto firm’s collapse raises scrutiny

- The Securities and Futures Commission checked with fund managers and determined their exposure risk to the company and its FTT cryptocurrency is limited

- FTX, founded in Hong Kong, is facing investigations in multiple markets following its rapid decline and bankruptcy last week

Hong Kong fund managers are not at risk from exposure to FTX, according to the Securities and Futures Commission (SFC), which has looked into the shocking collapse of the world’s second-largest cryptocurrency exchange that has rattled investor confidence and sent token prices spiralling.

“SFC has made enquiries with licensed fund managers with exposure to virtual assets, and considered the exposure, if any, to FTX, FTT and related entities to be immaterial,” an SFC spokesman said on Monday. “The fallout of FTX could impact other tokens and other parts of the virtual assets ecology. We will continue to monitor the situation.”

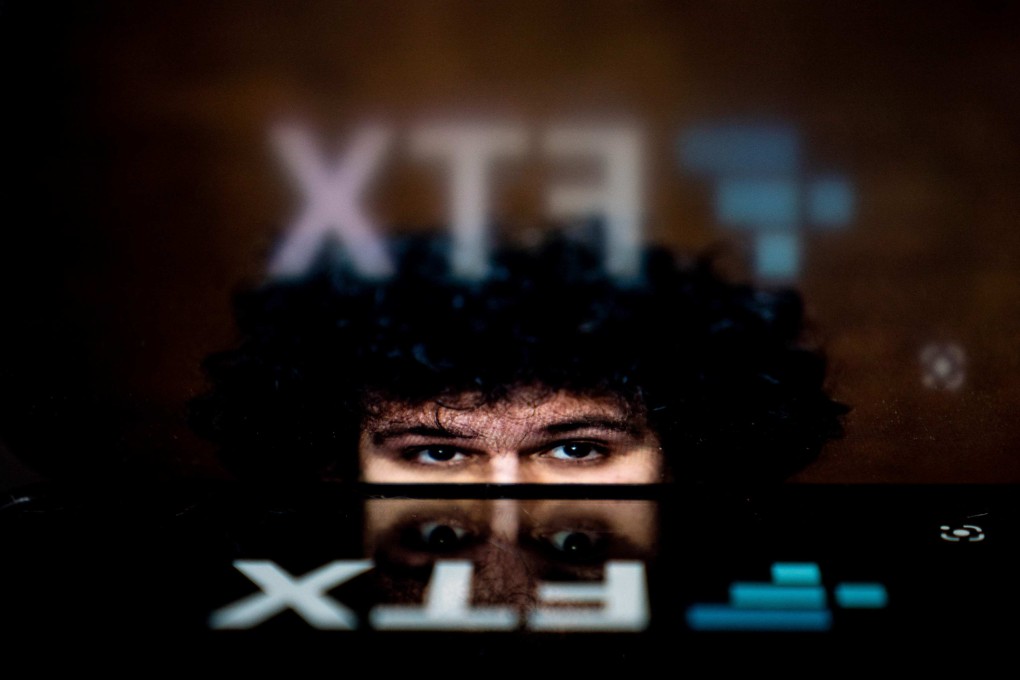

The spokesman added that FTX is not registered with the SFC, which is required in the city to operate as an exchange for digital assets. FTX was founded in Hong Kong and remains on the city’s corporate registry, but it moved its headquarters to the Bahamas in September 2021. Founder Sam Bankman-Fried cited a friendlier and clearer regulatory framework for cryptocurrencies in the archipelago as a reason for the move.

Like FTX, Alameda moved operations to the Bahamas last year. But the company, which originally moved to Hong Kong two months after it was founded in November 2017, has maintained a registered office under a subsidiary in the city.

FTX’s troubles began when CoinDesk reported on November 2 that the exchange’s native token FTT was Alameda’s biggest asset. Binance founder and crypto industry rival Zhao “CZ” Changpeng, who also previously ran his company from Hong Kong, subsequently announced that his exchange would be selling its roughly US$530 million in FTT.

Zhao’s announcement sent FTT prices tumbling, and users of FTX rushed to pull out US$6 billion in funds within 72 hours. Bankman-Fried tried to negotiate a takeover deal with Binance, but the company ultimately backed out of a statement of intent for an acquisition.