Analysis | TSMC sits out CES, but its role in everything from AMD and Nvidia chips to silicon speakers signals a bright 2023

- The contract chip maker has lowered capital expenditures for 2023, but uncontested market dominance makes it best poised to capture a rebound later this year

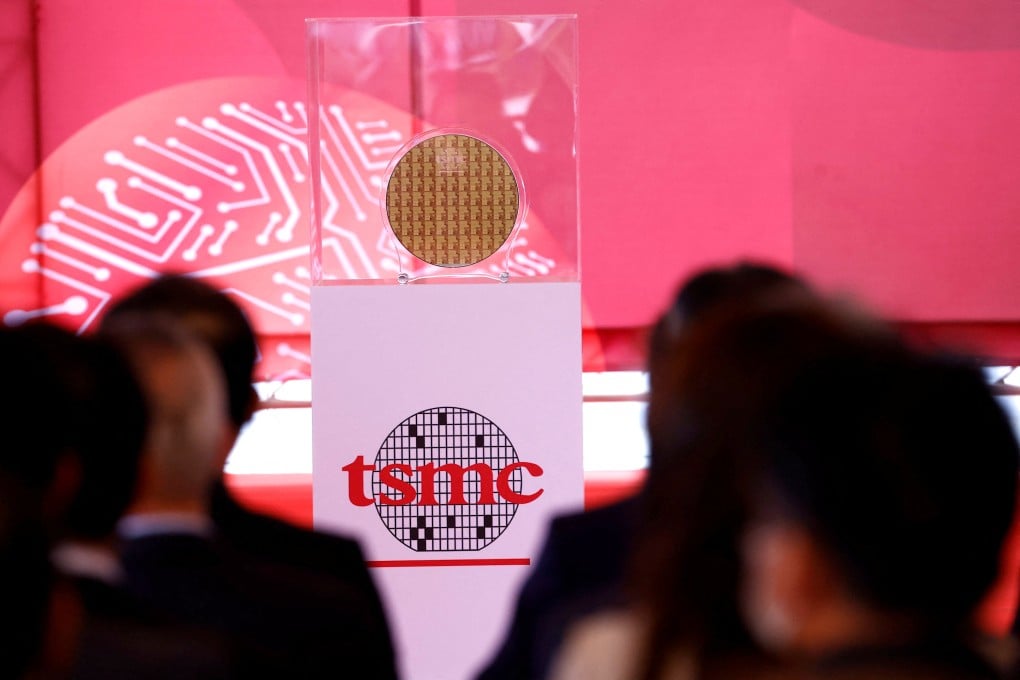

- TSMC, which is known to stay out of the spotlight, has become a more conspicuous presence in the semiconductor industry amid US-China tensions

CES 2023 was a perfect illustration of TSMC’s market power. Taiwan’s “sacred mountain” was on full display at the world’s biggest consumer electronics show in Las Vegas this month - even though it did not have its own booth - and semiconductors produced on the island could be seen in everything from the most advanced desktop processors to silicon speakers that could one day replace bulkier audio modules in miniature electronics.

This is not unusual: TSMC produces nearly all of the world’s most advanced chips. But the foundry’s role in the industry has become increasingly visible amid rising US-China tensions and semiconductor-related sanctions from Washington.

Kicking off CES with the first big product announcement on the evening of January 4, Advanced Micro Devices (AMD) debuted its latest laptop and desktop computer chips, including the Ryzen 7045 with a maximum of 16 cores and three new chips in the same 7000 line that use 3D V-Cache, which allows for stacking cache memory on a processor.

Like just about any other top chip designer, AMD’s main manufacturer is TSMC. Its new chips are based on the Taiwanese firm’s 5-nanometre node process and 4-nm, a derivative of 5-nm.