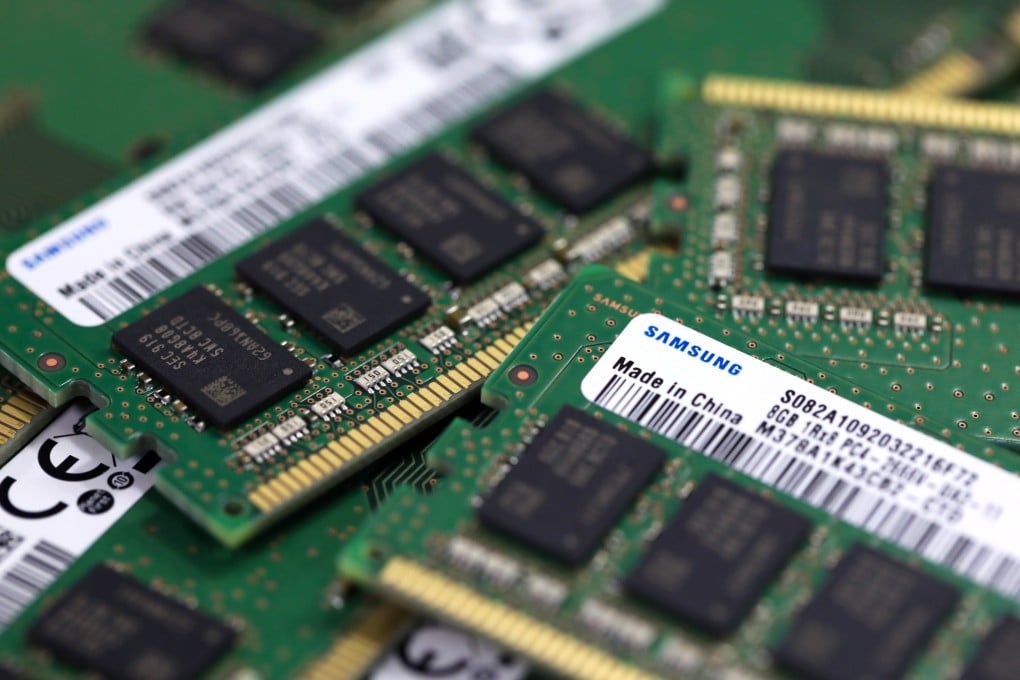

Semiconductor giants are losing money on every chip as historic glut threatens to wipe out earnings

- Intel, Samsung, Micron and others are being hit by one of the worst chip routs ever in a swift decent from the pandemic sales surge

- Chip inventories have more than tripled to record levels, reaching three to four months’ worth of supply

This time was supposed to be different.

The memory-chip sector, famous for its boom-and-bust cycles, had changed its ways. A combination of more disciplined management and new markets for its products – including 5G technology and cloud services – would ensure that companies delivered more predictable earnings.

And yet, less than a year after memory companies made such pronouncements, the US$160 billion industry is suffering one of its worst routs ever. There is a glut of the chips sitting in warehouses, customers are cutting orders, and product prices have plunged.

“The chip industry thought that suppliers were going to have better control,” said Avril Wu, senior research vice-president at TrendForce. “This downturn has proved everybody was wrong.”

The unprecedented crisis is not just wiping out cash at industry leaders SK Hynix and Micron Technology, but also destabilising their suppliers, denting Asian economies that rely on tech exports, and forcing the few remaining memory players to form alliances or even consider mergers.