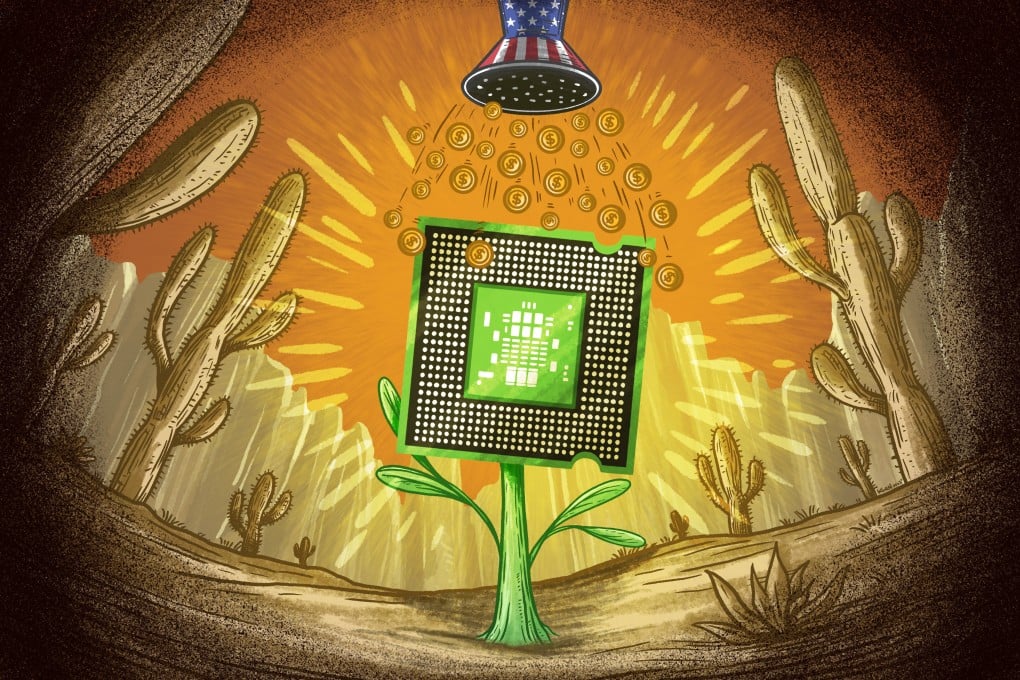

TSMC’s US plant the result of industrial policy meant to counter China, giving states like Arizona more economic heft

- Arizona’s strength in semiconductors helped it court TSMC, but the deal could not have happened without the implicit promise of federal spending

- The state has been ramping up educational pipelines to supply TSMC with everything from entry-level technicians to semiconductor engineers

This is the first of a two-part series looking at how Arizona was chosen as the US state to host the latest semiconductor wafer fabrication plant from TSMC, the world’s leading chip foundry, in a move that is redefining geopolitical boundaries in the global chip industry.

Years later, under pressure from the administration of then-president Donald Trump to open a facility in the US, Foxconn finally agreed to build a new display panel plant – in Wisconsin. Foxconn’s plans for the state included a 315-acre parcel of land that was supposed to house a facility that would create thousands of new jobs, but it never materialised. Microsoft recently agreed to buy the land for US$50 million.

In hindsight, Arizona may have dodged a bullet. But TSMC always made more sense for the state, which has a robust semiconductor industry in the desert. Arizona has thus become one of the biggest beneficiaries of resurgent place-based industrial policy in the US, which seeks to leverage specific industrial strengths in certain localities, as the country seeks to counter the technological rise of China, where industrial policy has long been a staple of central government planning.

“Left to their own devices, the companies are going to gravitate to places where there’s already significant presence. That is an advantage that Arizona has,” said Mark Muro, a senior fellow at Brookings Institution who studies place-based industrial policy. “As a sunbelt, new place, it’s one of the most established in semiconductors.”