China’s booming one-man bookstore on WeChat shows how Tencent is taking on ByteDance in live-streaming e-commerce

- A bookseller generating 1 million to 1.5 million yuan daily during the June 18 shopping festival has become a success story for Tencent to tout its Douyin rival

- The Shenzhen-based tech giant is cutting fees and boosting support for live-streaming merchants as it looks to grow its short video platform to profitability

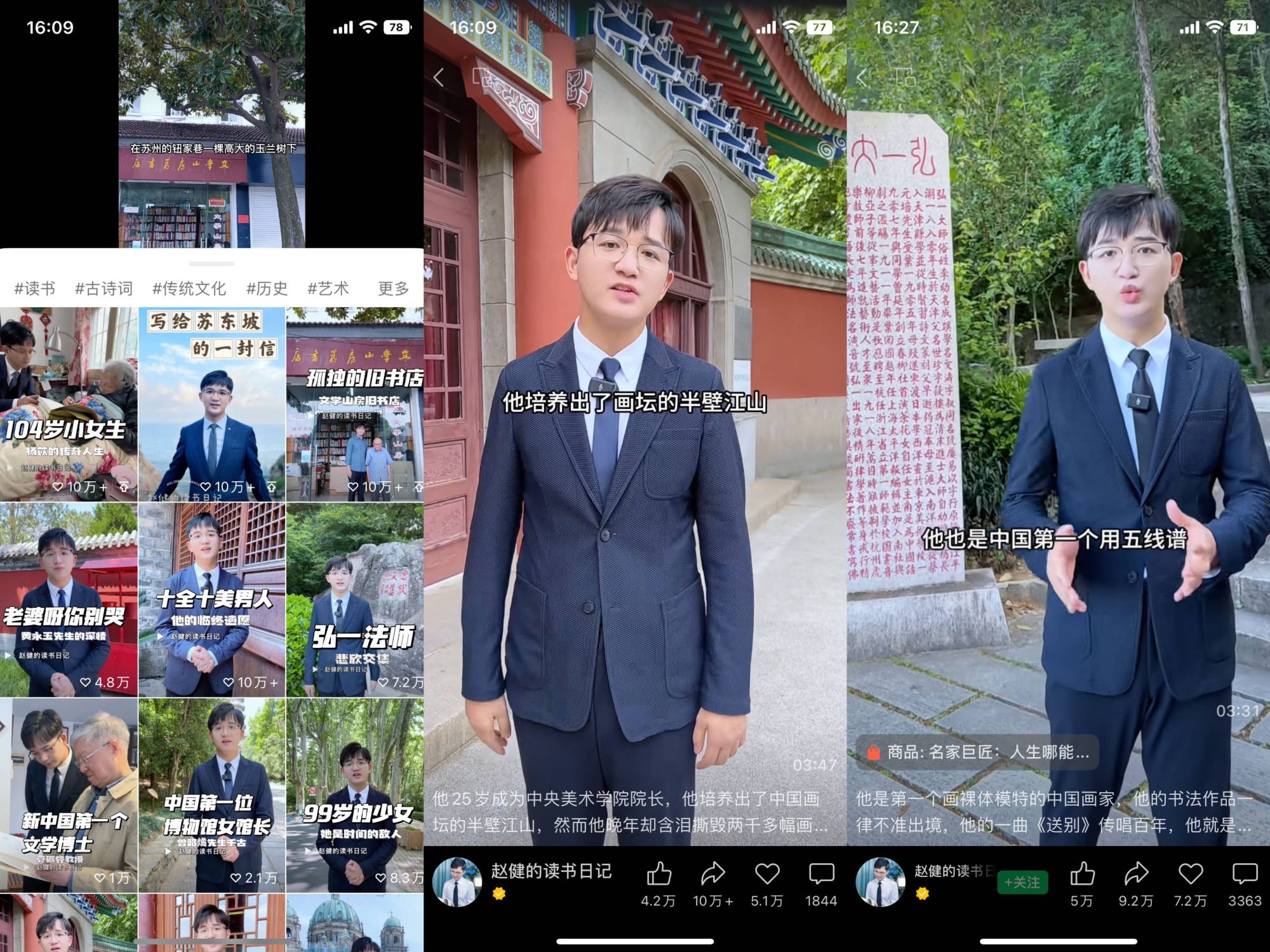

Zhao Jian used to run a massive bookstore in Nanjing that covered 9,000 square metres; now he runs a one-man shop online in front of a camera.

The Shenzhen-based tech giant is now boosting support for merchants on its platform as it seeks a greater slice of China’s online retail market. For the duration of the shopping festival this month, Tencent has cut the “technology support fee” for merchants to 1 per cent. Normal rates range from 1 to 5 per cent, depending on the product category.

Like many Chinese online retailers these days, Zhao said he live-streams every day, typically from 7.30pm to 11.30pm, introducing a new book every 30 minutes.

“Some books I’ll discuss [with readers] several times,” Zhao said in an interview arranged by Tencent. “For example, I talk about [the classic text of ancient Chinese historiography] Zizhi Tongjian two or three times every week. I guide readers in the live-streaming room to read it chapter by chapter following the table of contents.”

Zhao now has more than 1.8 million followers on WeChat Channels, which he grew initially through the app’s Moments feature, similar to Facebook’s Feed, he said. This eventually attracted people who were not in his social circle.

More than 30 per cent of his followers are based in Beijing, and more than 20 per cent are from Shanghai, Zhejiang, Jiangsu, and Guangdong provinces, Zhao said.

Drawing on WeChat’s vast base of 1.3 billion monthly active users, Channels has been growing rapidly with an estimated 813 million monthly active users as of June last year, according to data analytics firm QuestMobile. That put it ahead of the 680 million users on Douyin and the 390 million on Kuaishou that same month.

Although founder Pony Ma Huateng referred to Channels as the “new hope” of the company in an internal meeting at the end of 2022, Tencent has been measured in its approach to monetising the feature.

“In terms of e-commerce in relation to live-streaming in Video Accounts, there’s actually a very big opportunity, and part of it is already proven in the other short-video companies,” Tencent president Martin Lau said in a conference call with analysts in May. “But we want to do it on a gradual basis so that we can build the infrastructure right.”

Since its beta launch in January 2020, WeChat Channels has launched a series of e-commerce tools and incentive schemes to help merchants sell more through live-streaming, from which Tencent extracts commission. Gross merchandise value, a measure of the total value of goods sold on the platform, grew 800 per cent last year, according to the company.

Tencent’s cautious approach was the right move to ensure the quality of user experience and content, according to Zhang Yi, CEO of Guangzhou-based market research firm iiMedia.

“For Tencent, the most important prerequisite is to keep WeChat users, and not to lose them due to commercialisation,” Zhang said.

However, Tencent is still a long way from turning Channels into a cash cow. In contrast, Douyin has been a mature revenue generator for some time, with 1.41 trillion yuan in gross merchant value last year, according to a report by The Information.

Short video apps are also drawing advertisers away from other social media platforms. It was the only internet category with growth in ad revenue last year, according to a report by Interactive Marketing Lab Zhongguancun and PwC in January.

“While Douyin is still the most outstanding in the live-streaming e-commerce market, it’s not impossible for Channels to catch up in the future with its wide user base and a strong social network,” Zhang said. “But for Tencent, they are also looking at the problems exposed by Douyin’s live streams [to learn from them].”