Tech war: China’s second largest chip maker sets Shanghai listing price at hefty premium to Hong Kong as big state investors rush to subscribe

- Hong Kong-listed Hua Hong plans to sell up to 408 million shares at 52 yuan (US$7.23) apiece in Shanghai, a premium of about 120 per cent over Hong Kong

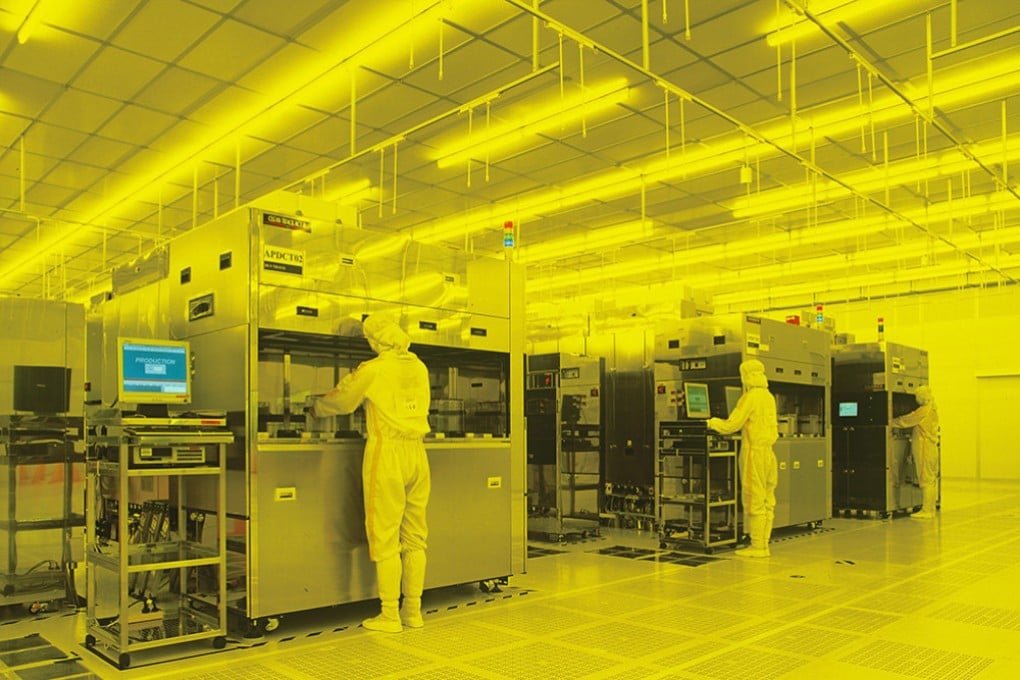

- While Hua Hong lags advanced international chip foundries, its mature 28-nm technology is suited for applications in cars, appliances, and consumer electronics

China’s second largest semiconductor maker is selling its Shanghai shares at significant premium over its Hong Kong stock price, taking advantage of funding from state investors keen to show support for Beijing’s drive for semiconductor self-sufficiency.

Hong Kong-listed Hua Hong Semiconductor started accepting A-share investor subscriptions on Tuesday, planning to sell up to 408 million shares at 52 yuan (US$7.23) apiece in Shanghai, representing a premium of about 120 per cent over its Hong Kong shares that were trading at HK$25.25 (US$3.23) on Tuesday.

The total capital-raising of 21.2 billion yuan (US$3 billion) also marked an 18 per cent increase from its initial plan of 18 billion yuan, likely making it the largest A-shares IPO this year, as the listing received endorsements from China’s deep-pocketed state investors. The National Integrated Circuit Industry Investment Fund, or the Big Fund, has earmarked 3 billion yuan for the offered shares.

According to the official China Securities Journal, half of offered shares, or 204 million, have already been subscribed to by state investors. In addition to Beijing’s chip fund, China Reform Holdings, a state investment firm controlled by China’s state assets watchdog, has put itself down for 2 billion yuan, while the China State-owned Enterprises Structural Adjustment Fund has subscribed to 1.5 billion yuan worth of shares.

The high pricing and strong subscription interest for Hua Hong, which ranks No 2 behind Semiconductor International Manufacturing Corp in terms of capacity and technology in China, comes amid Beijing’s new strategy of leveraging both the state and the market in pursuit of self-sufficiency in chipmaking amid tighter trade restrictions from the US and its allies.

While Hua Hong Semiconductor lags advanced international chip foundries such as Taiwan Semiconductor Manufacturing Co by “generations”, its mature technologies ranging from the 55-nanometre process node to 28-nm are suited for applications in cars, home appliances, and general consumer electronics.

Hua Hong’s application for a listing in Shanghai was approved by the China Securities Regulatory Commission in June. The chip maker said the money raised would mainly be used for ramping up capacity at its Wuxi foundry, which currently produces 65,000 wafers per month.