How Shein and Temu are changing the face of China’s export machine, making life easier for an army of small businesses

- China’s exports via e-commerce are surging, boosted by apps like Shein and Temu

- Newcomers are tapping China’s vast manufacturing capabilities and using their technology to connect producers directly with overseas consumers

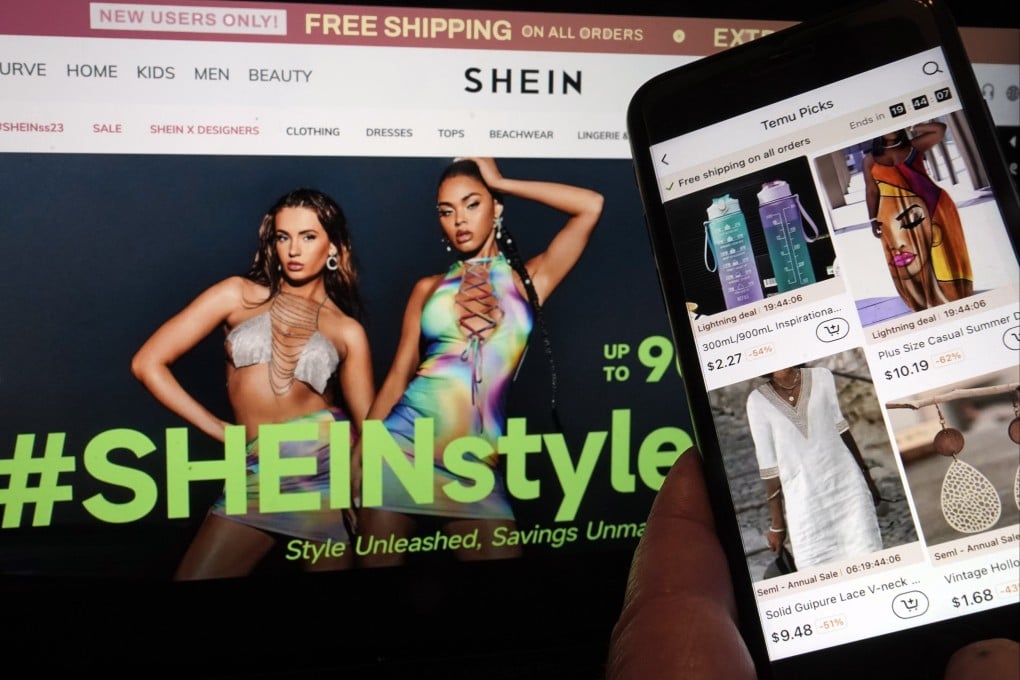

The arrival of Chinese shopping apps like Shein and Temu, which bring made-in-China goods directly to overseas consumers, is changing the face of Chinese commerce and making the world’s most powerful export machine even more formidable, according to data and merchants.

Kenny Li, who runs a garment factory in Guangzhou, capital of southern Guangdong province, is typical of the new breed of Chinese exporters. His business has been simplified thanks to fast-fashion app Shein, as he can now delegate pricing, marketing and customer service to the platform. Li says he sold about 70 million yuan (US$9.6 million) worth of clothes to Shein last year.

Li is also trying to diversify his operations by providing goods to Temu, a discount shopping app backed by PDD Holdings. “Having just one client can bring uncertainty, so we decided to try Temu too,” Li said. As a result, he says business is booming.

His story is just one anecdote from a Chinese export landscape that is being transformed by e-commerce apps, which are taking advantage of China’s vast manufacturing capabilities and using their new technology to connect producers directly with overseas consumers.

Temu’s competitors include the likes of TikTok Shop, a service rolled out by Beijing-based ByteDance, as well as e-commerce giant Alibaba Group Holding, owner of the South China Morning Post. Temu is growing fast though, and is present in 38 countries since its launch in the US last year when it ran an advert during the Super Bowl.

China’s deputy commerce minister Guo Tingting said at a conference last month that online cross-border business expanded elevenfold in the first eight months of this year compared to the same period of 2019.