Samsung shares trail rival SK Hynix as the smaller South Korean memory chip maker gets a boost from AI fever

- SK Hynix has surged 67 per cent compared with 24 per cent for Samsung owing to the smaller firm’s Nvidia deal and lead in AI-optimised high-bandwidth memory

- The AI battle is pitched against the backdrop of weak global demand for the companies’ traditional memory products amid a slump in smartphone demand

SK Hynix has surged 67 per cent this year thanks to its deal to supply premium high-bandwidth memory chips to Nvidia, trouncing Samsung, which is up 24 per cent as it struggles to get its HBM offering off the ground. That gap may widen further judging by options data, which show the put-to-call ratio on Samsung more than double that of SK Hynix.

The AI battle is pitched against the backdrop of weak global demand for the companies’ traditional memory products. That’s due in large part to smartphones, which are mired in what could be the worst industrywide slump in over a decade, hurting another key source of revenue for Samsung.

Chips remain hot overall thanks to the surge in demand for products needed to power generative AI services like ChatGPT. The Philadelphia Semiconductor Index up 31 per cent this year, outpacing gains in nearly any benchmark you can think of.

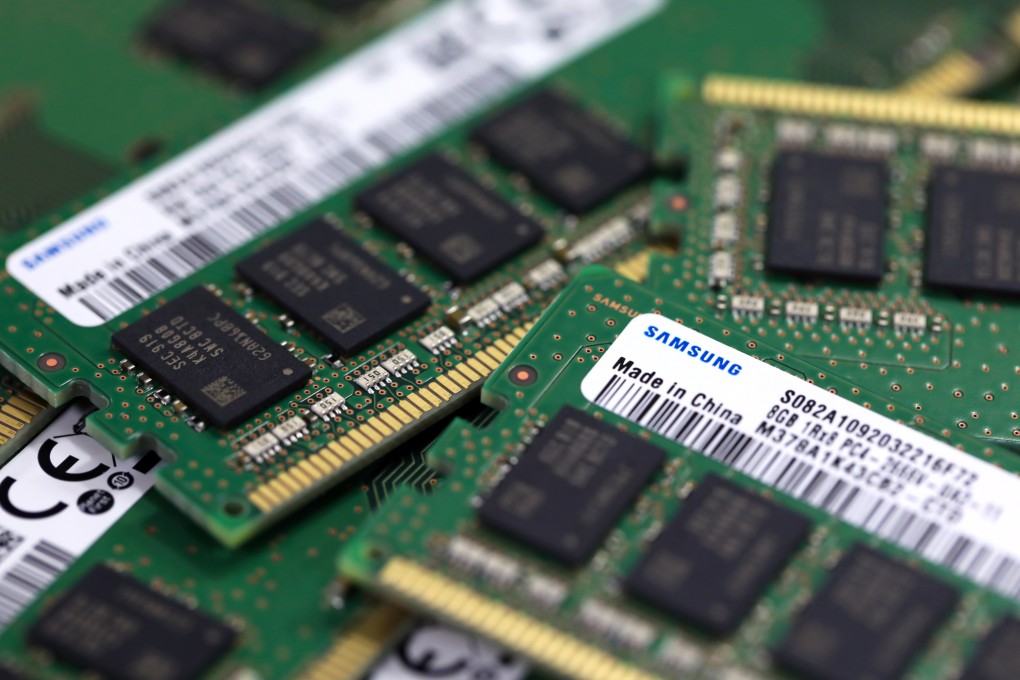

So after years of leading the memory industry, Samsung is now seen needing to play catch-up in HBM, an advanced technology optimised to work with AI accelerators. HBM features a stack of DRAM that sits on top of a processor instead of being housed in a separate memory module, enabling faster data transfer.

SK Hynix – more of a “pure-play” memory maker than its diversified peer – was able to get a jump on the latest generation of the chip, winning Nvidia as a customer for its HBM3. Samsung reportedly had trouble finalising a contract with the US AI giant for its offering, though it has developed a new HBM3E chip and said it plans to introduce an HBM4 by 2025.