China Rapid Finance casts eye towards untapped consumer base via partnerships with tech giants

China Rapid Finance, operator of the mainland’s fastest-growing online consumer lending platform, is seeking broader partnerships with major domestic internet companies and big data firms as it aims to cover the 500 million people who are underserved by the nation’s big financial institutions.

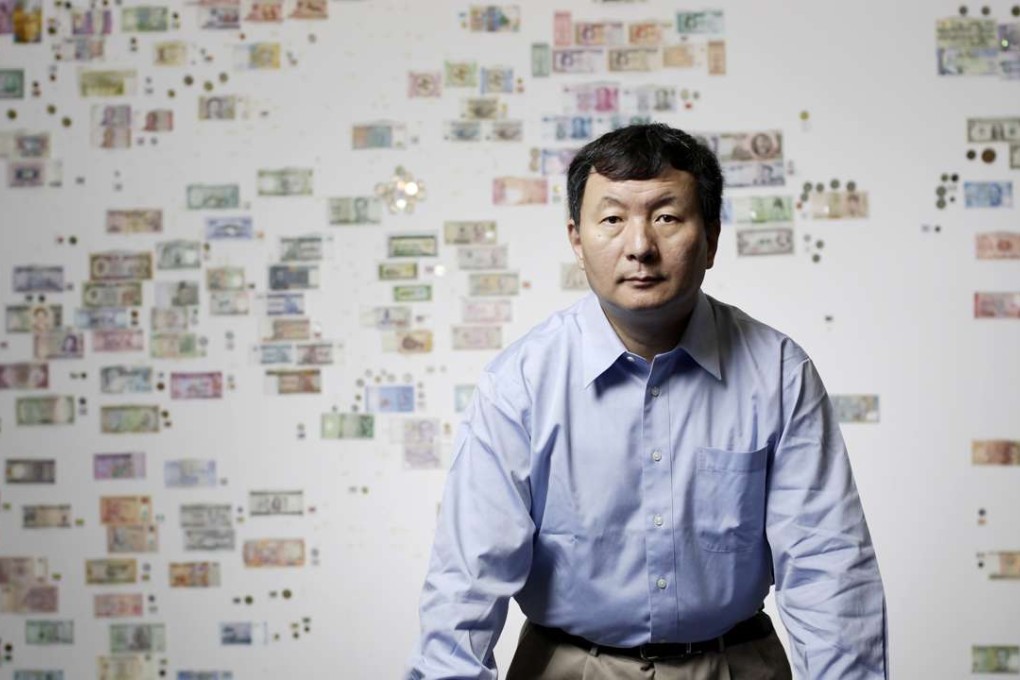

Zane Wang Zhengyu, the chairman and chief executive of China Rapid Finance, said those alliances are vital to reaching that unique market segment he calls EMMA, which stands for China’s emerging middle-class, mobile-active consumers without formal credit history.

“With data from the digital footprints of these people from their internet and mobile usage, we can use our proprietary technology to establish credit scores,” Wang said.

At the end of 2014, the Chinese central bank’s database covered around 800 million consumers, of which roughly 300 million had credit records.

That leaves about 500 million people who cannot borrow money from traditional financial organisations, Wang said.

He pointed out that these EMMA consumers in China have generated a tremendous amount of data, even if they lack a proper credit history. These included data from online search, social networks, online shopping and payments.

The mainland’s nascent peer-to-peer lending industry involves third-party investors lending money to unrelated individuals, or peers, through online marketplaces outside of traditional banking channels.