Chip foundry SMIC blows past market estimates with record US$690m Q2 revenue

Net profit for the three months also rises 27pc to US$97.6 million, the company’s 17th consecutive quarter of profitability

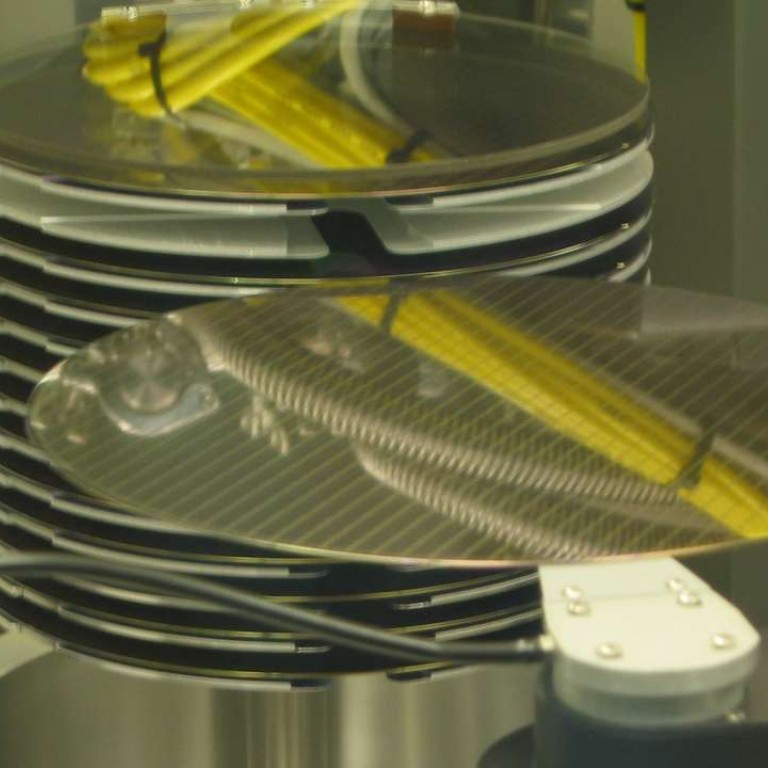

Semiconductor Manufacturing International Corp (SMIC), mainland China’s largest contract chipmaker, says it is ramping up production capacity to meet fast-growing demand in the second half of this year, following the company’s strongest quarterly results to date in the three months to June.

“We are guiding another strong quarter of growth in the third quarter, and target continued growth in the fourth quarter, contrary to seasonality, and another record year for 2016,” he said.

The Shanghai-based company expected LFoundry, the Italian integrated circuit manufacturer it bought recently for €49 million (HK$421.5 million), to significantly raise overall fabrication capacity over the next three to four quarters.

Net profit for the three months ended June 30 rose 27 per cent to US$97.6 million, up from US$76.7 million in the same period last year, on robust demand from Chinese “fabless” companies – firms that design chips and outsource their production to semiconductor foundries like SMIC.

“This marked our 17th consecutive quarter of profitability,” Chiu said, adding the firm’s capacity utilisation rate also reached 98 per cent in the period.

Gross margin was 31.6 per cent last quarter, compared to 32.3 per cent a year earlier, as revenue increased 26 per cent to a historical high of US$690.2 million from US$546.6 million the previous year.

Jefferies equity analyst Ken Hui said SMIC’s net profit was 54 per cent above his estimates and 47 per cent ahead of the market’s consensus forecast.

According to SMIC’s filing with the Hong Kong stock exchange, 52 per cent of revenue was generated from sales to customers in China, 26.5 per cent from North America, and 21.5 per cent from Europe and the rest of Asia.

Nomura analyst Huang Leping said in a report: “SMIC is operating under ideal status as a foundry with strong execution in sales and capacity expansion.”

Both Jefferies’ Hui and Nomura’s Huang identified Shenzhen-based HiSilicon, reputed to be the largest domestic designer of integrated circuits, as one of the big Chinese customers of SMIC in the second quarter.

SMIC is operating under ideal status as a foundry with strong execution in sales and capacity expansion

HiSilicon’s parent company is Huawei Technologies, the world’s largest supplier of telecommunications equipment.

Chiu said SMIC has forecast its third-quarter revenue to increase between 8 per cent and 11 per cent quarter on quarter, while its gross margin would range from 28 per cent to 30 per cent.

He added that its revenue growth target for this year would be in the mid- to high 20 per cent range, compared with the previous guidance of 20 per cent.

Jefferies’ Hui said SMIC’s higher revenue growth forecast this year “should include about two months of contribution from LFoundry”.

SMIC’s capacity expansion efforts received a boost last month when it completed its biggest debt offering to date. The company raised proceeds of US$441 million from its issue of US$450 million, zero-coupon convertible bonds due on 2022.