New | Chipmaker SMIC targets new foreign acquisition to bolster expansion

Shanghai-based firm seeks to drive new business from untapped market segments

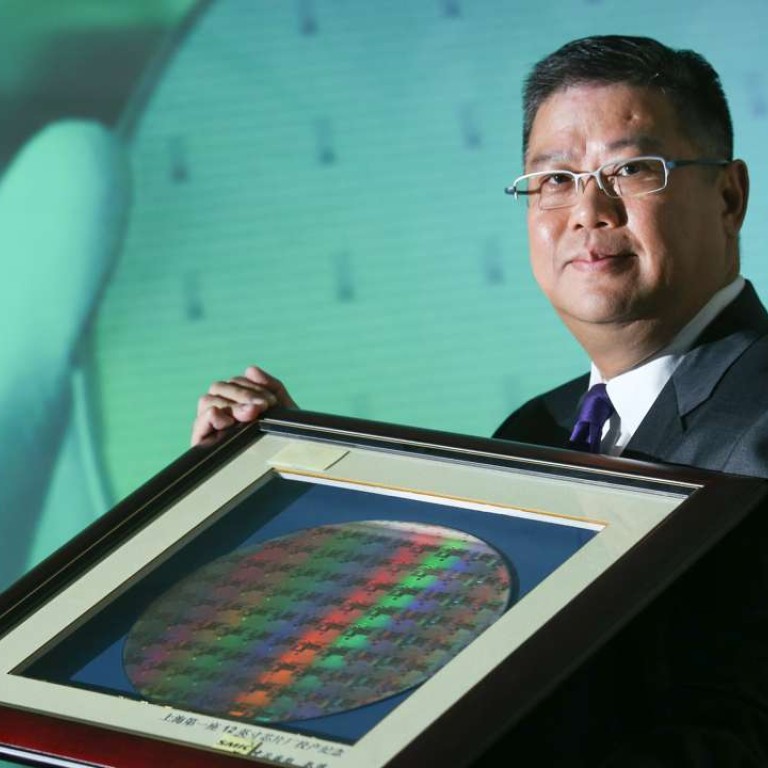

Semiconductor Manufacturing International Corp, China’s largest contract chipmaker, could be gearing up for another foreign acquisition to further expand its production capacity and drive new business from untapped market segments.

“After completing our LFoundry acquisition, we were approached by a number of [integrated-circuit foundry] players in Europe and Asia. They see SMIC as for real after that transaction.”

Shanghai-based SMIC bought a 70 per cent controlling interest in Italian contract chipmaker LFoundry for €49 million in June, marking its first purchase of an overseas-based semiconductor foundry.

It would also pave the way for the company to enter and supply chips to the vehicle and industrial markets.

Kung declined to identify SMIC’s potential new targets, but described them as similar-sized foundries “working with mature [chip-processing] technologies on a number of niche applications”.

He said a potential new deal could likely be made in the next 24 months.

“We’re weighing the risks and rewards,” he said. “We also have to make sure that we can successfully integrate LFoundry.”

The Italian firm, which had revenue of €218 million in the financial year to March, is an international contract manufacturer of so-called complementary metal-oxide semiconductor image sensors as well as analogue and mixed-signal chips used in security, vehicle and industrial-related applications.

Kung said the immediate goal of SMIC was to increase LFoundry’s capacity to produce as many as 50,000 wafers per month, up from 40,000 now.

The company expected LFoundry to significantly raise its overall fabrication capacity over the next three to four quarters.

“There is more room for us to expand capacity,” said Kung, noting the rapid growth of sales from Chinese firms that outsource chip production to SMIC.

In China, SMIC has fabs in Shanghai, Beijing, Tianjin and Shenzhen.

Mark Li, a senior analyst at Bernstein Research, said in a report that if SMIC “can bring LFoundry utilisation to the full level, that would add about 14 per cent to SMIC revenue”.

SMIC has estimated that a fully ramped-up LFoundry fab can contribute about US$300 million a year in sales to its total revenue.

Net profit rose 20 per cent to US$159 million on the back of increased wafer shipments while revenue grew 25 per cent to US$1.32 billion.

Sales from Chinese customers reached an all-time high of 49.7 per cent of total revenue for the first half.

“SMIC is able to maintain close to 100 per cent utilisation consistently [at its fabs], thanks to strong demand, especially from Chinese customers such as Huawei Technologies,” Nomura analyst Huang Leping said in a report.

SMIC earlier this year raised its capital spending to US$2.5 billion from US$1.5 billion last year to continue with its capacity expansion as well as research and development activities.