ZTE shares continue ascent on mainland mobile data growth in China, global 5G prospects

Analysts see the country’s largest-listed telecommunications equipment supplier benefiting from a fresh slate of mobile infrastructures projects worldwide

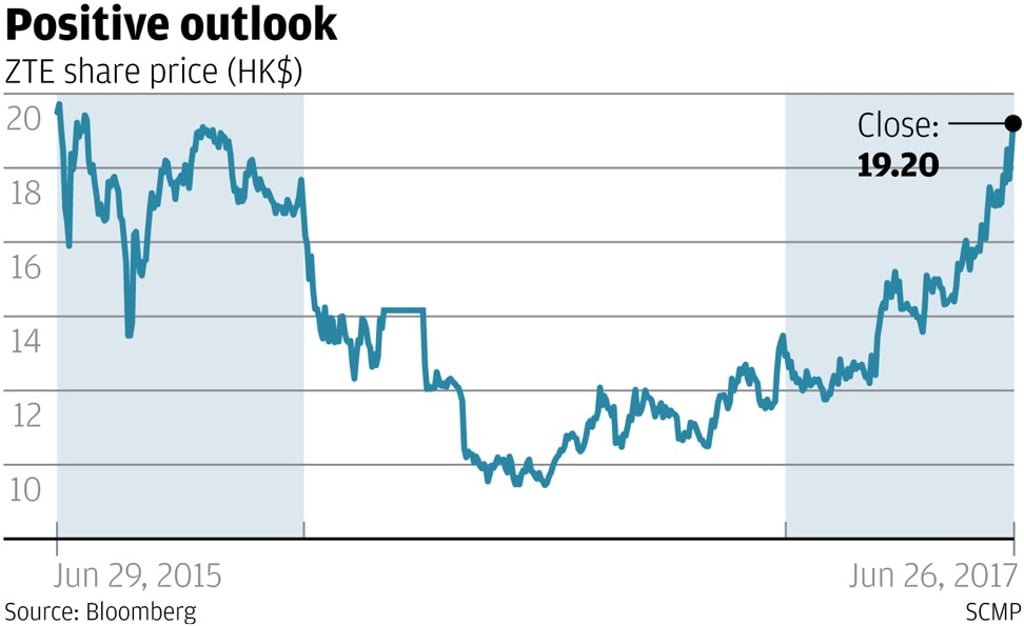

ZTE Corp’s share price continued its steady ascent since mainland China’s largest-listed telecommunications equipment maker emerged from US sanctions purgatory three months ago, reaching a two-year high of HK$19.20 on Monday.

“The trend is definitely positive,” said Jefferies equity analyst Edison Lee. “Developments over the past three months have prompted us to be even more bullish.”

Eleven market analysts out of 19 who cover ZTE had “buy” ratings on the company as of Monday, according to a Bloomberg survey. Four of them had a “hold” recommendation, while four others had a “sell” rating.

Jefferies, which has a buy recommendation on ZTE, raised its price target to HK$25.95 on Friday from the previous HK$18.60.

Shares of ZTE were up 4.4 per cent to finish at HK$19.20 on Monday, the stock’s highest close since reaching HK$19.72 on June 30, 2015.