ZTE shares continue ascent on mainland mobile data growth in China, global 5G prospects

Analysts see the country’s largest-listed telecommunications equipment supplier benefiting from a fresh slate of mobile infrastructures projects worldwide

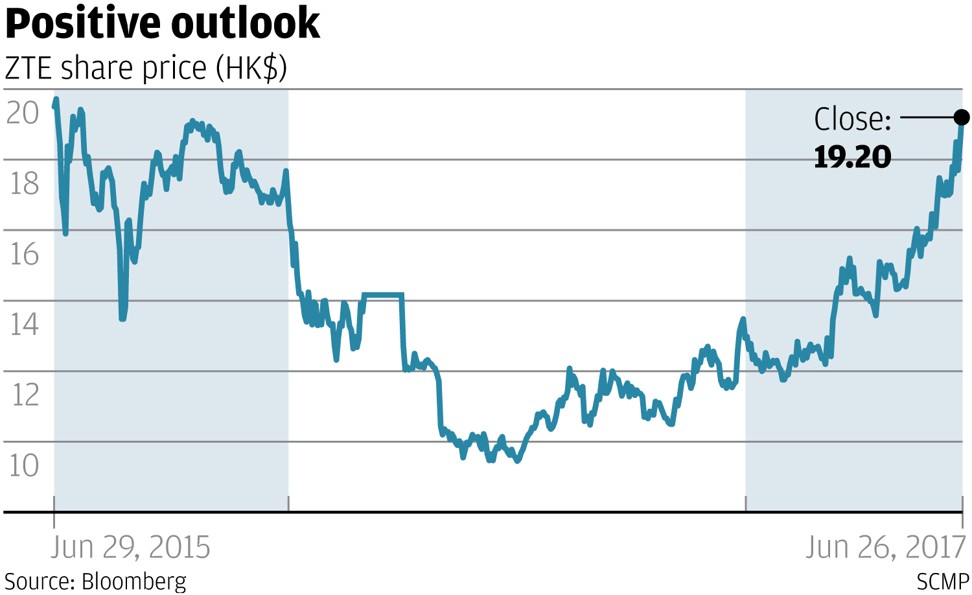

ZTE Corp’s share price continued its steady ascent since mainland China’s largest-listed telecommunications equipment maker emerged from US sanctions purgatory three months ago, reaching a two-year high of HK$19.20 on Monday.

“The trend is definitely positive,” said Jefferies equity analyst Edison Lee. “Developments over the past three months have prompted us to be even more bullish.”

Eleven market analysts out of 19 who cover ZTE had “buy” ratings on the company as of Monday, according to a Bloomberg survey. Four of them had a “hold” recommendation, while four others had a “sell” rating.

Jefferies, which has a buy recommendation on ZTE, raised its price target to HK$25.95 on Friday from the previous HK$18.60.

Shares of ZTE were up 4.4 per cent to finish at HK$19.20 on Monday, the stock’s highest close since reaching HK$19.72 on June 30, 2015.

That also marked a solid improvement from the close of HK$12.94 on March 8, when ZTE agreed to pay a record US$1.2 billion penalty imposed by the United States government to settle the company’s violation of long-standing trade sanctions on Iran and North Korea.

ZTE completed last year extensive verification tests of its so-called Pre5G antenna system, called TD Massive Mimo, with China Mobile in 50 cities of 29 provinces.

That put ZTE “in a strong position to win a major share” of the operator’s new infrastructure contracts, including those for its 5G network trials in 2019 and commercial roll-out in 2020, Lee said.

ZTE, along with larger rival Huawei Technologies and other mainland network equipment and smartphone suppliers, would benefit the most from increased 5G-related capital spending in the country over the next decade, according to a study published last week by the China Academy of Information and Communications Technology.

The research arm of regulator the Ministry of Industry and Information Technology forecast total 5G expenditure on the mainland to reach 2.8 trillion yuan (US$411 billion) from 2020 to 2030.

Yin Yimin, the chairman at ZTE, told shareholders at the company’s annual meeting last week that the plan is to increase investments in 5G research, development and marketing, while providing improved service to major customers in strategic markets.

ZTE has 5G development alliances in place with Japan’s SoftBank Corp, Unicom, Germany’s Deutsche Telekom, Spain’s Telefonica and KT Corp of South Korea.