Smartphone selfie demand drives lens shipments for China’s Sunny Optical

Bernstein sets HK$91 price target on shares of mainland’s biggest maker of handset camera modules and lenses

Sunny Optical Technology, mainland China’s largest manufacturer of smartphone camera modules and lenses, could be poised for a banner year in supplying domestic brands after it reported 81 per cent year-on-year growth in shipments of handset lens sets to 261.6 million pieces in the first half of this year.

Founded in the city of Yuyao, Zhejiang province, in 1984 and listed in Hong Kong in 2007, Sunny Optical is a key supplier to major Chinese smartphone brands Huawei Technologies, Oppo and Vivo.

Its main competition is Taiwan-based Largan Precision, the world’s largest maker of handset lens and a major supplier to Apple’s iPhone.

“While Largan is the dominant player in the high-end handset lens market, all smartphone manufacturers want a second supplier, and Sunny Optical fills that gap,” Bernstein senior analyst David Dai told the South China Morning Post. “As the Chinese brands moved to the high-end of the smartphone market in the past few years, Sunny Optical grew along with its customers.”

Global sales of smartphones reached 380 million units in the first quarter, led by Samsung Electronics, Apple, Huawei, Oppo and Vivo, according to research firm Gartner.

Counterpoint Technology research director Neil Shah recently estimated that Huawei, Oppo and Vivo accounted for 57.4 million units of the total 105.6 million smartphones shipped on the mainland in the first quarter.

“We believe Sunny Optical’s strong handset lens set growth is mainly driven by share gain among Chinese smartphone [brand] clients,” said Li, who pointed out that Citi has a HK$75 target price on Sunny Optical’s shares.

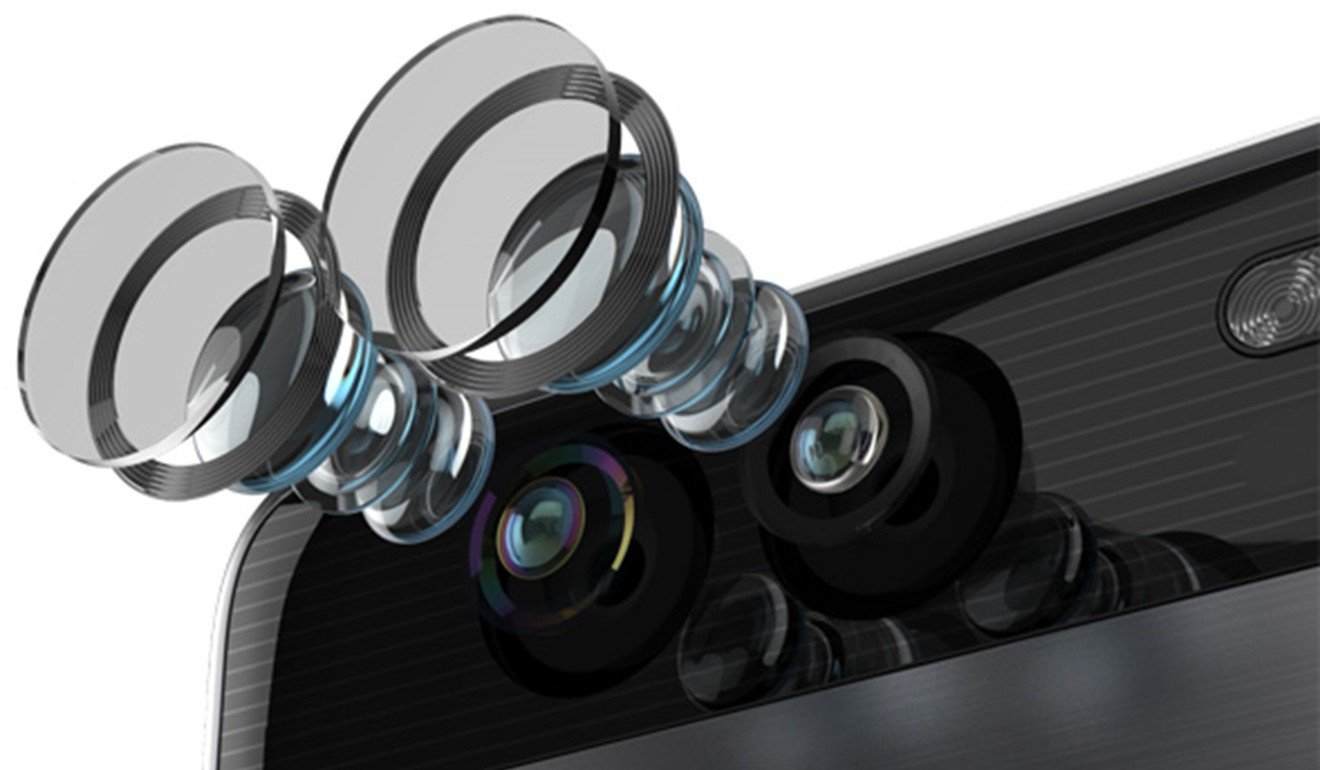

Sales of high-resolution smartphone camera lenses, those at 10-megapixels and above, have been growing rapidly because of the popularity of dual-camera models and more powerful front cameras for taking selfies.

“Sunny Optical has been catching up with Largan,” Dai said. “Since the high-end lens market is a duopoly between Largan and Sunny Optical, Largan has no interest to wage a price war because the high-end market is still growing rapidly.”

Handset camera module shipments by Sunny Optical in the first half rose 42 per cent year on year to 153.3 million pieces, which Citi said was well ahead of the company’s guidance of 15 per cent to 25 per cent growth.

Dai pointed out that Sunny Optical is currently the industry’s only lens and module supplier for mass-produced smartphone 3D cameras, such as those used on Lenovo Group’s Phab2 Pro and the ZenFone AR from Asus.

Sunny Optical posted a 36.6 per cent increase in revenue last year to 14.6 billion yuan (US$2.1 billion), up from 10.7 billion yuan in 2015.