Will Americans love Chinese tech brands? Two of China’s tech giants are about to find out

Tencent and Huawei, giants in their respective fields in China, are about to find out whether they can take on the likes of Apple and Facebook on their home turf

China’s tech giants have grown into some of the world’s biggest companies by satisfying the demand of the country’s increasingly affluent and internet-savvy middle class in their home market. Cashed up and confident, they are now leading another charge by Chinese brands to try to crack the US market.

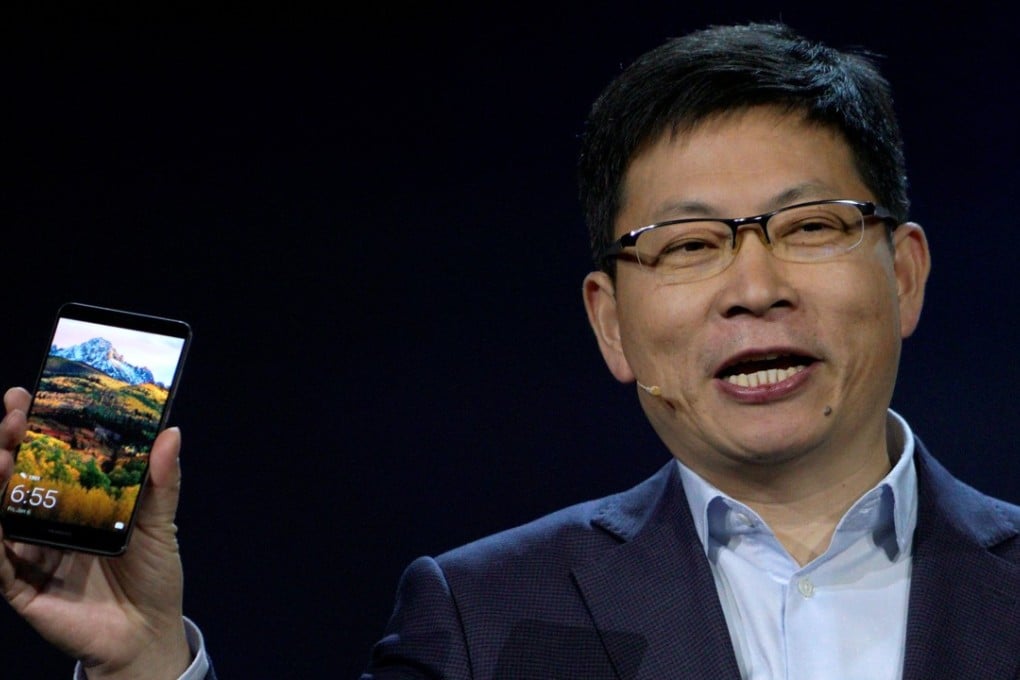

Tencent Holdings, China’s biggest social media and mobile gaming company, this week introduced its maiden title in the US to catch the year-end holiday season. Huawei Technologies, the country’s largest smartphone maker, said it plans to sell its flagship model in the US next year.

The US still represents the holy grail for any company with global aspirations, according to Tim Zanni, KPMG’s global and US technology leader. US consumers have higher disposable incomes, meaning they are willing to pay more for quality products, said Zanni, who is based in California.

“Any significant business needs to grow to be successful,” Zanni said. “Being the world’s largest economy, the US market is the most significant market in the world.”