Xiaomi’s smartphone shipments double ahead of IPO as ZTE’s slump by half

It is the best of times and worst of times for two Chinese smartphone brands.

Xiaomi, gearing up for a US$10 billion listing, doubled its global smartphone shipments in the latest quarter, while local rival ZTE Corp saw a nearly 50 per cent slump – and that was before it was slapped with a seven year ban on buying American tech products.

In the first quarter of this year Xiaomi’s smartphone shipments jumped 101 per cent year on year to 27 million, according to research agency Counterpoint. The boost in sales, which also helped Xiaomi expand its market share to 7.5 per cent from 3.6 per cent, elevated its global ranking to No 4 in the first quarter from No 7 a year earlier, according to the report.

ZTE, on the other hand, saw its first quarter global shipments slide 46 per cent year on year to 7.2 million from 13.3 million. ZTE’s global ranking dropped one place to No 9 while its market share shrank to 2 per cent from 3.6 per cent in the same period last year.

The companies are arguably the two most newsworthy smartphone brands in China today – but for very different reasons.

“The North America market has been problematic for Chinese brands and the ban on ZTE will further decline their share in the region,” Counterpoint’s research analyst Shobhit Srivastava said in a statement.

Xiaomi’s smartphone market share gains and ZTE’s losses came amid a 3 per cent year on year decline in global shipments for the quarter to 360 million units from last year’s 371.1 million. The top 10 players now hold 75 per cent of the market, leaving more than 600 other brands to compete for the remaining 25 per cent, according to Counterpoint.

Samsung, Apple and Huawei Technologies retained the top three spots globally in the first quarter, with market shares of 21.7 per cent, 14.5 per cent and 10.9 per cent respectively.

Contrary to the 3 per cent contraction in shipments for the South Korean brand, Apple and Huawei reported 3 per cent and 14 per cent shipment growth respectively, narrowing the gap with Samsung.

The South China Morning Post reported last week that Huawei started developing its own operating system five years ago as a strategic investment to prepare for a “worst-case scenario”, similar to the one that has befallen ZTE, which was also banned from using Google Android in its smartphones.

Huawei said last week it had no plans to release its own OS in the foreseeable future and will focus on products powered by Android OS and adopt an open attitude towards mobile OS.

iTel, a smartphone brand owned by Shenzhen-based Transsion, shipped 4.6 million handsets in the first quarter, three times more than the same period last year. Transsion offers affordable smartphones and feature phones that have physical keypads and more limited functionality, costing as little as US$10 per unit.

The saturating China smartphone market is forcing Chinese smartphone players to invest and expand beyond their home market

The Chinese company is currently the top mobile phone vendor on the African continent with almost one third of the market share, and has vaulted into the top three mobile phone vendors in India less than a year after it entered that country.

“The saturating China smartphone market is forcing Chinese smartphone players to invest and expand beyond their home market,” said Srivastava. “The ideal smartphone markets for Chinese brands are the emerging smartphone markets such as Bangladesh, Myanmar, Middle East and Africa where [4G] is being launched for the first time or the network is expanding to cover more geographies.”

Smartphone shipments in China plunged in the first quarter, falling below 100 million units for the first time since 2013, amid stiff competition between major domestic brands. The country saw a 21 per cent drop in shipments to 91 million units for the three months ending March 31 – its biggest ever annual decline – as growth rates fell at eight of the country’s top 10 smartphone brands, research firm Canalys said in a statement last week.

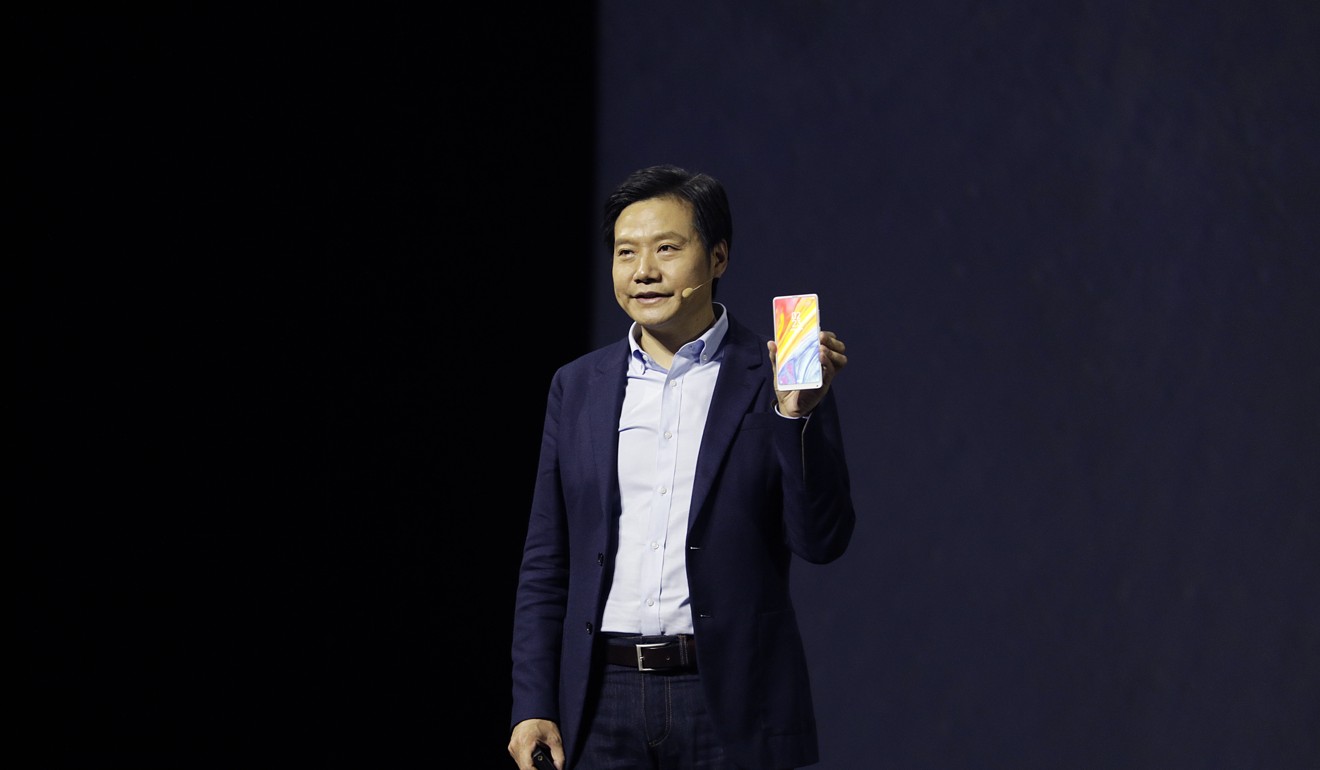

“The strong result for the first quarter is due to our introduction of the Redmi and Mix 2S,” Xiaomi’s founder and CEO Lei Jun said in an interview conducted before Counterpoint released the latest numbers. “Our Redmi Nove 5 is very outstanding in the under-1,000 yuan category, Xiaomi’s camera standard and technology is improving very fast, so the reaction to the two new products is very strong.”