Jetco working to bring P2P mobile payments to 'lagging behind' Hong Kong

Hong Kong's leading cash machine operator is working to introduce a inter-bank solution for peer-to-peer and peer-to-merchant mobile and online payments.

Jetco, which operates the cash machines of all banks in Hong Kong and Macau apart from HSBC and Hang Seng, hopes to become as large a player in the financial technology market, said chief executive Angus Choi.

"We want to facilitate the banks to help them handle online and mobile payments," Choi told the Post.

He said that at present, Hong Kong is "lagging behind" mainland China and developed countries in terms of introducing effective mobile payment and peer-to-peer (P2P) solutions.

P2P mobile payments, by which a user can send money to a friend or merchant using their smartphone, are already hugely popular in mainland China.

"Tencent and Alipay are very interested in entering the [Hong Kong] market," he said. "That is one of the reasons the banks are becoming more aggressive."

"Banks are trying to catch up" with internet companies, Andrew Cheng Chun Chung, executive director of e-commerce consortium Tradelink, told the Post earlier this year.

Cheng said that banks did not want to lose the transaction fees they charged on online transfers, "but if they don't [launch mobile payment solutions] they could lose their market position".

He predicted that as well as Chinese internet companies, the Hong Kong banks may face competition from Octopus, which is currently used by more than 95 per cent of Hongkongers for contactless payments on the MTR and to merchants around the city and has introduced limited mobile payment features.

In a statement, Octopus said that it was "[continuing] to explore and introduce simple, easy-to-use and diverse Octopus payment channels to customers".

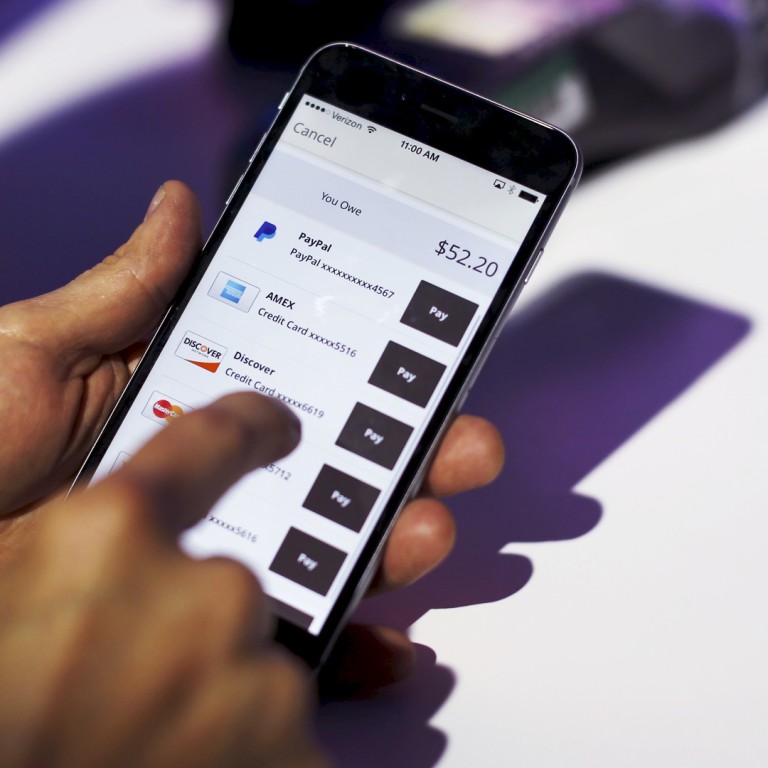

Jetco hopes to roll out its solution to its banking partners in the coming months. In a demo version of a mobile app seen by the Post, users can send money to their contacts at the push of a button, opting whether or not to set a one time password the receiver must enter in order to claim the money.

Other features include cardless cash machine withdrawals, in which the app sends a code to the machine allowing the user to withdraw a set amount of money, and peer-to-merchant options, which Choi predicted would eventually replace credit card machines in many smaller businesses.

By saving start-ups and small enterprises credit card transaction fees, Choi said, "we can help smaller businesses to fast develop e-commerce solutions", but he warned that this would be a second stage feature following rollout of P2P functions.

Two main hurdles remain to widespread adoption of mobile payment in Hong Kong, Choi said.

"Market adoption is the challenge and also the key. Jetco will play a very active role to educate the consumer not only to use P2P but to use it in a secure way."

As well as convincing consumers to use the product, Jetco also had to reassure the regulator – the Hong Kong Monetary Authority – that the system was secure and in compliance with various regulations, including anti-money laundering laws.

Choi predicted that the regulator would set a relatively low initial limit for P2P payments of under HK$1,000 per transaction, but that this would rise with widespread adoption.