China Unicom secures cash injection, but missteps mar ownership reform roll out

US$11.6 billion in cash raised to cut debt and financing costs, as well as fund major infrastructure projects

Mainland China’s first test case under its ambitious mixed-ownership reform scheme for state-owned enterprises showed unprecedented private-sector support in terms of investment and commitment, but has also revealed teething problems and clumsiness caused by the rush to execute the plan.

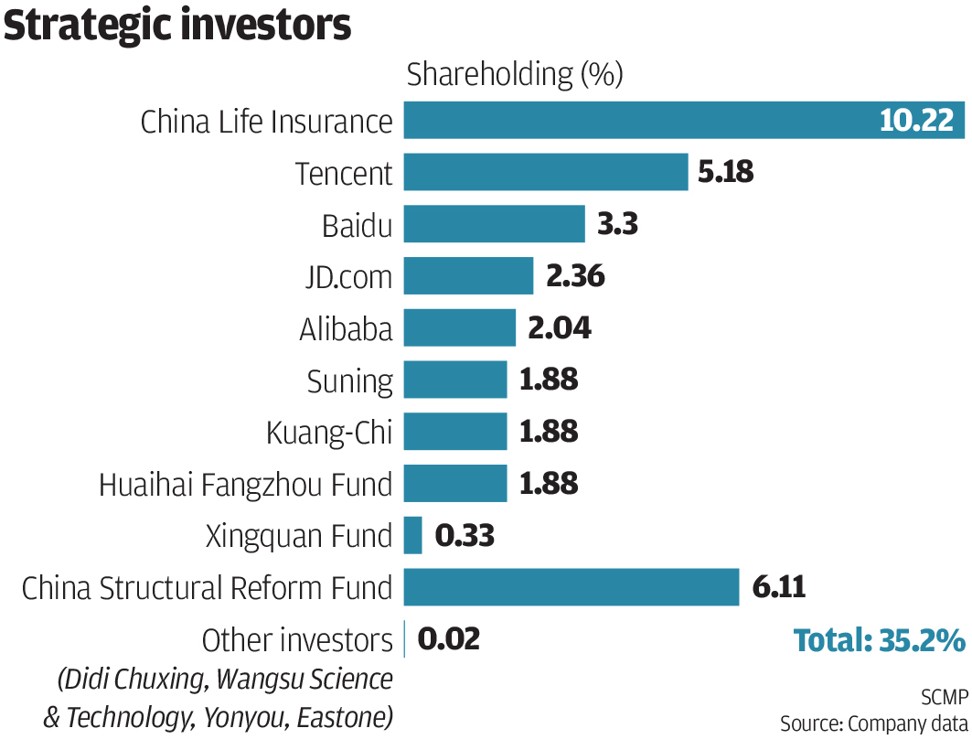

China Unicom, the country’s second-largest telecommunications network operator, unveiled in Hong Kong on Thursday 78 billion yuan (US$11.6 billion) in total new investments raised by its controlling shareholder, China United Network Communications, from more than a dozen private and state-owned companies which agreed to acquire a combined 35.2 per cent stake in the Shanghai-listed company.

The cash raised from the issue of new shares and sale of existing shares of China United Network will all be injected into Unicom through a private placement, rights issue or other means, according to Unicom chairman and chief executive Wang Xiaochu.

Such equity injection will result in an 80 per cent reduction in Unicom’s debt, and a substantial decrease in financing costs, while helping fund new infrastructure development initiatives, said Bernstein senior analyst Chris Lane in a report.

Speculation was rife that the issue concerned a potential violation of the China Securities Regulatory Commission’s requirement that private placement of shares should be capped at 20 per cent of a company’s original total equity ahead of the placement. The placement price for China United Network was 6.83 yuan per share.

The A-share company said it would make an amended filing within three trading days, which means trading on its shares and those of Unicom would remain suspended.

Ivan Wong, investor relations director at Unicom, clarified that it is state-owned CRRC Group Corp, the parent of Hong Kong-listed CRRC, which is investing in China United Network through another subsidiary.

The deal is already complicated, but Unicom had to rush the announcement with its interim results

“It just so happens that they both use the same logo, which was the source of the confusion,” Wong said.

Such clumsy steps were likely caused by the strain of executing this radical ownership restructuring initiative.

“The deal is already complicated, but Unicom had to rush the announcement with its interim results,” Jefferies equity analyst Edison Lee said. “I think the National Development and Reform Commission wanted to push this deal out of the window as soon as possible, which put Unicom under pressure to get it completed.”

Iris Pang, an economist at ING, pointed out that “having a bunch of investors that are themselves in competition with one another could increase difficulties in decision making at the board level” for China United Network.

Jefferies’ Lee, however, said Unicom’s plan was to forge specific cooperative arrangements with each of the private investors. “This will mean no single strategic investor will likely play a leading role” in working with Unicom, he said.