Huawei’s hold on half of world’s telecoms gear gives it a shoo-in seat at the top table of cloud services

Research firm Gartner estimates worldwide public-cloud services have grown 18 per cent this year alone, and are now worth US$246.8 billion

Huawei Technologies, the world’s largest telecommunications equipment supplier, is targeting a place among the world’s top five public cloud service providers, despite its relatively weak market share in the domestic public cloud market.

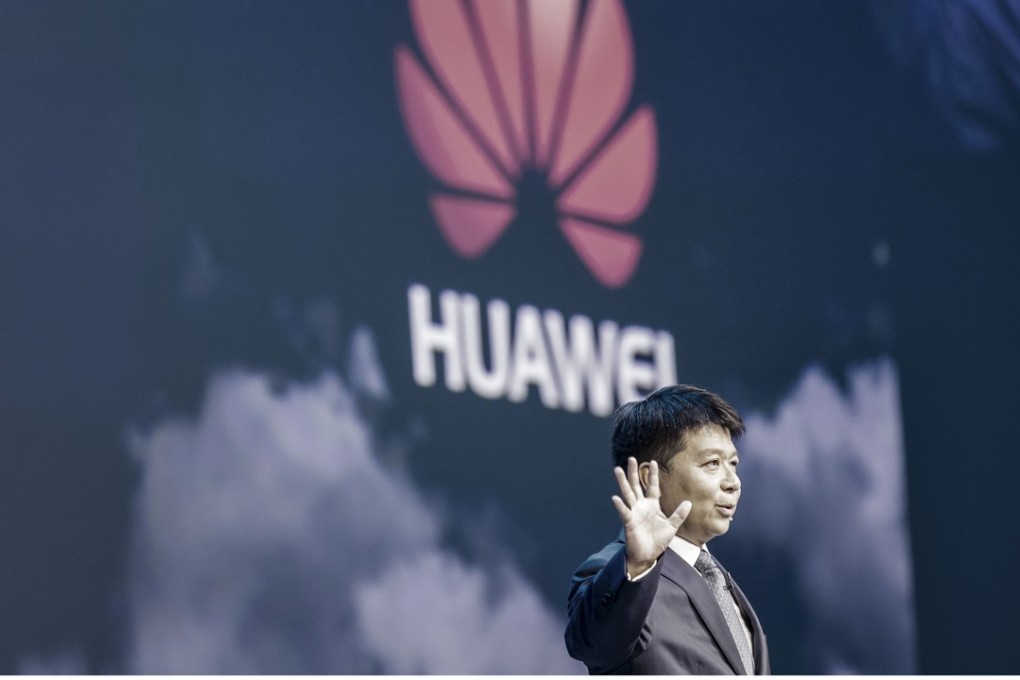

Guo Ping, Huawei's deputy chairman and rotating chief executive, said the Shenzhen-based company is confident of overtaking the country’s recognised leaders in the field, and is already touting the abilities of its extensive networks with telecommunications network operators around the world.

He pointed out that half of the world’s population is already using networks supported by Huawei’s equipment or technologies.

Huawei plans to set up cloud alliances via its global telecommunications networks to tap companies owning operations at home and overseas, to provide seamless cloud services support.

It already has long-standing partners that include Deutsche Telekom, Orange and Telefonica – the three major telecommunications network operators in Europe – to unify their cloud standards.

“Huawei is determined to develop public cloud services as a long-term and strategic investment priority,” said Guo at the company’s annual gathering in Shanghai on Tuesday. he added that the strategu is a natural move for the company, which is widely considered to be a world leader in information and communications technology.