China’s chance to lead global innovation may lie with 5G mobile technology development

Mainland telecoms equipment giants Huawei and ZTE push research and implementation of 5G-related technologies

China is on the cusp of recasting itself as a leading technology innovator from a mere follower in the telecommunications industry, as efforts to develop a global 5G mobile standard near the final stage.

“While China has the world’s largest mobile market by subscriber and network size, other countries have dominated mobile technology innovation,” said Jefferies equity analyst Edison Lee. “5G is the opportunity of the century for China.”

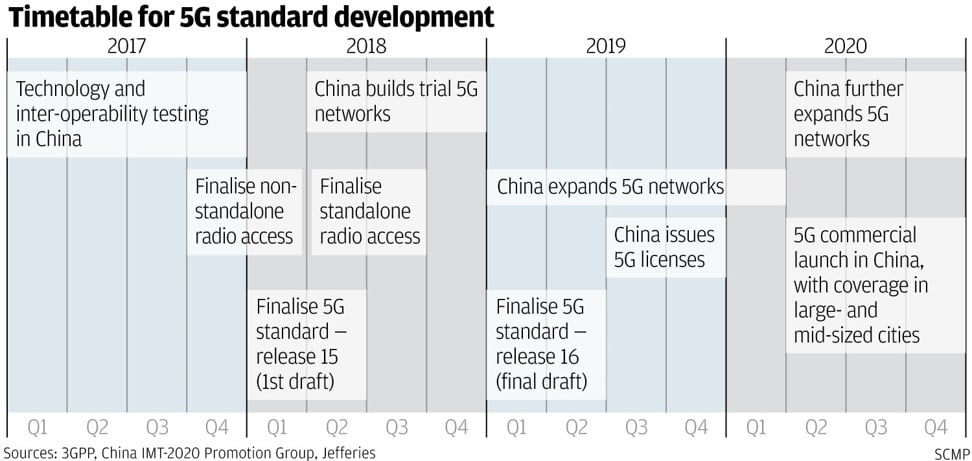

The international authorities overseeing the creation of a unified standard for 5G mobile technologies are expected to release its initial phase next year and the final phase in 2019, paving the way for a broad roll-out of 5G services by mobile network operators from 2020.

China’s bid to gain a greater share of the intellectual property behind the universal 5G standard would not only increase its global influence, but improve its bargaining power with foreign patent holders and help lower costs for mainland telecoms equipment makers, chip companies and other enterprises in the supply chain, according to Lee.

The International Telecommunications Union (ITU), the UN agency shepherding the development of the so-called IMT 2020 standard for 5G technologies, has said the upcoming universal specification will support: a million connected devices per square kilometre; 1 millisecond latency, or the amount of time a packet of data takes to get from one point to another; higher energy and spectral efficiency; and a peak data download rate of up to 20 gigabits per second.

That agency works in tandem with the 3rd Generation Partnership Project (3GPP), an international collaboration of seven telecoms standard development organisations which draw up complete mobile system specifications.

5G is the opportunity of the century for China

Lee pointed out that China was keen to raise its share of mobile technology intellectual property rights (IPR) in the 3GPP’s phase 2 release of 5G specifications. Phase 2 will not be backward-compatible to the 4G network whereas the phase 1 release will be, in order to protect legacy network investments.

Phase 2 will be based on an all-new design that can address the three major 5G use cases: 100 megabits per second minimum data speed for consumers, massive machine connections, and super-low latency and reliable services.

“With its bad experience in 3G, China is determined to be a major player in 5G, with a meaningful share of IPRs,” Lee said.

“Ever since the ITU started its 'IMT-2020 and Beyond' initiative in 2012, various Chinese entities have actively engaged in research and development work in 5G.”

LexInnova Technologies, a legal services and technology consulting firm in the United States, estimated earlier this year that China owned about 10 per cent of the “5G-essential” IPRs in radio access, modulation and core networking. Huawei had the most such IPRs among the Chinese entities, followed by ZTE.

“We believe China’s eventual share will very likely be above that 10 per cent level,” said Lee.

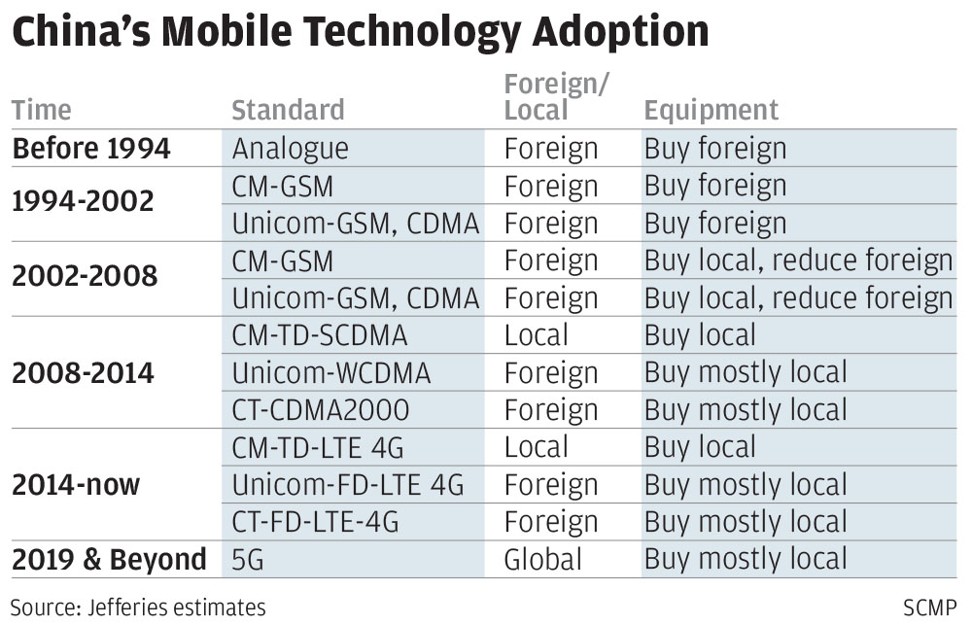

China was not involved in 2G mobile development, so it pushed for a national 3G standard called Time Division Synchronous Code-Division Multiple Access that China Mobile implemented. It was one of three globally-recognised 3G standards.

Qualcomm, the giant American semiconductor and telecommunications technology supplier, had challenged China’s claim over IPRs in that standard on the grounds that the system was based on its Code Division Multiple Access technology. The two sides later reached a private, undisclosed settlement.

In the 4G era, China championed one of the two sanctioned global standards, called Time Division Long-Term Evolution.

Despite that push, neither Huawei nor ZTE was among the top 10 owners of so-called essential 4G IPRs. The top five holders of those vital technologies were Qualcomm, Samsung Electronics, Intel, Ericsson of Sweden and Finland’s Nokia, according to technology consulting firm iRunway.