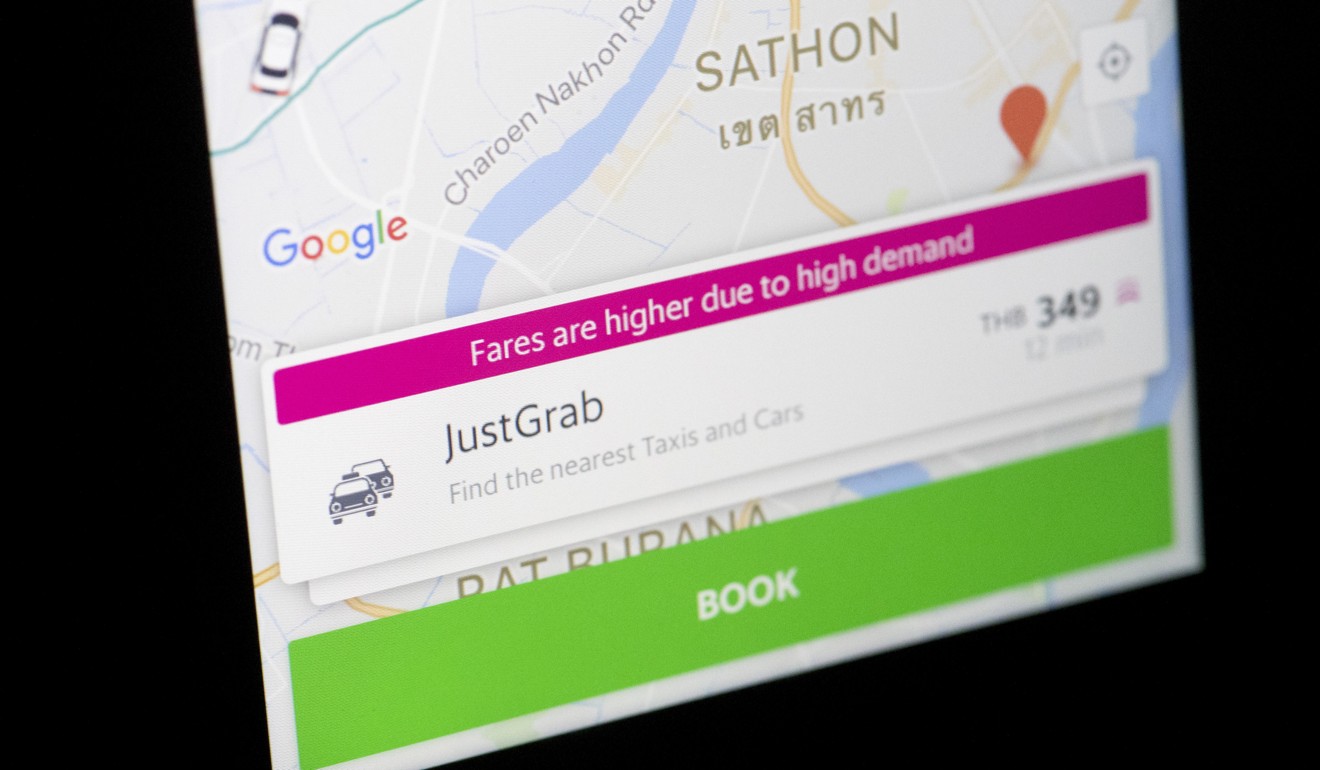

Ride-hailing firm Grab expands into lending in Southeast Asia via new venture

Grab will use its data on transport movements, payment transactions and consumer behaviour to assess customers’ creditworthiness at its new financial services enterprise

Southeast Asia’s Grab has teamed up with Japanese credit card company Credit Saison Co to provide loans and lending services in the region, marking the ride-hailing firm’s biggest expansion into financial services.

Their new joint venture firm, Grab Financial Services Asia, will offer micro-financing products and leverage Grab’s network of millions of consumers and small businesses as well as data on consumer behaviour, blending it with Credit Saison’s expertise in credit analysis and consumer lending.

The move comes as Tencent Holdings-backed WeChat Pay and Alipay, the payments arm of Alibaba Group Holding affiliate Ant Financial Services, expand into Southeast Asia – home to some of the world’s fastest-growing economies with about 640 million people and an active mobile phone user base.

Financial details of the venture were not disclosed.

Grab is betting that its data on transport movements, GrabPay transactions and consumer behaviour will help in assessing customers’ creditworthiness.

A Google and Temasek study late last year forecast that Southeast Asia’s internet economy would exceed US$200 billion by 2025, from an estimated US$50 billion this year.

Grab, which started as a taxi-hailing app firm and competes with Uber Technologies, has been expanding into financial services over the past two years, partly by acquiring companies.

The company said it has facilitated over US$737 million in loans over that period for drivers and agents, with a default rate of less than 1.5 per cent.

Grab’s new venture will offer credit scoring services to financial firms who can use the information for services such as virtual credit cards.

The company already offers services ranging from payments to rewards and loyalty services.

Grab, which operates in eight countries in Southeast Asia, said its app has been downloaded on more than 86 million mobile devices. It offers ride-hailing, on-demand food and delivery services through its 2.6 million drivers.

Didi Chuxing, the biggest ride-hailing operator in China, last year teamed up with Japanese conglomerate SoftBank Group Corp to lead a US$2.5 billion financing round in Grab.

Start-ups Grab and Indonesia’s Go-Jek, which have both raised hundreds of millions of dollars, boast an estimated valuation of US$6 billion and US$5 billion, respectively.

“You can imagine these guys, much like WeChat in China, beginning to move into more and more adjacencies until such time as your Go-Jek or your Grab app becomes your primary application that you do a range of services through,” said James Lloyd, Asia-Pacific financial technology leader at EY.

Alipay stepped up its expansion in Southeast Asia last year when parent Ant Financial merged with helloPay, which was the payments platform of online retail services provider Lazada since November 2014. New York-listed Alibaba owns the South China Morning Post.

Analysts expected a boom in digital financial services in Southeast Asia, especially Indonesia, where the majority of its 250 million population do not have bank accounts.

“The problem in Indonesia today is that the middle economy actually has no financial services,” Grab Financial’s Thompson said.

“All the things that you know so well around credit history, credit scoring, none of this is available,” he said. “In the world of lending, that has to be our differentiator.”