Flash sales, social media savvy helped Xiaomi topple Samsung as India’s No 1 smartphone supplier

Chinese technology start-up Xiaomi plans to double sales in India to about US$2 billion this year, but quickly building up supply to meet fast-growing demand remains a challenge

After five failed attempts over the past month, Indian college student Bhavsar Hardik recently succeeded in placing an online order for his dream smartphone – the Redmi Note 5 Pro from Xiaomi.

The handset “looks like the iPhone X”, he said.

The 19-year-old Hardik is one of many in the country now hooked on the flash sales that Xiaomi conducts through domestic online channels like Flipkart and Amazon India, as well as its own Mi.com site. These flash sales run for less than three seconds each time, so only a few people get their orders through for any device up for grabs.

Hardik said demand for Xiaomi smartphones was huge, but there was short supply in the market. Despite that limitation, Hardik said he remains a big Xiaomi fan because its smartphones deliver good quality at an affordable price.

“I don’t like Samsung because it costs too much just for the name of the brand; same with Apple, Vivo, and Oppo,” he said.

His Redmi Note 5 Pro costs 13,999 rupees (US$215), while the cheapest starting price for the iPhone X in India is 83,499 rupees.

Millions of Indian consumers like Hardik helped vault Xiaomi to prominence in the world’s second-largest smartphone market.

About three-and-a-half years after entering India, Xiaomi unseated Samsung Electronics to become the country’s top smartphone supplier in the fourth quarter of last year. Xiaomi, which entered India in July 2014, seized a 27 per cent share of the country’s smartphone market last quarter, ahead of Samsung with 25 per cent, according to research firm Canalys.

Xiaomi, often dubbed the “Chinese Apple”, has identified India as its next growth engine amid increased competition and slowing smartphone growth in its home market. The company was also looking for diversified, long-term revenue channels that will strengthen its efforts to go public.

Projecting a more international image would help Xiaomi attract more global investors for its planned initial public offering (IPO). While its management does not comment on listing plans, the Beijing-based firm has appointed investment banks to work on its proposed IPO in the Hong Kong stock exchange, according to a person with knowledge of the matter.

Market speculation that Xiaomi would seek a listing intensified after the company staged a dramatic turnaround last year, following a lacklustre performance in the prior year.

In the three months ended December 31, Xiaomi’s handset shipments grew 83 per cent – the biggest gain among the world’s top 10 smartphone brands – to become the world’s fifth biggest smartphone supplier, according to Counterpoint Research.

For the full year, Xiaomi was ranked sixth worldwide with total smartphone shipments of 96 million units.

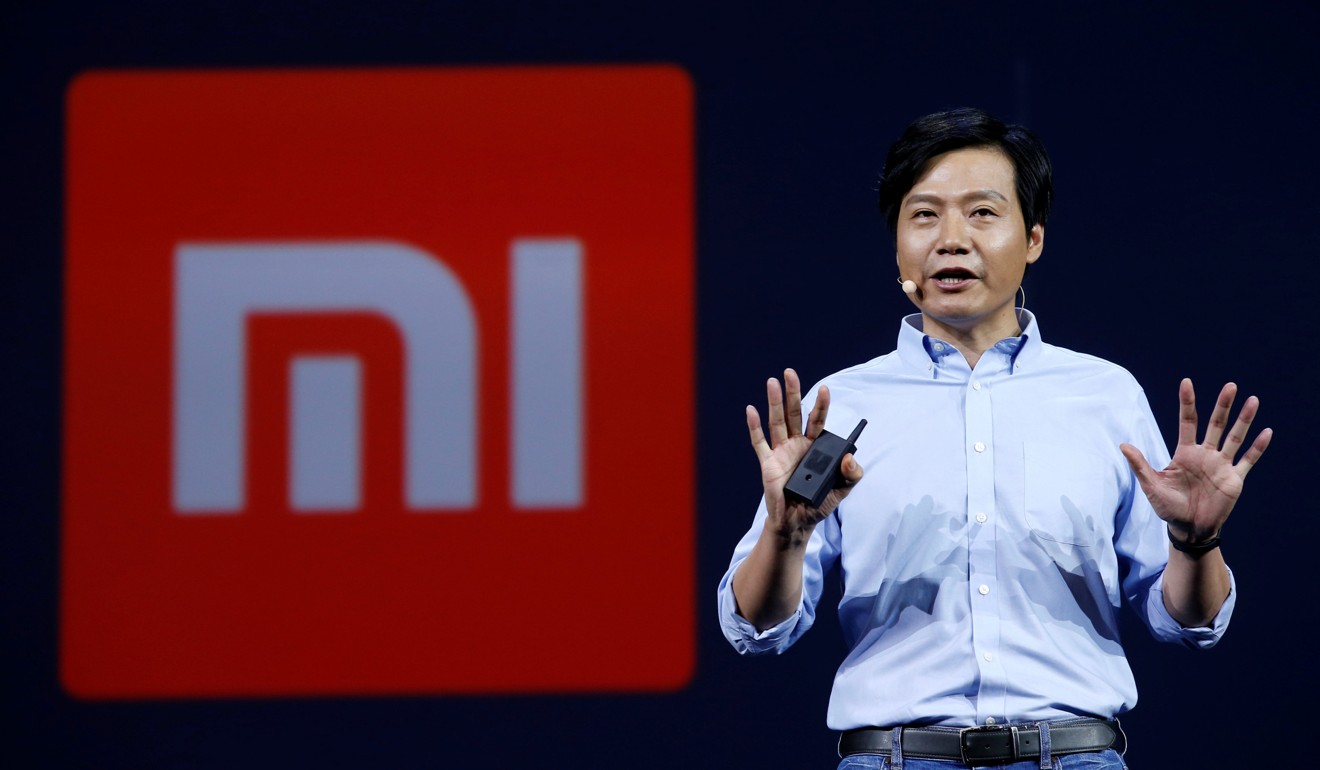

In India, Xiaomi set a record annual revenue of US$1 billion last year. That performance prompted Xiaomi founder and chief executive Lei Jun to forecast the company’s revenue from India would exceed US$2 billion this year.

Manu Jain, the managing director and first employee of Xiaomi India, said the company started with a small office with six chairs in the country.

Today, Xiaomi India has grown into an operation with 400 local employees and three domestic manufacturing facilities. The social media-savvy company has also amassed about four million active Indian Mi fans.

Xiaomi has stuck to its tried-and-tested marketing playbook of flash sales and development of its Mi Community in India.

Tarun Pathak, associate director at Counterpoint Research, said Xiaomi “managed to build Mi fans through continuous engagement, including organising city-level offline interactions”.

Through online interactions via Facebook, Xiaomi fans can get priority pass and first-hand knowledge of new products, Pathak said.

“By using social media effectively, Xiaomi helped create positive word of mouth about the company and its products,” he said.

Ekrar Saiyyad, who claims to be one of Xiaomi’s most loyal fans, said he has bought more than 100 Xiaomi handsets for himself, family members and friends since July 2014.

Saiyyad, 29, meets with fellow Mi fan in Nagpur, India’s 13th largest city in terms of population, every week, typically on a Sunday.

“We talk about cellphones and their capabilities, and what will be the future of Mi cellphones,” he said.

Other Chinese smartphone brands, by comparison, have aggressively poured cash into advertising campaigns to raise brand awareness among Indian consumers.

Vivo last year paid title rights worth US$338 million to the country’s professional cricket league, now sporting the name Vivo Indian Premier League. Oppo signed a five-year deal worth US$166 million to sponsor the country’s national cricket team.

At this point, Xiaomi’s on a roll in India

Navkendar Singh, an associate research director at research firm IDC in India, said the country’s smartphone buyers “look for value in terms of high specifications at affordable prices” ahead of clever marketing campaigns.

The stakes are high for smartphone players in India since the market has seen rapid annual growth, which was 12 per cent last year, while the rest world recorded slower demand.

More than 75 per cent of demand in the Indian smartphone market was for handsets priced below US$200, according to IDC.

Xiaomi sells smartphones costing US$100 to US$200 in India, which provides very thin margins.

“At this point, Xiaomi’s on a roll in India,” said Kiranjeet Kaur, senior research manager at IDC in Singapore. “If it continues at the same pace, Lei Jun’s goal [of reaching about US$2 billion in domestic sales this year] don’t look unrealistic.”

Still, Xiaomi may need to heed the lessons learned in mainland China, where being just a low-cost handset supplier does not cut it any more.

Established in 2010, Xiaomi at one time was the world’s most valuable private start-up, worth more than US$46 billion at the end of 2014. But the rise of other Chinese smartphone brands, including Huawei Technologies, Oppo and Vivo, redefined the smartphone market in China, as its competitors offered reasonably priced, high-quality devices promoted by local celebrities.

As a result, the Xiaomi user base of younger consumers gained through social media engagement and flash sales campaigns was eroded, with many of them switching brands.

Analysts said Xiaomi has not yet created a big-enough base of users who can afford more expensive smartphones. “This is a difficult ceiling to break through,” said IDC’s Kaur.

The limited user base in the premium market directly limits Xiaomi’s profitability. As of the third quarter of last year, Xiaomi’s per unit profit is US$2, according to Counterpoint estimates.

Huawei, Oppo and Vivo generated higher unit profits of US$15, US$14 and US$13, respectively. Apple, the world’s second largest smartphone supplier, posted US$151 profit per device.

Counterpoint has estimated that India, which made up nearly 30 per cent of Xiaomi’s global sales last year, could contribute up to 35 per cent of total revenue this year.

Xiaomi’s Jain, who also serves as a vice-president, said the company remained optimistic about opportunities in the market. “We can achieve a lot more here,” he said.

Xiaomi has been an active venture capitalist in India, pledging to invest at least US$1 billion into 100 Indian start-ups between 2017 and 2022. “We are interested in start-ups that can be long-term partners and help our businesses here,” said Jain.

Xiaomi also sells smart television, fitness bands and power banks in India. The company plans to launch more smart-connected devices, such as scooters and water purifiers, in future.

While India might be ripe for Xiaomi to introduce a range of smart devices, its supply chain constraints make it unprepared for a large launch nationwide.

Xiaomi’s self-proclaimed biggest fan, Saiyyad, knows this. “I’m very much interested in buying Xiaomi’s 55-inch 4K TV, but they just don’t have enough stock,” he said.

Additional reporting by Zen Soo