Samsung looks to put more cutting-edge features in cheaper smartphones to fend off Chinese brands

Samsung has been challenged in recent years by major handset vendors, including Apple and a slew of Chinese smartphone brands

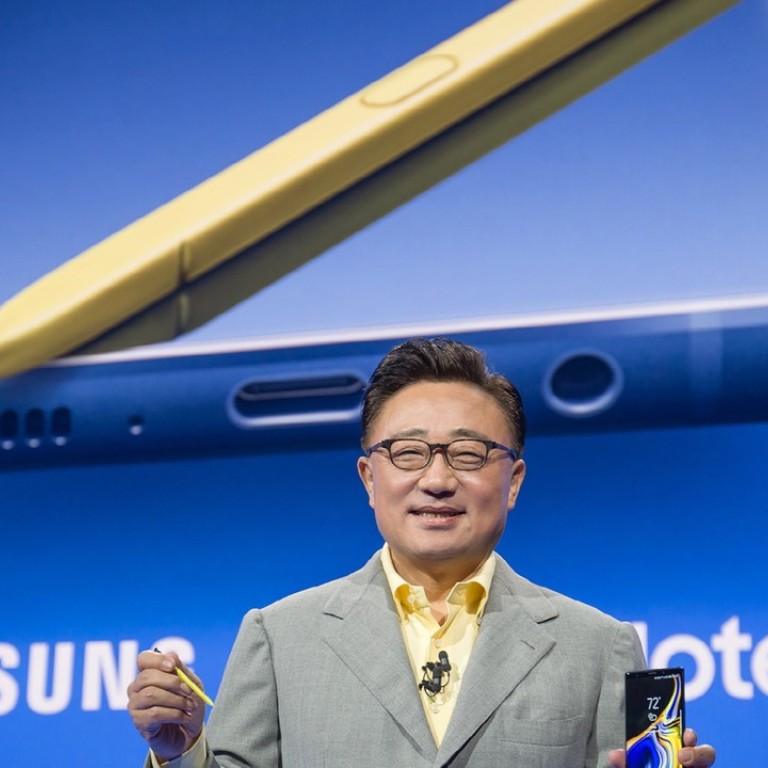

Samsung Electronics, the world’s No 1 smartphone brand by shipment, plans to overhaul its strategy by putting its most advanced features in its cheaper range to appeal more to customers born after the 1980s, according to its mobile chief Koh Dong-jin.

Instead of concentrating on its top-of-the-range Galaxy S and Galaxy Note devices, which are generally priced at US$1,000 and above, Koh told CNBC the South Korean company will in future equip its mid-priced Galaxy A series of smartphones with the most cutting-edge features first.

“In the past, I brought the new technology and differentiation to the flagship model and then moved to the mid-end,” Koh told CNBC in an interview last week. “But I have changed my strategy from this year to bring technology and differentiation points starting from the mid-end.”

The first of these phones will come onto market later this year, he said. A spokesman for Samsung did not immediately reply to an email request for comment on the interview.

In China, the world’s largest smartphone market, Samsung has been edged out of the top tier of handset vendors with less than 1 per cent share in the past quarter. Domestic brands including Huawei Technologies, Oppo, Vivo and Xiaomi, whose flagship models are generally half the price of Samsung’s comparable models or less, account for more than 80 per cent of the market.

Cupertino, California-based Apple will unveil its renewed iPhone strategy at an event on September 12. It is planning three new models that look like the iPhone X, including a cheaper model that comes in different colours, according to Bloomberg.

Samsung expects its change of strategy will help boost sales after revenue from its mobile division fell by a fifth in the second quarter this year due to the lacklustre sales of its high-end Galaxy S9 device. Last month, Samsung launched its highly-anticipated Galaxy Note 9, which starts from US$1,000 per handset.

The company’s decision to overhaul its strategy to focus on mid-priced handsets could imply that its latest Galaxy Note 9 handsets released in August have failed to meet expectations in sales, said Flora Tang, an analyst from industry research firm Counterpoint. The mid-priced handset market, though the subject of intense competition, is crucial for Samsung to maintain revenue gains, she said.

“China, US and Europe are three key markets that could bring about major sales values for smartphone brands, but Samsung is meeting increasing challenges in these regions where the high-end market is dominated by Apple while the mid and lower-tier markets are gradually eroded by Chinese brands,” Tang said.

Samsung, which remains the top smartphone vendor in the second quarter this year, has seen its global share shrink to 20.9 per cent during the three-month period from 22.9 per cent a year earlier, with shipments down 10.4 per cent year-on-year in the quarter, according to IDC data released in July.

Apple, Xiaomi and Oppo, which all rank behind Samsung and Huawei, have reported positive growth in handset shipments and market share in the past quarter, said IDC.