Behind the rise of China’s smartphone brands lies growing unease over country’s tech gains

- Huawei, Xiaomi, Oppo and Vivo are helping change people’s perception about the quality of Chinese Android phones

- China is now home to some of the most successful smartphone brands, rivalling the likes of Samsung Electronics, Apple and LG Electronics

Like many urban Chinese consumers, Shenzhen civil servant Gao Jian has had a long-held belief that the quality of domestic smartphone brands paled in comparison with foreign brands, especially Apple.

But in December, Gao joined the growing number of mainland consumers who have made the switch from Apple’s iPhone to a premium Android smartphone from a major Chinese brand. He bought a Mate 20 Pro, the flagship model from the country’s largest smartphone supplier Huawei Technologies.

“Its design and cameras are better than what I expected,” Gao said. “Also, iPhones have become increasingly unaffordable.”

His experience reflects the broader success of the Chinese mobile phone industry in smashing people’s perception that domestic suppliers are only good for inexpensive, low-quality products.

That stereotype has beset many Chinese brands in the home appliances, consumer electronics, personal computer, car and mobile phone markets, where products from more established brands in the US, Japan or Europe were preferred by mainland consumers for many years.

But brands like Haier Group Corp, Lenovo Group and, more recently, Huawei, have expanded their operations, increased research and development, and made advanced products to change that impression around the world.

China is now home to some of the most successful smartphone brands, which rival the likes of Samsung Electronics, Apple and LG Electronics.

Shenzhen-based Huawei, the top global supplier of telecommunications network equipment, was ranked the world’s second biggest smartphone vendor – behind Samsung and ahead of Apple – for the second consecutive quarter in the three months ended September 30, according to research firm IDC. Xiaomi Corp and Oppo took the No 4 and 5 spots in the same quarter.

“Clearly, not all [Chinese smartphone brands] have been equally successful,” said Kiranjeet Kaur, a senior research manager at IDC Asia-Pacific. “But most of those that are doing well in the domestic market have had good fortune in the global market, too.”

Kaur said other major Chinese smartphone players include Vivo, OnePlus, Alcatel brand licence-holder TCL Corp, ZTE Corp and Lenovo Group, which bought Motorola Mobility in 2014 and now sells a line of handsets under the Moto brand.

Demand for Chinese-brand mobile phones doubled each year between 2010 and 2012 during the period when 3G mobile services were being rolled out across the country, but gradually slowed down from 2013 ahead of the deployment of faster 4G services by the mainland’s three mobile network operators.

The emergence of Chinese smartphone brands on the global stage has mirrored the rising competitiveness of the country’s telecoms network equipment suppliers, which have won market share with value-for-money offerings as well as on heavy investments in research and development.

The gains have also sparked increasing pushback by the US, which is persuading its allies to boycott Chinese telecoms gear suppliers such as Huawei on grounds of national security.

With the world’s biggest internet population and smartphone market, China had as many as 300 domestic mobile phone companies about three years ago. Cutthroat competition reduced that number to about 200 last year, as Chinese consumers bought fewer smartphones and the economy grew at a slower pace.

The larger, deep-pocketed Chinese smartphone suppliers have won a big chunk of the domestic market through aggressive promotions, advanced designs and features, and offering a wide array of models in a range of prices to entice both younger and affluent buyers. It also represents their standard operating procedure overseas, particularly in India and countries in Southeast Asia.

If we steadily improve our quality and design, consumers will be willing to pay more to buy our products

Unlike the smaller smartphone brands in China, Kaur said none of the major players competed in the very low-end of the market because they focused on building their brands and offered sophisticated features at affordable prices – a strategy that worked well against global brands like Apple and Samsung.

Xiaomi blazed a successful trail in China by exclusively selling online low-cost Android smartphones with design and technical specifications comparable to high-end models.

The Beijing-based company also expanded its product line to include mobile phone accessories, tablets, earphones, smart television sets and laptop computers.

Huawei, with operations in about 170 countries and territories, achieved broad distribution on the back of its role as a telecoms gear supplier to many mobile network operators around the world.

In 2016, Huawei collaborated with Germany’s Leica Camera to help it address the premium smartphone segment and further differentiate the firm from other Android device makers.

For privately held BBK Electronics Corp, headquartered in the southern coastal city of Dongguan in Guangdong province, a multiple brand strategy has allowed it to cover nearly all smartphone segments in China and overseas. The company is behind Oppo and Vivo as well as newer brands OnePlus and Realme.

OnePlus is already a global top five supplier of high-end Android handsets, according to Counterpoint Research. Realme, which started as an India-focused vendor of affordable smartphones, now plans to expand its operations across Southeast Asia, Africa and Europe.

Samsung has been hit hard by that competition. In December, the South Korean tech giant said it was shutting down its smartphone manufacturing plant in the northern city of Tianjin amid slumping sales in the country and rising labour costs. Samsung was No 1 in China with 20 per cent of the market in 2013, but fell to less than 1 per cent last year.

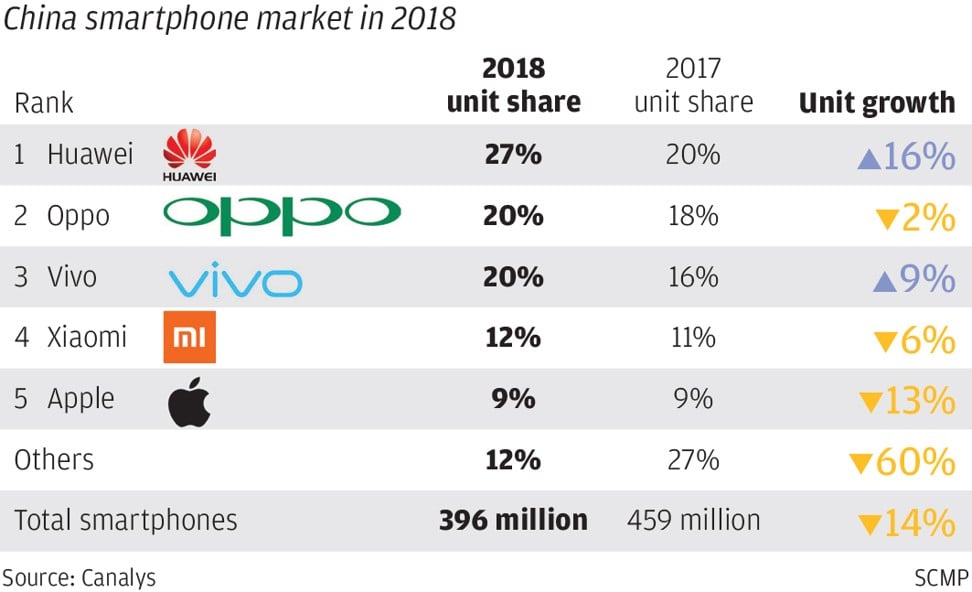

Huawei, Vivo, Oppo and Xiaomi were the top-selling smartphone brands in China in the quarter ended September 30, according to Counterpoint. Apple ranked fifth in the same period.

Earlier this month, Apple chief executive Tim Cook blamed a weak Chinese economy for a downgrade in the company’s revenue guidance for the quarter ended December 31.

Market experts, however, said Cook may have glossed over strategic missteps made by Apple on the mainland, where its latest iPhones are the most expensive and compete against vastly improved Chinese handsets that cost less.

“The new iPhones are certainly not as popular as four years ago,” said Wang Dan, who runs a mobile phone store in the Huaqiangbei electronics marketplace in Shenzhen. “A lot of Chinese customers cannot afford them, and there are now more choices available.”

Wang said Apple typically reduced the price of new iPhones after a certain period in the market. Four smartphone wholesalers in the area estimated that iPhone prices there have been cut between 200 yuan (US$29) and 500 yuan in the past few days.

Zaker Li, a Shenzhen-based senior industry analyst with IHS Markit, credited better smartphone design and performance by Chinese brands for attracting users away from foreign brands.

Huawei’s flagship Mate 20 Pro, for example, received an overall review score of 9 out of 10 on tech news site CNET. That matched well against Samsung’s Note 9, with a similar score, and the iPhone XS, with an 8.8 mark.

Major Chinese smartphone brands look to ratchet up the delivery of smartphones based on 5G technology in 2019, as mobile network operators around the world step up testing and development of next-generation wireless infrastructure. Huawei, ZTE and OnePlus have joined Samsung among the first big brands to announce plans to release 5G handsets in 2019.

Still, a prolonged US-China trade dispute could spoil those initiatives, especially if Washington restricts the export of American-made software and hardware components.

That would threaten to slow down China’s expansion in everything from smartphones, wireless network equipment and self-driving cars to semiconductors, e-commerce and financial technology.

Lei Jun, Xiaomi’s founder and chief executive, recently suggested a way to ride out that trade conflict. He said Xiaomi will sharpen its focus on Europe, where main Chinese rival Huawei is growing, and push high-end Android devices there.

“If we steadily improve our quality and design, consumers will be willing to pay more to buy our products,” Lei said.

Additional reporting by Celia Chen and Yingzhi Yang