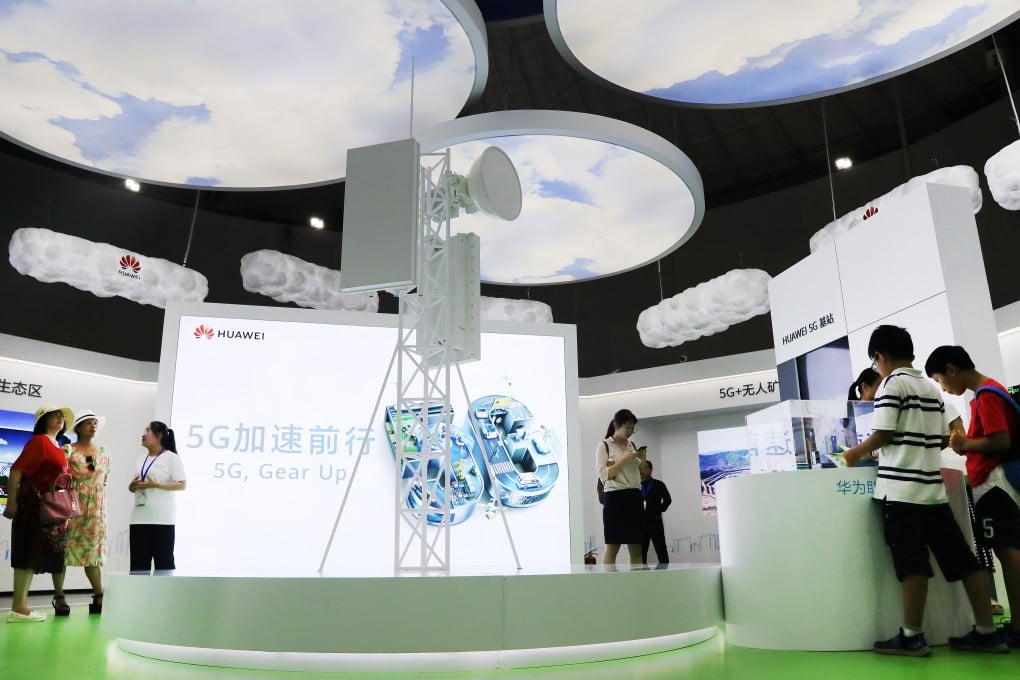

Huawei, ZTE expand share in global telecoms gear, but all eyes are on the second half amid trade tensions

- Chinese telecoms giants grow global share in first half on back of rising 5G network equipment orders

Huawei Technologies and ZTE Corp have expanded their market share in the global telecommunications equipment market in the first half of this year, despite increased scrutiny about the security of their products and rising tensions in the US-China trade war.

Shenzhen-based Huawei, the world’s largest telecoms gear supplier, saw its global share reach 28.1 per cent at the end of June, up from about 27 per cent at the end of December, according to a report on Thursday by California-based Dell’Oro Group. Founded in 1995, Dell’Oro is a leading independent market research firm for the telecoms industry.

ZTE, the crosstown rival of Huawei, seized a 9.6 per cent share in the same period, compared with 8 per cent at the end of last year.

With peak data rates up to 100 times faster than what current 4G networks provide, 5G has been held out as “the connective tissue” for the Internet of Things, autonomous cars, smart cities and other new mobile applications, establishing the backbone for the industrial internet.