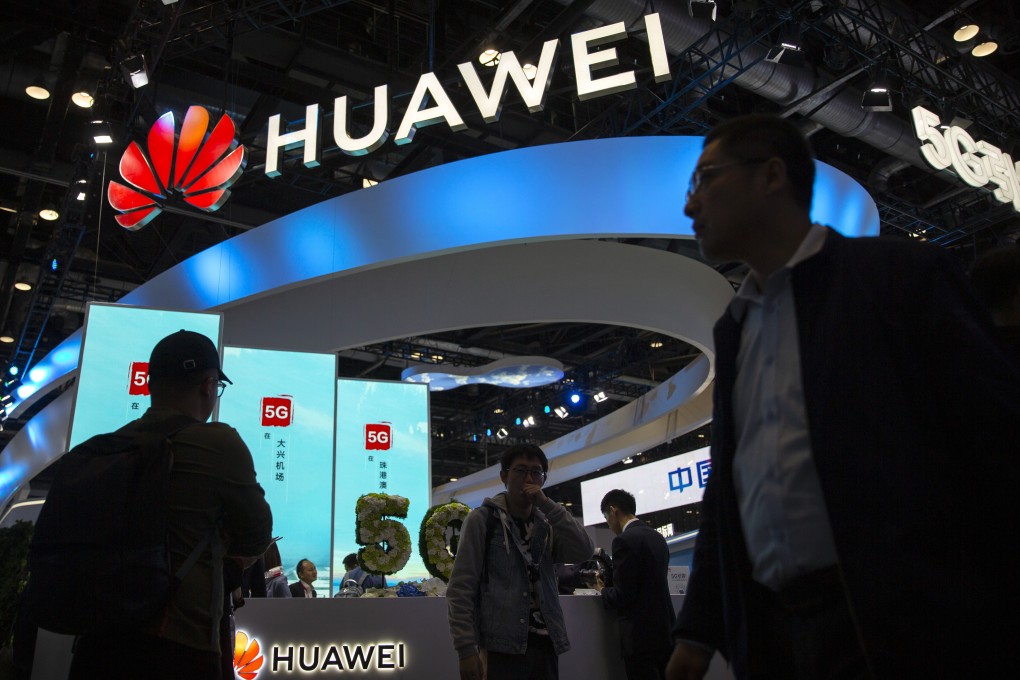

Huawei defies the odds to lead global telecoms market after 180 days on US trade blacklist

- Strategies that include a sharper focus on its home market have helped Huawei stabilise the ship through the trade ban

When the US government added Huawei Technologies to its trade blacklist on May 16, the Trump administration expected to hobble the Chinese telecommunications gear maker’s business by restricting its access to American hi-tech components.

Shenzhen-based Huawei will mark 180 days under the US trade blacklist on Sunday, a dubious milestone that has been tempered by efforts to stabilise its operations.

This performance has defied early predictions that Huawei would stumble under the US trade ban, which restricts the company’s access to American-origin technologies such as software and semiconductors.

However, Huawei’s septuagenarian founder and chief executive Ren Zhengfei, may need to double down on initiatives to bolster confidence in the world’s biggest network gear maker, as political and economic headwinds still threaten to push its overseas business off a cliff.